Expands national footprint and enhances architectural and strategic planning capabilities TORONTO and SEATTLE, Dec. 02, 2024 (GLOBE NEWSWIRE) — Leading global diversified professional services company Colliers (NASDAQ and TSX: CIGI) today announced that Colliers Engineering & Design has finalized an agreement to partner with MG2 Corporation (“MG2”), a premier architecture, strategic planning, design, and program… [Read More]

CAPREIT Announces $313 Million of Capital Deployment In November

This news release constitutes a “designated news release” for the purposes of CAPREIT’s prospectus supplement dated February 22, 2024, to its short form base shelf prospectus dated May 9, 2023. TORONTO, Dec. 02, 2024 (GLOBE NEWSWIRE) — Canadian Apartment Properties Real Estate Investment Trust (“CAPREIT”) (TSX:CAR.UN) announced today that it has closed on the acquisition… [Read More]

Westphalia Dev. Corp. Reports Third Quarter 2024 Fiscal Results

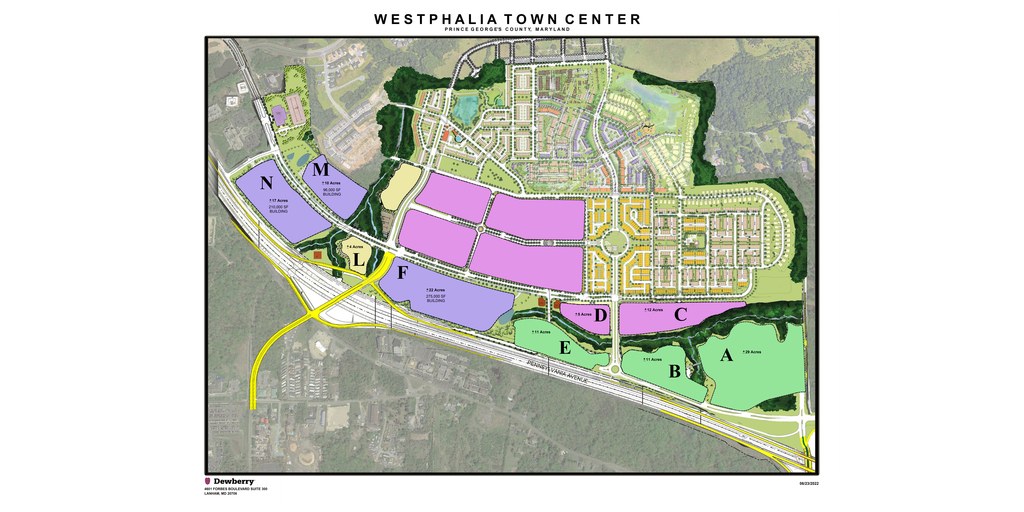

SCOTTSDALE, Ariz.–(BUSINESS WIRE)–Westphalia Dev. Corp. (the “Corporation”) announced today its results for the third quarter ending September 30, 2024. The Corporation was formed in March 2012, for the development of a 310-acre Westphalia property located in Prince George’s County, Maryland, United States. The Corporation is managed by Walton Global (the “Manager”).

Material Event:

- There is material going concern uncertainty as the Manager has informed the Board that it will not fund on a go forward basis, unless a plan is put in place to address the liquidity of the Corporation and to make a definitive plan to pay the outstanding debt, unsecured creditors, and the Manager.

- The Board and the Manager have made a commitment to construct and implement a plan as soon as possible to deal with these matters, which will include a restructuring of the Corporation.

- The Manager (and its affiliates) are owed ~$10,000,000+ and has not been paid a management fee since 2016.

Financial Results

- Operating expenses for this quarter remained consistent with Q2 2024.

- On August 27, 2024, the Corporation signed the First Amendment to the Amended New Loan Program which extends the maturity date of the loan to July 31, 2025.

- On August 27, 2024, The Corporation also signed the First Amendment to the WTCF Loan which provides a second advance of $6,761,678 USD, with a maturity date of June 30, 2025.

- On November 19, 2024, The Corporation exercised their option to extend the maturity date of the first WTCF Loan advance to December 31, 2025.

- The Manager and its affiliates continue to fund monetary shortfalls.

Development and Sales Activities

- The Westphalia Interchange TIF project located at the intersection of Pennsylvania Avenue (Route 4) and Woodyard Route (Route 223) is substantially complete. The General Contractor is preparing to finish the remaining State Highway Administration punch list items by Q2 2025.

- The Presidential Parkway East TIF project is substantially complete. We are in discussions with the local County for final acceptance. A contract to complete the final punch out landscaping is being finalized with anticipated completion in Q4 2024/Q1 2025.

- The Presidential Parkway West TIF project has work remaining. Management has a plan to complete all work, except utility dependent work, by the end of Q2 2025.

- The Manager has received multiple purchase offers for Parcels A & B from best-in-class retail developers to build a first-class mixed-use commercial development. Deal terms are currently being negotiated and we expect to have an agreement in place within 90 days.

- The Manager has completed Purchase and Sale Agreements for Parcels F, N, and M totaling approximately 50 acres. Settlements are anticipated to occur between Q1 and Q3 2025.

- The Manager received unanimous approval of our Detailed Site Plan (DSP Infrastructure) from The Maryland-National Capital Park and Planning Commission for Parcels A & B. This plan approval streamlines and accelerates the approval timeline for the future mixed-use development to be located on these parcels.

- The Manager has hired a best-in-class engineering and planning firm to complete the entitlements for the remaining approximately 96 acres, which includes the adjacent land to the north owned by a related party. The expectation is that this work will take 2 to 3 years to complete and receive full approval.

The Corporation’s unaudited interim consolidated financial statements and management’s discussion and analysis for the third quarter ended September 30, 2024, are available under the Corporation’s SEDAR profile at www.sedar.com.

Walton Global is a privately-owned, leading land asset management and global real estate investment company that concentrates on the research, acquisition, administration, planning, and development of land. With more than 45 years of experience, Walton has a proven track record of administering land investment projects within the fastest growing metropolitan areas in North America. The company manages and administers US$4.37 billion in assets on behalf of its global investors, builders and developer clients and industry business partners. Walton has more than 90,000 acres of land under ownership, management and administration in the United States and Canada with business lines ranging from exit-focused pre-development land investments, builder land financing and build-to-rent. For more information visit walton.com.

This news release, required by Canadian laws, does not constitute an offer of securities, and is not for distribution or dissemination outside Canada. This news release contains forward looking information, and actual future results may differ from what is disclosed in this news release. Forward-looking information is based on the current expectations, estimates and projections of the Corporation at the time the statements are made. They involve a number of known and unknown risks and uncertainties which would cause actual results or events to differ materially from those presently anticipated. The risks, uncertainties and other factors that could cause the Corporation’s actual results and performance in future periods to differ materially from the forward looking information contained in this news release include, among other things, the development of Westphalia Town Center, general economic and market factors, including interest rates, a decline in the real estate market, changes in government policies and regulations or in tax laws, changes in municipal planning strategies and whether certain development approvals are obtained and changes in the Canadian/U.S. dollar exchange rate, in addition to those factors discussed or referenced in documents filed with Canadian securities regulatory authorities and available online at www.sedar.com.

Except as otherwise noted, all amounts are in Canadian dollars, and are based on unaudited condensed interim consolidated financial statements for the nine months ended September 30, 2024, and related notes, prepared in accordance with International Financial Reporting Standards.

Contacts

Allison+Partners

waltonglobal@allisonpr.com

Halmont Properties Corporation Third Quarter Results

TORONTO, Nov. 29, 2024 (GLOBE NEWSWIRE) — HALMONT PROPERTIES CORPORATION (TSX-V: HMT) (“Halmont” or the “Company”) announced today that net income to shareholders for the nine months ended September 30, 2024, was $10,346,000 as compared to net income of $7,873,000 for the nine months ended September 30, 2023. (thousands, except per share amount) Nine months… [Read More]

Colliers expands credit facility to US$2.25 billion

Extends term, enhances flexibility to continue funding global growth TORONTO, Nov. 29, 2024 (GLOBE NEWSWIRE) — Colliers International Group Inc. (TSX and NASDAQ: CIGI) (“Colliers”) today announced the expansion and extension of its unsecured multi-currency revolving credit facility (the “Credit Facility”) for a new five-year term, maturing November 2029. The updated Credit Facility replaces the… [Read More]

Slate Asset Management Acquires Morrisons Regional Distribution Center in Bridgwater, United Kingdom

LONDON–(BUSINESS WIRE)–Slate Asset Management (“Slate” or the “Firm”), a global investor and manager focused on essential real estate and infrastructure assets, today announced that it has entered into an agreement to acquire the Morrisons Regional Distribution Center (the “Center”) in Bridgwater, United Kingdom (“UK”) from Aviva Investors. The Center is a high-quality, 780,000 square foot distribution facility that is fully leased by Morrisons, a leading UK grocer, on an index-linked and triple-net basis.

The Center is Morrisons’ only distribution facility in the Southwest UK and is strategically located on the most important motorway axis in the region with excellent transport connections to South England and South Wales. The Center is essential to Morrisons’ supply chain, operating 24 hours a day, seven days a week to serve nearly 20% of Morrisons’ supermarket locations.

The Center benefits from strong ESG credentials, with over 4,000 rooftop solar panels, rainwater harvesting systems, and on-site recycling. Morrisons also continues to actively invest in upgrades and technologies that are further improving the sustainability and operational resiliency of the Center.

“This property meets all the key criteria we look for in income-generating essential real estate investments,” said Brady Welch, Co-Founding Partner at Slate. “It’s a modern, sustainably built facility underpinned by a leading national grocer. The property’s strategic location makes it uniquely well positioned to efficiently distribute everyday goods to millions of consumers. It’s an exciting acquisition for us in the UK, where we continue to actively evaluate opportunities across the essential real estate sector.”

Slate has been an active investor in the European real estate market since 2016. To date, the Firm has transacted on approximately 1,000 commercial properties across 7 countries in the region. Slate’s focus on European essential real estate spans the risk spectrum, with value creation and income strategies, targeting grocery, pharmacy, food logistics, and other assets that support the non-discretionary needs of day-to-day life.

Cushman & Wakefield, Gowling WLG, and KPMG advised Slate on this transaction, which is expected to close in December 2024 subject to customary closing conditions.

About Slate Asset Management

Slate Asset Management is a global investor and manager focused on essential real estate and infrastructure assets. We focus on fundamentals with the objective of creating long-term value for our investors and partners across the real assets space. We are supported by exceptional people and flexible capital, which enable us to originate and execute on a wide range of compelling investment opportunities. Visit slateam.com to learn more, and follow Slate Asset Management on LinkedIn, X (Twitter), and Instagram.

Contacts

Karolina Kmiecik

Head of Communications

Karolina@slateam.com

Middlefield Announces Intention to Revise Names and Reduce ESG Limitations for Two ETFs

TORONTO, Nov. 28, 2024 (GLOBE NEWSWIRE) — Middlefield Limited (the “Manager”), the manager of Middlefield Sustainable Global Dividend ETF (TSX:MDIV) and Middlefield Sustainable Infrastructure Dividend ETF (TSX:MINF) (collectively, the “Funds”), is announcing its intention to de-emphasize the environmental, sustainability, and governance (“ESG”) factors associated with MINF and MDIV by revising the names, investment objectives and… [Read More]

APOLLO and Zen Residential Property Management Services Partner to Offer Digital Insurance to Residents

TORONTO–(BUSINESS WIRE)–APOLLO Insurance, a Canadian digital insurance provider and leading innovator in the emerging embedded finance sector, has partnered with Zen Residential as their exclusive provider of tenant insurance.

APOLLO’s digital platform launched in 2019 and began serving Canadian consumers with fully digital insurance products. Since then, APOLLO has partnered with leading REITs, property management companies, proptechs, and other organizations to embed insurance products into their existing workflows. For property managers, the insurance purchase experience is embedded directly into the leasing and renewal workflows.

“APOLLO and Zen Residential are both committed to improving the tenant experience through technology and innovation,” said Jeff McCann, APOLLO Founder and CEO. “Zen Residential has set the standard for resident care and property management excellence, and this partnership will elevate their service even further by making tenant insurance more accessible.”

Zen Residential has established itself as a leading property and asset management company across Alberta, known for its dedication to creating exceptional living environments. By leveraging APOLLO’s cutting-edge platform, Zen Residential will provide their tenants with an easy, digital-first way to purchase tenant insurance, while also reducing administrative work for property managers and ensuring compliance.

“We’re thrilled about this exclusive partnership with APOLLO Insurance,” said AJ Slivinski, Zen Residential CEO. “Their digital-first approach aligns perfectly with our commitment to leveraging technology to enhance the resident experience. With APOLLO, we can offer our tenants a seamless and convenient insurance solution.”

In 2022, APOLLO became the only Insurance provider in Canada to integrate with Yardi Systems to enable instant insurance transactions and automate compliance, with real time tracking and alerts for property managers. Earlier this year, APOLLO launched FinShore, a wholly owned buy now, pay later (BNPL) subsidiary, to provide a fully embedded monthly payment option to their customers.

Visit https://apollocover.com/partnerships for more information.

About APOLLO Insurance

APOLLO Insurance (“Apollo Insurance Solutions Ltd. and its subsidiaries”) is Canada’s leading online insurance provider. Our proprietary platform allows insurance agents and their customers to purchase their policy immediately, from anywhere, on any device, 24/7. Unlike traditional paper-based processes, APOLLO leverages extensive data and sophisticated algorithms to quote, collect a payment, and issue policies without human intervention.

Through traditional agents and embedded finance partnerships, APOLLO is redefining the distribution of insurance. For more information visit https://apollocover.com/.

About Zen Residential Management Services

At Zen Residential, we provide unparalleled, high-grade asset and property management solutions to rental property proprietors in Edmonton, Calgary, and the neighboring regions. Our core emphasis lies in harmonizing lifestyles and dwellings, benefiting both proprietors and occupants. We are a comprehensive management company that handles every aspect, starting from the inception of a project. Our expertise encompasses early-stage consulting, marketing strategy, and asset management, offering a “cradle to grave” approach.

Contacts

For media inquiries, please contact:

David Dyck, Chief Marketing Officer

APOLLO

Email: david@apollocover.com

LinkedIn: APOLLO

Flacks Group Acquires The Famous Augusta Golf Crowne Plaza Hotel in Augusta, Georgia, USA

MIAMI & NORTH AUGUSTA, S.C.–(BUSINESS WIRE)–Flacks Group, a Miami-based investment firm with over $4 billion in assets, is proud to announce the acquisition of the 180-room Crowne Plaza North Augusta, an IHG Hotel known for its premier hospitality offerings in the vibrant Augusta, Georgia area. Perfectly located on the scenic banks of the Savannah River, and a short distance from the iconic Augusta National Golf Club, home of The Masters Tournament, the Crowne Plaza offers a unique blend of luxury and proximity to world-class events.

Built in 2019, the Crowne Plaza North Augusta quickly established itself as a premier luxury destination in the region, catering to both business and leisure travelers, especially during key events such as The Masters Tournament and the Augusta National Women’s Amateur (ANWA). The hotel features state-of-the-art meeting spaces, perfect for corporate gatherings and special events, along with acclaimed dining options, including the renowned steakhouse Salt + Marrow and the rooftop bar Jackson’s Bluff, which boasts breathtaking views of the Savannah River and downtown Augusta.

Adjacent to the Augusta GreenJackets’ minor league baseball park and situated within the expanding Riverside Village community, the hotel provides easy access to high-end retail, luxury housing, cultural attractions, and diverse cuisine. Its unique location allows guests to experience the best of Augusta while enjoying unmatched comfort and luxury at the hotel.

“We saw a compelling opportunity with the Crowne Plaza North Augusta, a newly built, full-service luxury hotel in a prime location within one of America’s most celebrated tourist destinations,” said Michael Flacks, Chairman, CEO & Founder of Flacks Group. “The hotel’s close proximity to the Augusta National Golf Club and the unrivaled Riverside Village location makes it an ideal asset for our real estate portfolio.”

Flacks Group was represented by Hodges Ward Elliott and advised by Blue Lotus Ventures in this acquisition. Financing was provided by J.P. Morgan.

Flacks Group is searching for more hospitality properties as it continues to invest in U.S. real estate.

For more details, visit the Flacks Group website – https://flacksgroup.com/portfolio/crowne-plaza-north-augusta-ihg-hotel/

Contacts

To present properties to Flacks Group, please reach out to:

Jim Fried

Director of Real Estate and Legacy Environmental Assets

JFried@flacksgroup.com

305-773-6300

Or

Jordan Desnick

Director of US Real Estate

JDesnick@flacksgroup.com

312-618-0000

Report on Financial Results for the Three and Nine Months Ended September 30, 2024

TORONTO, Nov. 26, 2024 (GLOBE NEWSWIRE) — Mitchell Cohen, Chief Executive Officer and President of Urbanfund Corp. (TSX-V: UFC) (“Urbanfund” or the “Company”), confirmed today that the Company has filed its financial statements for the three and nine months ended September 30, 2024 (the “Consolidated Financial Statements”) and corresponding Management’s Discussion and Analysis (“MD&A”). BUSINESS… [Read More]

LP Appoints Leslie Davis as Vice President, Controller and Chief Accounting Officer

NASHVILLE, Tenn.–(BUSINESS WIRE)–LP Building Solutions (LP), a leading manufacturer of high-performance building products, today announced the appointment of Leslie Davis to Vice President, Controller and Chief Accounting Officer, effective immediately.

In her new role, Davis will oversee LP’s accounting, internal controls, and financial reporting. She will also be responsible for ensuring compliance with governance standards and managing both internal and external financial disclosures.

“Leslie has consistently demonstrated her expertise in financial management and accounting operations,” said LP Executive Vice President and Chief Financial Officer Alan Haughie. “Her analytical insight, decisive leadership, and ability to inspire teams have been invaluable. I am confident that she will excel in this role, furthering our strategic goals and enhancing value for our customers and shareholders.”

Davis joined LP in 2020 as Assistant Controller and was promoted to Senior Director of Internal Audit the following year. She brings more than 15 years of experience in financial reporting, having held key roles at EY and KPMG before joining LP.

A Certified Public Accountant, Davis earned her Master of Science in Accounting and a Bachelor of Science in Accounting from the University of Kentucky.

About LP Building Solutions

As a leader in high-performance building solutions, Louisiana-Pacific Corporation (LP Building Solutions, NYSE: LPX) manufactures engineered wood products that meet the demands of builders, remodelers and homeowners worldwide. LP’s extensive portfolio of innovative and dependable products includes Siding Solutions (LP® SmartSide® Trim & Siding, LP® SmartSide® ExpertFinish® Trim & Siding, LP BuilderSeries® Lap Siding and LP® Outdoor Building Solutions®), LP Structural Solutions (LP® TechShield® Radiant Barrier, LP WeatherLogic® Air & Water Barrier, LP Legacy® Premium Sub-Flooring, LP® FlameBlock® Fire-Rated Sheathing, LP NovaCore® Thermal Insulated Sheathing and LP® TopNotch® 350 Durable Sub-Flooring) and oriented strand board (OSB). In addition to product solutions, LP provides industry-leading customer service and warranties. Since its founding in 1972, LP has been Building a Better World™ by helping customers construct beautiful, durable homes while shareholders build lasting value. Headquartered in Nashville, Tennessee, LP operates 22 plants across the U.S., Canada, Chile and Brazil. For more information, visit LPCorp.com.

Contacts

615-986-5886

Media.Relations@lpcorp.com

Melcor REIT and Melcor Developments Announce Amended and Restated Arrangement Agreement and Cancellation of Unitholder Meeting

Melcor REIT and Melcor Developments enter into Amended and Restated Arrangement Agreement which provides increased per-Unit consideration of $5.50 Special unitholder meeting scheduled for November 26, 2024 is cancelled and Melcor REIT engages in new 90-day extended “go-shop” period Under the terms of the “go-shop”, Melcor Developments will not have the right to match a… [Read More]

- « Previous Page

- 1

- …

- 51

- 52

- 53

- 54

- 55

- …

- 1160

- Next Page »