Real takes a major step toward its mission of simplifying life’s most complex transaction for agents and their clients

MIAMI–(BUSINESS WIRE)–$REAX #PropTech–The Real Brokerage Inc. (NASDAQ: REAX), a technology platform reshaping real estate for agents, home buyers and sellers, today announced its acquisition of the AI-powered consumer home search portal and related technology assets of Flyhomes. Concurrently, Real has made an equity investment in Flyhomes to support Flyhomes’ evolution into a wholesale mortgage lender focused on modern home financing solutions.

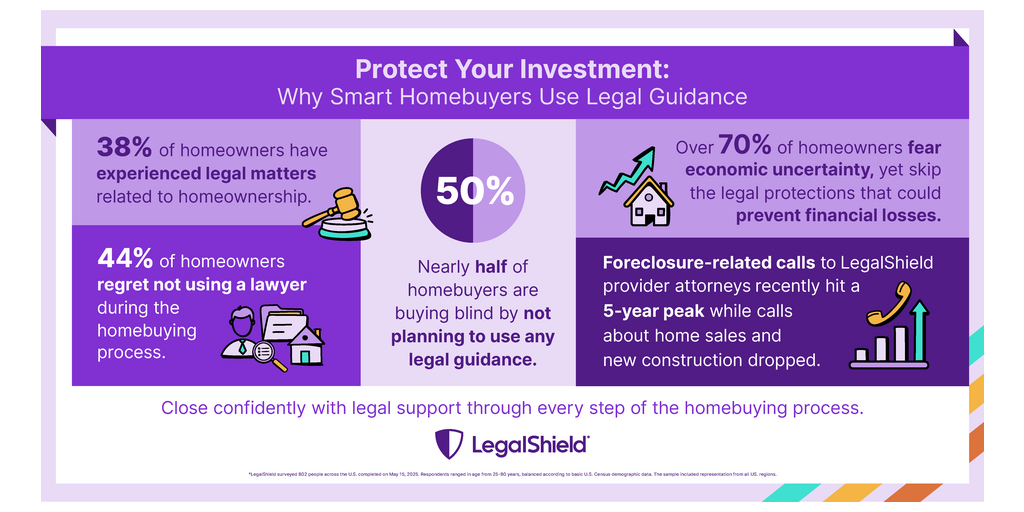

The acquisition marks a significant step forward in Real’s mission to simplify the home buying process and enhance the agent and client experience through seamless, AI-driven technology. In the coming months, Flyhomes’ consumer portal, built with deep MLS integrations, real-time market insights and an intuitive user-friendly interface, will be integrated into Real’s forthcoming consumer-facing product, Leo for Clients, an AI-powered platform designed to simplify the buying and selling journey for clients. This consumer experience will serve as a natural extension of Real’s AI-powered assistant for real estate agents, Leo, which was designed to deliver context-aware, real-time support for agents and now answers thousands of questions daily.

Through its subsidiary One Real Mortgage, Real will also offer Flyhomes’ flagship “Buy Before You Sell” financing solutions to agents and their clients. This integration represents another move forward in Real’s strategy to streamline the transaction process, empowering agents to offer more flexible, client-first mortgage products that align with modern homeownership goals.

“By bringing Flyhomes’ consumer technology under the Real umbrella, we’re combining the best in real estate innovation to deliver a seamless, AI-powered experience—designed around people—for both agents and consumers,” said Tamir Poleg, Chairman and CEO of Real. “We’re also excited to offer Flyhomes’ ‘Buy Before You Sell’ products through One Real Mortgage, giving our agents and their clients more flexibility and control on their path to homeownership. It’s another step forward in simplifying the real estate transaction.”

Real’s proprietary agent-facing software platform, reZEN, was built entirely in-house and now powers more than 120,000 transactions annually. With the integration of Flyhomes’ consumer platform and engineering team, Real gains market-tested technology and skilled R&D talent with deep real estate domain expertise to elevate the client experience.

“This acquisition allows us to connect the dots between agent tools, client experience and transaction flow, all in one intelligent ecosystem,” said Pritesh Damani, Chief Technology Officer at Real. “With Leo and reZEN already transforming how agents operate, we now have the foundation in place to bring that same level of intelligence to buyers and sellers through a consumer interface that’s intuitive, personalized and deeply integrated.”

“We built the world’s first purpose-built AI home search portal to challenge the status quo and deliver a fundamentally smarter home search and research experience,” said Tushar Garg, Co-Founder and CEO of Flyhomes. “Its performance and the ingenuity of the engineering team behind it have exceeded all expectations, proving the platform’s potential to transform the consumer experience. As we focus on scaling our ‘Buy Before You Sell’ financial products nationwide through the wholesale mortgage channel, we made the strategic decision to transition the portal and the team to the best environment for continued growth. Real is uniquely positioned to take it forward, with the vision, agent network and technology infrastructure to fully unlock its potential.”

Both the acquisition and investment were funded with existing cash on hand and are not expected to have a material impact on Real’s financial results.

About Real

Real (NASDAQ: REAX) is a real estate experience company working to simplify life’s most complex transaction. The fast-growing company combines essential real estate, mortgage and closing services with powerful technology to deliver a single seamless end-to-end consumer experience, guided by trusted agents. With a presence in all 50 states throughout the U.S. and Canada, Real supports over 27,000 agents who use its digital brokerage platform and tight-knit professional community to power their own forward-thinking businesses. Additional information can be found on its website at www.onereal.com.

Forward-Looking Statements

Some of the statements in this press release are “forward-looking statements,” as that term is defined in the Private Securities Litigation Reform Act of 1995, including statements regarding the impact of the acquisition and investment, the integration of Flyhomes’ technology into Real’s platform, and Real’s consumer-facing product, Leo for Clients. Forward-looking statements are subject to risks, uncertainties and assumptions, including the risk that Real’s consumer-facing product may not be launched as expected or may not include its anticipated features, and the risk that the integration of these technologies may face unforeseen challenges. Actual results may differ materially from those expressed or implied in these statements due to various factors, including, but not limited to, market conditions, regulatory changes, operational challenges, and other risks as detailed under the heading “Risk Factors” in the Company’s Annual Information Form dated March 6, 2025, and “Risks and Uncertainties” in the Company’s Quarterly Management’s Discussion and Analysis for the period ended March 31, 2025, copies of which are available under the Company’s SEDAR+ profile at www.sedarplus.ca. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this press release, except as required by applicable law. It is not possible for management to predict all the possible risks that could affect Real or to assess the impact of all possible risks on Real’s business.

Contacts

Investor inquiries, please contact:

Ravi Jani

Chief Financial Officer

investors@therealbrokerage.com

908.280.2515

For media inquiries, please contact:

Elisabeth Warrick

Senior Director, Marketing, Communications & Brand

press@therealbrokerage.com

201.564.4221