- GoCanvas is a leading provider of SaaS solutions for enhancing productivity and safety through paperless collection, reporting and integration of field data in construction

- Perfect fit with Nemetschek’s Build & Construct Division portfolio strategy

- Complementary technology, customer base and regional sales split will create strong synergies and accelerate Subscription/SaaS business model transition

- Combining Bluebeam office and GoCanvas field worker community will create a unique construction ecosystem

RESTON, Va.–(BUSINESS WIRE)–The Nemetschek Group (NEM.DE), a leading global provider of software solutions for the AEC/O and media industries, today announced that it has signed a definitive agreement to acquire all shares in GoCanvas Holdings, Inc., headquartered in Reston, Virginia, USA. GoCanvas® is a leading provider of field worker collaboration software that digitizes traditionally paper-based processes, simplifies inspections, improves safety, and maximizes compliance with more than 300,000 active users worldwide in the first quarter of 2024.

The Nemetschek Group´s Build Segment offers subscription and SaaS products that simplify customers’ jobs and connect openly with other AEC/O solutions and platforms. GoCanvas fits perfectly in this strategy by offering flexible cloud and mobile field worker solutions that help customers efficiently collect real-time data, collaborate across worksites, create digital checklists, make data-driven business decisions, and replace paperwork with smart, simple workflows.

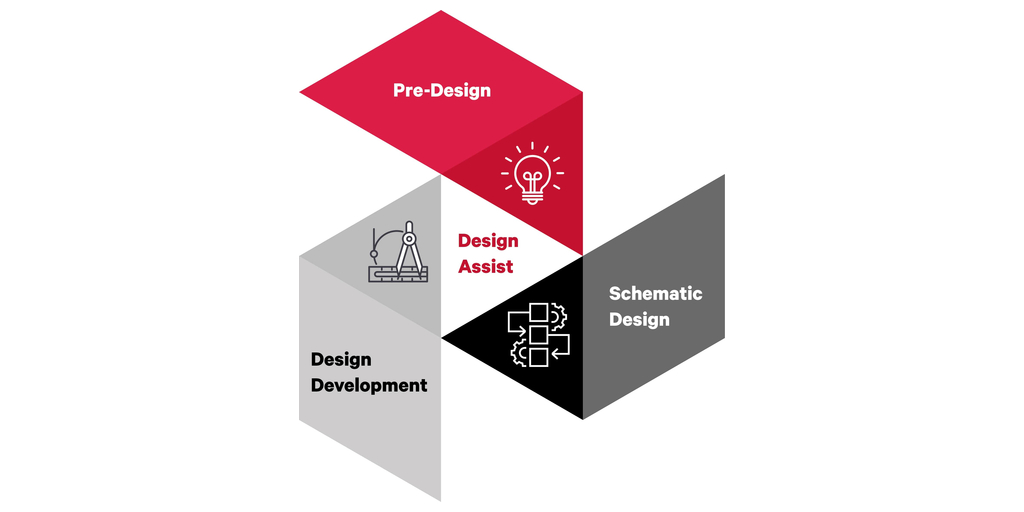

Complementary technologies create a best-in-class portfolio for a sustainable built environment globally

The acquisition of GoCanvas will capture significant growth opportunities and technology synergies through further enhancing market and customer access. GoCanvas further strengthens Nemetschek Group’s positioning in the US while Nemetschek will provide GoCanvas a unique footprint to expand in Europe and Asia-Pacific.

Nemetschek Group’s largest brand Bluebeam is already the most trusted name for collaboration solutions in the built environment and is poised to utilize this market leadership to introduce GoCanvas solutions to extend value to field workers. GoCanvas expands the existing Build portfolio of Nemetschek by providing solutions that simplify operations for on-site professionals across diverse sectors including construction, manufacturing and energy with workflows including safety, ESG (Environmental, Social, and Governance), quality and work progress. These solutions deliver enhanced productivity and efficiency gains for field workers, including reduced travel, heightened safety measures, and improved collaboration.

GoCanvas already has a strong position in the fast-growing field worker market. Consequently, the TAM (total addressable market) for the Build segment increases significantly.

“GoCanvas is a great fit and a perfect complement to our existing solution portfolio in the Build segment and therefore represents a valuable addition to our expertise in covering the complete AEC/O life cycle,” says Yves Padrines, CEO of the Nemetschek Group. “Adding the powerful solutions of GoCanvas gives us a strong competitive edge while opening access to a rapidly growing market for field workforces in construction and other adjacent verticals.”

Viyas Sundaram, GoCanvas CEO, adds: “We are thrilled to join the Nemetschek Group as we continue our mission to simplify inspections and digitize paper-based processes. This partnership will accelerate our growth and development, allowing us to offer our solutions to a wider range of customers. Together, we will support them in safeguarding their people, protecting their assets, and delivering exceptional quality.”

“We are very much looking forward to welcoming the GoCanvas team to the Nemetschek family,” adds Usman Shuja, Chief Division Officer of the Build & Construct Division and CEO of Bluebeam Inc. “GoCanvas extends the simplicity and delightful user experience that Bluebeam and 123OnSite users value. I am excited to expand our latest innovations to the field worker. Our customers will significantly benefit from this combined power, as we are now able to provide a comprehensive offering with the most advanced and sustainable functionalities possible.”

Innovative and fast-growing company

GoCanvas was founded in 2008 and has more than 300 employees with locations in the US, Canada, Australia and South Africa. With its strong Annual Recurring Revenue (ARR) growth of around 20% in recent years, GoCanvas generated an ARR of USD 67 million and an operating margin still below the Nemetschek Group average in 2023. GoCanvas’ growth is expected to stay at the level of around 20% in the coming years with an increase in operating margin resulting from operational leverage, synergies and economies of scale. The purchase price (on a cash-/debt-free basis) represents a 2023 ARR multiple of around 11.5x based on the 2023 ARR.

Transaction financing will be provided by Nemetschek’s own cash resources and existing credit facilities. The acquisition is expected to close in summer 2024 and is subject to customary regulatory approval and closing conditions. Until the transaction closes, each company will continue to operate independently. Upon closing, the CEO of GoCanvas, Viyas Sundaram, and his team will join the Nemetschek Group. More details related to the transaction will be disclosed after closing of the acquisition.

About the Nemetschek Group

The Nemetschek Group is a globally leading provider of software for digital transformation in the AEC/O and media industries. Its intelligent software solutions cover the entire life cycle of construction and infrastructure projects and allow creatives to optimize their workflows. Customers can plan, construct, and manage buildings and infrastructure more efficiently and sustainably, and develop digital content such as visualizations, films, and computer games in a creative way. The software company drives new technologies and approaches such as artificial intelligence, digital twins, and open standards (OPEN BIM) in the AEC/O industries to increase productivity and sustainability. We are continuously expanding our portfolio, including through investments in disruptive start-ups. More than 7 million users are currently designing the world with the customer-focused solutions of our four segments. Founded by Prof. Georg Nemetschek in 1963, the Nemetschek Group today employs more than 3,400 experts.

The company, which has been listed in the MDAX and TecDAX since 1999, achieved a revenue of EUR 851.6 million and an EBITDA of EUR 257.7 million in 2023.

About GoCanvas

GoCanvas is dedicated to transforming how businesses connect their office and field workers. The user-friendly platforms aim to simplify inspections, digitize traditional paper-based processes, improve safety, and ensure maximum compliance with industry standards. GoCanvas mobile and cloud solutions are designed to streamline data collection from the field to the office, taking care of administrative tasks so GoCanvas’ customers can focus on what matters most — ensuring the safety of their teams, maintaining the integrity of their equipment, and operating more efficiently.

Since 2008, GoCanvas has been driven by a commitment to excellence and continuous innovation. Based in Reston, Virginia, GoCanvas is trusted by thousands of companies to optimize their operations and deliver fast, high-quality results.

Contacts

Ema Gantcheva | ema.gantcheva@gocanvas.com

443.326.9918