TORONTO–(BUSINESS WIRE)–DREAM IMPACT TRUST (TSX: MPCT.UN) (“Dream Impact” or the “Trust”) looks forward to presenting its business today at its head office at 30 Adelaide Street East, Suite 301 at 10:00 a.m. ET, as part of the Dream group of companies’ Investor Day.

A copy of the presentation will be archived and available on our website here.

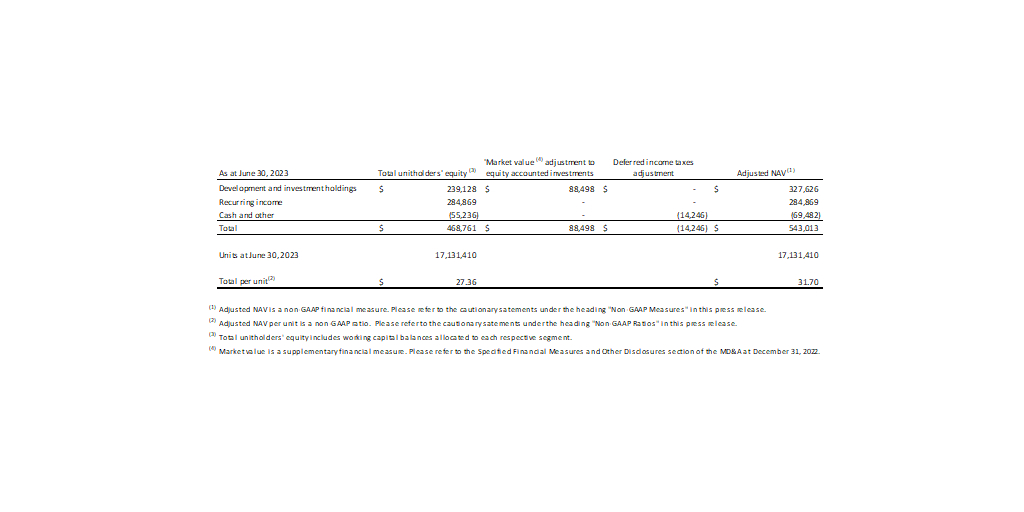

As part of the investor presentation, the Trust is publishing an adjusted net asset value (“NAV”)(1) as of June 30, 2023. Based on total unitholders’ equity of $468.8 million as of June 30, 2023, or $27.36 per unit, and incorporating the Trust’s market value adjustment from December 31, 2022, the Trust’s June 30, 2023, adjusted NAV would be $543.0 million or $31.70 per unit(2).

The table below provides a reconciliation of adjusted NAV to total unitholders’ equity as of June 30, 2023, which is the closest IFRS measure to adjusted NAV:

See Figure 1, Reconciliation of adjusted NAV to total unitholders’ equity

At the Investor Day, the Trust’s senior management team will discuss its business plan and strategy, target capital allocation and future growth business drivers to generate returns.

About Dream Impact Trust

Dream Impact Trust is an open-ended trust dedicated to impact investing. Dream Impact’s underlying portfolio is comprised of exceptional real estate assets reported under two operating segments: development and investing holdings, and recurring income, that would not be otherwise available in a public and fully transparent vehicle, managed by an experienced team with a successful track record in these areas. The objectives of Dream Impact are to create positive and lasting impacts for our stakeholders through our three impact verticals: environmental sustainability and resilience, attainable and affordable housing, and inclusive communities; while generating attractive returns for investors. For more information, please visit: www.dreamimpacttrust.ca.

SPECIFIED FINANCIAL MEASURES AND OTHER MEASURES

The Trust’s condensed consolidated financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”). In this press release, as a complement to results provided in accordance with IFRS, the Trust discloses and discusses certain specified financial measures, including adjusted net asset value and adjusted net asset value per unit. These specified financial measures are not defined by or recognized measures under IFRS, do not have a standardized meaning and may not be comparable with similar measures presented by other issuers. The Trust has presented such specified financial measures as management believes they are relevant measures of our underlying operating performance. Specified financial measures should not be considered as alternatives to unitholders’ equity or comparable metrics determined in accordance with IFRS as indicators of the Trust’s performance and profitability. Certain additional disclosures such as the composition, usefulness and changes as applicable are expressly incorporated by reference from the Trust’s MD&A for the year ended December 31, 2022 in the section titled “Specified Financial Measures and Other Disclosures”, which has been filed and is available on SEDAR+ under the Trust’s profile.

NON-GAAP MEASURES

“Adjusted net asset value (“Adjusted NAV”)”, a non-GAAP financial measure, represents total unitholders’ equity per the condensed consolidated financial statements (the most directly comparable financial measure), adjusted for market value adjustments for equity accounted investments (including applicable deferred income tax adjustments). The market value adjustments account for the applicable deferred income tax estimates considering the timing of their realization and, if appropriate, will be incorporated into the determination of the Adjusted NAV. The applicable deferred income tax estimates related to the market value adjustments are calculated either based on income or capital gain rates or a combination thereof. The income tax rates used to determine Adjusted NAV are dependent on various factors such as anticipated development plans, stage of development and current market trends applicable to the future development plans, and will be reviewed on a regular basis and are subject to change. Excluded from the Adjusted NAV calculation are any market value adjustments with respect to liabilities as well as commitments/contracts that are not otherwise recorded as liabilities on the Trust’s condensed consolidated statements of financial position. The Trust has not appraised the lending portfolio, as the Trust intends to hold certain investments in the lending portfolio until maturity and its term to maturity is over the next one to five years; as such, this portfolio is considered fairly liquid. This non-GAAP measure is an important measure used by the Trust in evaluating the Trust’s and Asset Manager’s performance as it is an indicator of the intrinsic value of the Trust; however, it is not defined by IFRS, does not have a standardized meaning and may not be comparable with similar measures presented by other issuers. A reconciliation of Adjusted NAV to unitholders’ equity, the most directly comparable financial measure, as of June 30, 2023 can be found in the table above.

NON-GAAP RATIOS

“Adjusted net asset value (“NAV”) per unit” represents the Adjusted NAV (a non-GAAP financial measure) of the Trust divided by the number of units outstanding at the end of the period. This non-GAAP ratio is an important measure used by the Trust in evaluating the Trust’s performance as it is an indicator of the intrinsic value of the Trust; however, it is not defined by IFRS, does not have a standardized meaning and may not be comparable with similar measures presented by other issuers. A reconciliation of Adjusted NAV to unitholders’ equity, the most directly comparable financial measure, as of June 30, 2023 can be found in the table above.

Contacts

DREAM IMPACT TRUST

Meaghan Peloso

Chief Financial Officer

(416) 365-6322

mpeloso@dream.ca

Kimberly Lefever

Director, Investor Relations

(416) 365-6339

klefever@dream.ca