Latest funding round will accelerate the expansion of AI-powered maintenance and asset management platform as unplanned equipment downtime continues to cost industries billions annually.

SAN FRANCISCO–(BUSINESS WIRE)–#AI—MaintainX, the leading maintenance and asset management platform, announces today $150M in Series D funding. Key investors in this round include Bessemer Venture Partners, Bain Capital Ventures (BCV), D. E. Shaw Ventures, Amity Ventures, August Capital, Founders Circle Capital, Sozo Ventures, and Fifth Down Capital, as well as angel investors Rahul Mehta, co-founder of DST Global, and Dave McJannet, CEO of Hashicorp, among others. The new round of funding will allow MaintainX to expand its AI and machine health monitoring capabilities and partnerships, advance predictive maintenance solutions, and further develop enterprise asset management (EAM) capabilities. This investment brings the total raised to $254M while reaching a new valuation of $2.5B.

“Equipment failures cost companies $1.4 trillion annually, and many still rely on outdated tools. We built MaintainX to change that,” said Chris Turlica, CEO and Co-Founder of MaintainX. “In today’s unpredictable global environment where supply chain disruptions and external cost pressures are hard to control, our mission is more important than ever. I’m proud to see our customers offset external pressures by reducing unplanned asset downtime, parts, and labor costs while turning their frontline professionals into the knowledge workers they deserve to be with AI.”

MaintainX’s approach centers on amplifying human capability rather than replacing it. The platform puts AI-driven insights directly in the hands of both the technician on the shop floor and the executive in the boardroom – both of whom are accountable for uptime, safety, and performance. This human-AI collaboration approach transforms maintenance from reactive to proactive operational excellence.

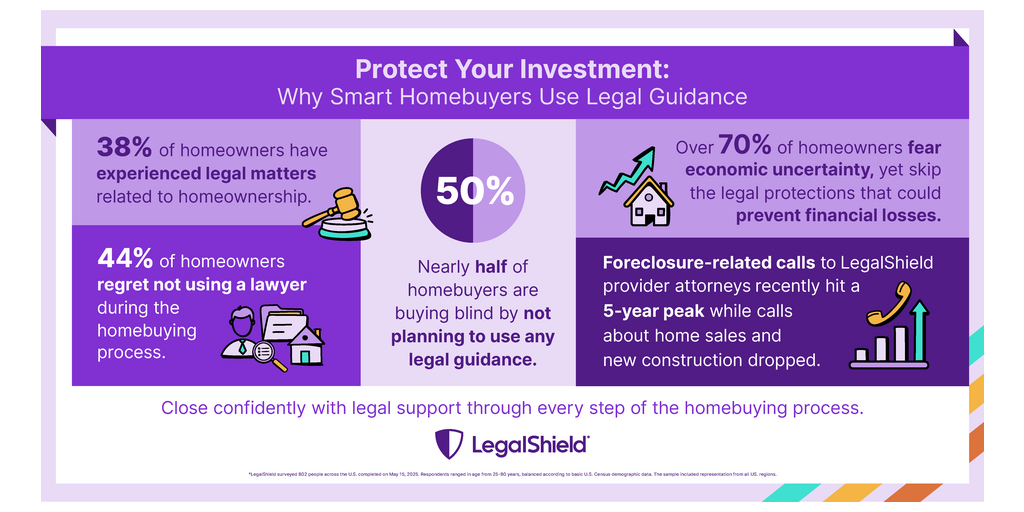

This financing comes at a pivotal moment when industrial organizations face unprecedented pressure to maximize operational efficiency amid economic uncertainty, supply chain disruptions, and the ongoing shortage of skilled labor. As manufacturers and facility operators seek to extract optimal value from existing assets, MaintainX’s platform delivers the actionable insights needed to meet these converging challenges.

“MaintainX has achieved remarkable product-market fit by addressing a critical challenge that affects virtually every physical asset-driven industry,” said Byron Deeter, Partner at Bessemer. “What impressed us most was the overwhelmingly positive feedback from customers who have transformed their maintenance operations using the platform. Their AI-powered insights are what truly differentiates MaintainX in the market – this intelligent layer transforms raw operational data into predictive recommendations that drive unprecedented value creation. This investment reflects our confidence in Chris and MaintainX’s ability to lead the global digital transformation of maintenance and asset management.”

“Companies are increasingly turning to operational technology not just to improve performance, but to protect margins and preserve jobs,” said Merritt Hummer, Partner at BCV. “MaintainX is driving this shift, transforming maintenance from a manual, reactive process into a data-rich, AI-powered advantage. Their platform doesn’t just streamline workflows; it introduces a new operating model where AI surfaces insights, predicts failures, and unlocks entirely new revenue streams and efficiencies. This is a step-change in how businesses manage assets and plan for the future.”

The company will use the investment to:

- Advance its AI-powered asset and work intelligence capabilities.

- Expand its machine health monitoring capabilities and ecosystem of partners to capture real-time operational data through a sensor-agnostic approach that works with any industrial sensor or control system.

- Accelerate market expansion across key industries and geographic regions.

- Attract top talent to support its product roadmap while helping customers address the industrywide skilled labor shortage through more intuitive, AI-assisted workflows.

“With MaintainX AI, it is even easier to digitize our preventive maintenance workflows, and our technicians can now use CoPilot to get accurate, real-time answers the moment they need them instead of having to dig through lengthy manuals and data – it’s like having an expert on hand 24/7 to guide our team through any task. MaintainX has quickly become a trusted resource for our maintenance operations and has a big impact on the training and onboarding of our technicians,” said Jeremiah Dotson, Facility Maintenance Manager, Amfab Steel, Inc.

Since its founding in 2018, MaintainX has achieved significant milestones and impact in the industry, including:

- Serving over 11K companies worldwide, managing 11M+ assets across manufacturing, facilities management, food and beverage, distribution centers, and more.

- Helping customers achieve key success metrics, including reducing unplanned downtime by 34%, increasing production capacity by 15%, and achieving up to 32% savings in monthly maintenance costs.

- Processing over 27M work orders and 370K+ safety procedures annually.

- Recognized for innovation, including ranking in the top 50 of the Deloitte Technology Fast 500, as the #1 Enterprise Asset Management and CMMS provider in G2’s Summer 2025 Report, and as a Leader in the Verdantix 2025 Green Quadrant CMMS Report.

About MaintainX

Headquartered in San Francisco, MaintainX is a technology company pioneering a next-generation approach to AI-powered maintenance and asset management. It empowers frontline teams to reduce unplanned equipment downtime and boost production capacity. MaintainX leverages AI and IoT to connect asset and work intelligence data, providing real-time insights that drive proactive maintenance and operational excellence for customers across physical asset-driven industries. MaintainX operates in North America with additional support worldwide. MaintainX is reimagining how maintenance and operations can be designed and managed to address the realities of today and the future ahead. For more information, visit www.maintainx.com.

MaintainX is actively hiring for numerous roles and seeks talented individuals ready to join our team. Those interested in building the future of maintenance and asset management can search open roles and apply here.

MaintainX® is a registered trademark of MaintainX Inc.

About Bessemer Venture Partners

Bessemer Venture Partners helps entrepreneurs lay strong foundations to build and forge long-standing companies. With more than 145 IPOs and 300 portfolio companies in the enterprise, consumer and healthcare spaces, Bessemer supports founders and CEOs from their early days through every stage of growth. Bessemer’s global portfolio has included Pinterest, Shopify, Twilio, Yelp, LinkedIn, PagerDuty, DocuSign, Wix, Fiverr Toast and ServiceTitan and currently has more than $19 billion of assets under management. Bessemer has investment teams located in Tel Aviv, Silicon Valley, San Francisco, New York, London, Hong Kong, Boston, and Bangalore. Born from innovations in steel more than a century ago, Bessemer’s storied history has afforded its partners the opportunity to celebrate and scrutinize its best investment decisions (see Memos) and also learn from its mistakes (see Anti-Portfolio).

About Bain Capital Ventures

Bain Capital Ventures (BCV) is a multi-stage VC firm with over $10B under management. Investing across seven core domains—AI applications, AI infrastructure, commerce, fintech, healthcare, industrials and security, BCV offers distinctive access to Bain Capital’s broader industry expertise and portfolio of companies. For over 20 years, BCV has invested from seed through IPO and acquisition, backing more than 400 companies including Attentive, Bloomreach, Clari, Docusign, Flywire, LinkedIn, Moveworks, Redis, Rubrik and ShipBob.

Contacts

For media inquiries: press@getmaintainx.com