EDMONTON, Alberta, April 16, 2024 (GLOBE NEWSWIRE) — Melcor Real Estate Investment Trust (“Melcor REIT” or the “REIT”) (TSX: MR.UN) today announces the appointment of Barry James, FCA, FCPA, ICD.D and Brandon Kot as new Trustees of Melcor REIT effective immediately. Mr. James brings extensive board and financial experience to the REIT. Mr. James qualified… [Read More]

Flagship Communities Real Estate Investment Trust Announces April 2024 Cash Distribution

Not for distribution to U.S. newswire services or dissemination in the United States. TORONTO, April 16, 2024 (GLOBE NEWSWIRE) — Flagship Communities Real Estate Investment Trust (the “REIT”) (TSX:MHC.U; MHC.UN) announced today a cash distribution of US$0.0492 per REIT unit for the month of April 2024, representing US$0.59 per REIT unit on an annual basis…. [Read More]

SmartCentres Real Estate Investment Trust to Release 2024 First Quarter Results and Host Conference Call

TORONTO, April 16, 2024 (GLOBE NEWSWIRE) — SmartCentres Real Estate Investment Trust (“SmartCentres”) (TSX: SRU.UN) announced today that it will be reporting its financial results for the three months ended March 31, 2024 after the market closes on Wednesday, May 8, 2024. Management will hold a conference call on Thursday, May 9, 2024 at 3:00… [Read More]

SmartStop Self Storage REIT, Inc. Acquires New Facility in Colorado Springs, Colorado

LADERA RANCH, Calif.–(BUSINESS WIRE)–SmartStop Self Storage REIT, Inc. (“SmartStop” or the “Company”), a self-managed and fully integrated self-storage company, announced today its acquisition of a self-storage facility spanning approximately 64,700 net rentable square feet in Colorado Springs, Colorado. The facility comprises 20 single-story buildings with approximately 450 units offering convenient drive-up access, 24-hour video surveillance, and approximately 100 parking spaces. It also features a two-story leasing office with approximately 30 climate-controlled, single-tenant office suites.

Situated at 3150 Boychuk Avenue, the facility sits across from a retail center that houses a bank, grocery store, and various dining establishments and is within a 10-minute drive of the Colorado Springs airport. In addition to dense three- and five-mile populations with above-average household incomes, the facility is located within five miles of the Fort Carson U.S. Army Post and Peterson Space Force Base, which include approximately 45,000 military personnel. The Colorado Springs location will serve Southeast Colorado Springs, Stratmoor, Stratmoor Hills, Stratton Meadows, and Security-Widefield.

“We are thrilled to announce the launch of our second self-storage facility in Colorado Springs,” stated Wayne Johnson, President of SmartStop. “This expansion underscores our ongoing dedication to offering well-maintained solutions with valuable amenities for our customers.”

About SmartStop Self Storage REIT, Inc. (SmartStop):

SmartStop Self Storage REIT, Inc. (“SmartStop”) is a self-managed REIT with a fully integrated operations team of approximately 500 self-storage professionals focused on growing the SmartStop® Self Storage brand. SmartStop, through its indirect subsidiary SmartStop REIT Advisors, LLC, also sponsors other self-storage programs. As of April 12, 2024, SmartStop has an owned or managed portfolio of 196 operating properties in 22 states and Canada, comprising approximately 138,100 units and 15.6 million rentable square feet. SmartStop and its affiliates own or manage 34 operating self-storage properties in Canada, which total approximately 29,700 units and 3.0 million rentable square feet. Additional information regarding SmartStop is available at www.smartstopselfstorage.com.

Contacts

David Corak

VP of Corporate Finance

SmartStop Self Storage REIT, Inc.

IR@smartstop.com

Allied Announces April 2024 Distribution

TORONTO, April 15, 2024 (GLOBE NEWSWIRE) — Allied Properties REIT (“Allied”) (TSX:AP.UN) announced today that the Trustees of Allied have declared a distribution of $0.15 per unit for the month of April 2024, representing $1.80 per unit on an annualized basis. The distribution will be payable on May 15, 2024, to unitholders of record as… [Read More]

ERES REIT Declares April 2024 Monthly Distribution

TORONTO, April 15, 2024 (GLOBE NEWSWIRE) — European Residential Real Estate Investment Trust (TSX: ERE.UN, “ERES”) is pleased to announce that the trustees of ERES have declared the April 2024 monthly cash distribution of €0.01 per Unit and Class B LP Unit (the “April Distribution”), being equivalent to €0.12 per Unit annualized. The distribution will… [Read More]

CAPREIT Announces April 2024 Distribution

TORONTO, April 15, 2024 (GLOBE NEWSWIRE) — Canadian Apartment Properties Real Estate Investment Trust (“CAPREIT”) (TSX: CAR.UN) announced today its April 2024 monthly distribution in the amount of $0.12084 per Unit (or $1.45 on an annualized basis). The April 2024 distribution will be payable on May 15, 2024 to Unitholders of record at the close… [Read More]

Flagship Communities Real Estate Investment Trust Announces April 2024 Cash Distribution

Not for distribution to U.S. newswire services or dissemination in the United States. TORONTO, April 15, 2024 (GLOBE NEWSWIRE) — Flagship Communities Real Estate Investment Trust (the “REIT”) (TSX:MHC.U; MHC.UN) announced today a cash distribution of US$0.0492 per REIT unit for the month of April 2024, representing US$0.59 per REIT unit on an annual basis…. [Read More]

PACS Group, Inc. Announces Pricing of Its Upsized Initial Public Offering

FARMINGTON, Utah–(BUSINESS WIRE)–PACS Group, Inc. (“PACS” or the “Company”) today announced the pricing of its upsized initial public offering of 21,428,572 shares of its common stock being sold by the Company at a public offering price of $21.00 per share, for total gross proceeds of approximately $450 million, before deducting underwriting discounts and commissions and offering expenses. In addition, certain selling stockholders have granted the underwriters a 30-day option to purchase up to an additional 3,214,284 shares of the Company’s common stock at the initial public offering price, less underwriting discounts and commissions. PACS will not receive any proceeds from any sale of shares by the selling stockholders. The shares are expected to begin trading on the New York Stock Exchange on April 11, 2024, under the ticker symbol “PACS.” The offering is expected to close on April 15, 2024, subject to customary closing conditions.

Citigroup, J.P. Morgan and Truist Securities are acting as lead book-running managers for the offering. RBC Capital Markets and Goldman Sachs & Co. LLC are acting as joint book-running managers. Stephens Inc., KeyBanc Capital Markets, Oppenheimer & Co. and Regions Securities LLC are acting as co-manager.

A registration statement relating to the securities was declared effective by the U.S. Securities and Exchange Commission. This offering is being made only by means of a prospectus, copies of which may be obtained, when available, from: Citigroup Global Markets Inc. at 388 Greenwich Street, New York, New York 10013, Attention: General Counsel, facsimile number: +1 (646) 291-1469; J.P. Morgan Securities LLC at 383 Madison Avenue, New York, New York 10179, Attention: Equity Syndicate Desk, facsimile number: +1 (212) 622-8358; and Truist Securities, Inc. at 3333 Peachtree Road NE, 11th Floor, Atlanta, GA 30326, Attention: Equity Capital Markets, facsimile number: (404) 816-8535.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About PACS Group, Inc.

PACS is a holding company investing in post-acute healthcare facilities, professionals, and ancillary services. Founded in 2013, PACS is one of the largest post-acute platforms in the United States. Its independent subsidiaries operate over 200 post-acute care facilities across nine states serving over 20,000 patients daily.

Contacts

Brooks Stevenson

VP Corporate Communications

(801) 597-9538

Brooks.Stevenson@pacs.com

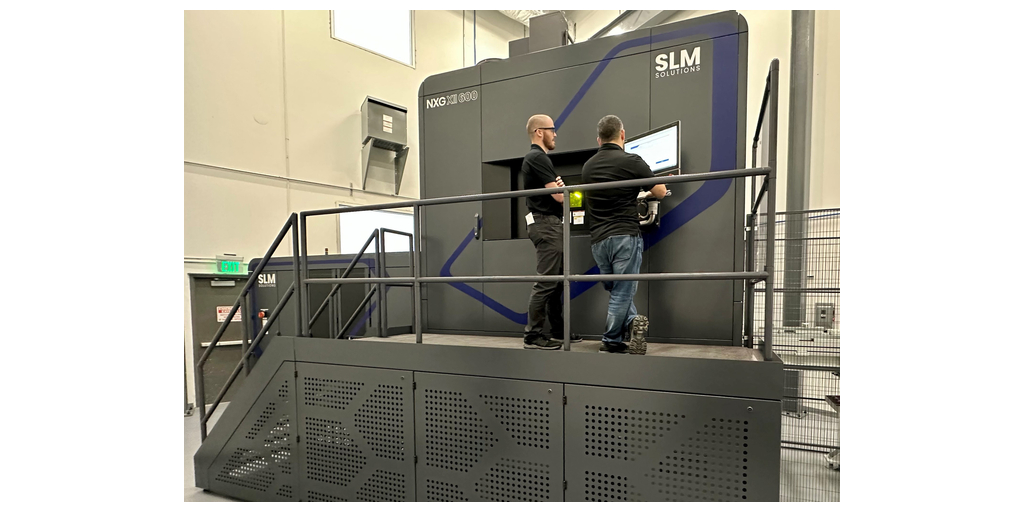

Sintavia Announces $25M Expansion in Hollywood, Florida

Investments in facilities and equipment will power company’s growth over the coming years

HOLLYWOOD, Fla.–(BUSINESS WIRE)–#3dprinting–Sintavia, LLC, the world’s first all-digital aerospace component manufacturer, today announced its single largest expansion in facilities and equipment since 2019. The $25 million investment includes additional advanced manufacturing space, large format printers, large format post-processing equipment, and component testing equipment. It is expected that with this investment, Sintavia will be able to meet the demand from the programs it supports across the U.S. Department of Defense for the balance of this decade.

“Looking into the next few years, it is clear to us that we need to make the investments today that will support the demand from our customers tomorrow,” said Brian Neff, Sintavia’s Founder and CEO. “As the world’s first truly all-digital aerospace component supplier, Sintavia is in a unique position to push the boundaries of what is possible in terms of designing and manufacturing next generation aerospace components along a single, fully digital thread. But to do that, you need first to have the right facilities, hardware, and software in place. That is what we are doing today in support of our customers and their critical programs.”

A major focus of the new expansion will be the continued design and development of high-performance thermodynamic components, in particular aerospace heat exchangers. Sintavia’s heat exchangers, which are enabled using additively designed triply periodic minimal surface structures, demonstrate improved heat rejection at comparative flow rates when evaluated against traditional versions. Additionally, the manufacturing sturdiness of a fully digital thread results in production yields close to 100%, multiples higher than manufacturing yields often experienced by traditional heat exchanger manufacturers.

As part of the expansion, Sintavia signed a long-term lease on an additional 25,000 ft2 of manufacturing space adjacent to its existing headquarters, which it will use for printing, post-processing, and materials testing. New equipment included in the expansion includes Sintavia’s second SLM NXG XII 600, a third AMCM M4K-4, a second CT Scanner (450 kV), a second large air furnace, cold flow test machine, a shock and vibration table, pressure cycle testing equipment, acoustic testing equipment, multiple additional 5-axis CNC machines, multiple additional fatigue rigs, and multiple additional polishing machines. As it announced last October, Sintavia is also the North American launch customer for the AMCM M8K-K, the world’s largest industrially viable laser powder bed fusion printer, with an impressive cubic displacement of 38 ft3.

The expansion is expected to be completed by the fourth quarter of 2024.

About Sintavia

Sintavia is the world’s first all-digital Aerospace & Defense component manufacturer. A founding member of the Additive Manufacturer Green Trade Association, Sintavia is committed to the highest quality standards in the industry and holds multiple Nadcap and other aerospace accreditations. For more information visit http://www.sintavia.com.

Contacts

Sintavia, LLC

Lindsay Lewis

+1 954.474.7800

The Real Brokerage to Host First Quarter 2024 Earnings Conference Call

TORONTO & NEW YORK–(BUSINESS WIRE)–The Real Brokerage Inc. (NASDAQ: REAX), the fastest growing, publicly traded real estate brokerage, will release its financial results for the first quarter ended March 31, 2024, on Tuesday, May 7, 2024, before the market open.

The Company will hold a conference call to discuss operating and financial results for the quarter at 8:00 a.m. ET. Investors wishing to join the live call can use the dial-in details provided below. An audio-only webcast of the call will be available on the Investor Relations section of the Company’s website at https://investors.onereal.com/ and can also be accessed directly through the link provided below. A replay will be available for one year.

|

Conference Call Details: |

||

|

Date: |

Tuesday, May 7, 2024 |

|

|

Time: |

8:00 a.m. ET |

|

|

|

||

|

Dial-in Number: |

North American Toll Free: 888-506-0062 |

|

|

International: 973-528-0011 |

||

|

Access Code: |

123643 |

|

|

Webcast: |

||

|

|

||

|

Replay Information: |

|

|

|

Replay Number: |

North American Toll Free: 877-481-4010 |

|

|

International: 919-882-2331 |

||

|

Access Code: |

50322 |

|

|

Replay Link: |

||

|

|

|

|

About Real

Real (NASDAQ: REAX) is a real estate experience company working to make life’s most complex transaction simple. The fast-growing company combines essential real estate, mortgage and closing services with powerful technology to deliver a single seamless end-to-end consumer experience, guided by trusted agents. With a presence in all 50 states throughout the U.S. and Canada, Real supports more than 16,000 agents who use its digital brokerage platform and tight-knit professional community to power their own forward-thinking businesses. Additional information can be found on its website at www.onereal.com.

Forward-Looking Information

This press release contains forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking information is often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect”, “likely” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof. Forward-looking information in this press release includes, without limiting the foregoing, information relating to Real’s first quarter 2024 earnings call, the release of the financial results and the business and strategic plans of Real.

Forward-looking information is based on assumptions that may prove to be incorrect, including but not limited to Real’s business objectives, expected growth, results of operations, performance, business projects and opportunities and financial results. Real considers these assumptions to be reasonable in the circumstances. However, forward-looking information is subject to known and unknown risks, uncertainties and other factors that could cause actual results, performance or achievements to differ materially from those expressed or implied in the forward-looking information. Important factors that could cause such differences include, but are not limited to, slowdowns in real estate markets, economic and industry downturns and Real’s ability to attract new agents and retain current agents. These factors should be carefully considered and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this press release are based upon what management believes to be reasonable assumptions, Real cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this press release, and Real assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Contacts

For additional information, please contact:

Ravi Jani

Vice President, Investor Relations and Financial Planning & Analysis

investors@therealbrokerage.com

908.280.2515

For media inquiries, please contact:

Elisabeth Warrick

Senior Director, Marketing, Communications & Brand

elisabeth@therealbrokerage.com

201.564.4221

First Onsite Restoration Enhances Geographic Footprint in Growing Southeast U.S. Region

Acquires All Restoration Solutions TORONTO, April 10, 2024 (GLOBE NEWSWIRE) — FirstService Corporation (TSX and NASDAQ: FSV) (“FirstService”) announced today that its subsidiary, First Onsite Property Restoration (“First Onsite”), has recently acquired All Restoration Solutions, LLC (“ARS” or the “Company”). The executive leaders of ARS will continue to hold a minority equity stake and oversee… [Read More]

- « Previous Page

- 1

- …

- 84

- 85

- 86

- 87

- 88

- …

- 1160

- Next Page »