All dollar references are in U.S. dollars, unless noted otherwise. BROOKFIELD NEWS, April 30, 2025 (GLOBE NEWSWIRE) — Brookfield Property Partners (“BPY” or the “Partnership”) announced today that the Board of Directors has declared quarterly distributions on the Partnership’s Class A Nasdaq-listed BPYPP, BPYPO, BPYPN and BPYPM (TSX: BPYP.PR.A) preferred units of $0.40625 per unit,… [Read More]

Workflow Optimization: New Report From Simpro Reveals How Digital Tools Drive Growth for Trade Businesses

Simpro’s 2025 Trades Outlook Report Reveals How Data Centralization & AI-Driven Workflow Drive Revenue Growth for Electrical, HVAC and Plumbing Business Owners

BROOMFIELD, Colo.–(BUSINESS WIRE)–Trade business owners are facing unprecedented challenges and opportunities, according to Simpro’s 2025 Trades Outlook Report. For plumbing, electrical, HVAC, and other field service business owners, the landscape has shifted dramatically, but so have the tools for success.

The report, gathering insights from over 600 diverse trade and field service businesses worldwide, reveals that companies thriving amid today’s economic pressures are those that invest in operational efficiency while building more resilient organizations.

“As someone who’s witnessed the success of trade business owners, I can tell you this is a pivotal moment,” says Gary Specter, CEO of Simpro. “The most successful businesses are facing these challenges head-on: rising customer expectations, evolving workforce dynamics, and the need to embrace technology as a competitive advantage. Those building resilient operations will see substantial growth in the coming years.”

Four Key Findings that Directly Impact the Bottom Line:

1. Focus on Operational Fundamentals

The report shows successful business owners prioritize systems that perfect the fundamentals: job management, accurate quoting, efficient scheduling, and streamlined invoicing. Nearly 80% of owners surveyed consider robust invoicing capabilities essential, recognizing that cash flow remains king.

2. Software Sprawl is Killing Efficiency

The average trade business now manages at least five software systems, with more extensive operations juggling eight or more. Yet nearly a third have no strategy for integrating the information generated by these resources. This fragmentation creates blind spots that prevent owners from making informed decisions about profitability, resource allocation, and growth opportunities.

3. AI Delivers Real ROI

For practical business owners, AI isn’t about futuristic concepts but tangible returns today. The report found that 69% of owners see AI’s most significant impact in optimizing workflows – reducing technician downtime, improving routing efficiency, and increasing job completion rates. Over 30% report that predictive maintenance capabilities help prevent costly equipment failures and emergency service calls.

4. Winning the Talent War Requires New Strategies

While blue-collar job growth continues to outpace white-collar positions, business owners still struggle to attract qualified workers. The perception problem is stark: only 23% of young people believe trades involve cutting-edge technology, while 89% of actual trades professionals report working with advanced tech daily. This disconnect has created a situation where just 16% of young people would even consider a career in the trades.

Strategic Priorities for Business Owners

For business owners looking to build more resilient operations, the report suggests three key focus areas:

- Optimize Your Revenue Engine: The most successful owners invest in systems that streamline quoting, scheduling, invoicing, and payment processing – reducing overhead costs while accelerating cash flow.

- Build a Data-Driven Business: Leading companies are consolidating information across their operations. Consider either hiring dedicated data expertise or partnering with software providers who can help transform your business data into actionable intelligence.

- Modernize Your Recruiting and Retention: Forward-thinking owners are reshaping company culture to attract younger workers by highlighting the tech-driven nature of today’s trades — from automation tools that reduce manual tasks to clear pathways for career growth. Companies that lag in tech adoption risk being seen as outdated and less appealing to top talent.

“I’ve owned my security business for over fifteen years, and the pace of change has never been faster,” says Jennifer Lambert of Team Wired, a Houston-based company specializing in commercial security and fire alarm systems. “The businesses that will thrive aren’t necessarily the ones with the most trucks or the longest history – they’re the ones willing to modernize their operations while maintaining their commitment to quality service.”

Survey Methodology

Simpro partnered with Quietly Research to conduct comprehensive research for this report, drawing on insights from a series of first-party surveys across our global customer base. With over 600 responses from trade and field service businesses worldwide, the findings reflect a robust and diverse snapshot of industry trends and challenges.

About Simpro

Simpro is field service software for trade and field service businesses, offering best-in-class solutions that provide trade business leaders with a powerful workforce and business management platform that drives efficiency and growth. Simpro supports over 250,000 users worldwide, with offices in North America, Australia, New Zealand, and the UK. For more information, visit: www.simprogroup.com.

Contacts

Wise Collective, Inc. for Simpro

simpro@wisecollective.co

press@simprogroup.com

Urbanfund Corp. Announces Loan to Shareholder

TORONTO, April 29, 2025 (GLOBE NEWSWIRE) — Urbanfund Corp. (TSX-V: UFC) (“Urbanfund” or the “Company”), announces that it entered into loan agreement dated April 29, 2025 (the “Loan Agreement”) pursuant to which the Company has agreed to loan Westdale Construction Co. Limited (“Westdale”) the principal amount of $3,000,000 (the “Loan”). The Loan is repayable on… [Read More]

New Research Finds Building with Zinc Prevents Substantial Carbon Emissions

DURHAM, N.C.–(BUSINESS WIRE)–Using zinc to build a single home prevents more than 50 tonnes in carbon emissions, and if just ten percent of new homes in North America were built using zinc, more than 40 million tonnes in carbon emissions would be prevented. These impressive numbers demonstrating zinc’s success story as an agent of decarbonization are the first results of the International Zinc Association’s new Zinc Enables Decarbonization (ZED) initiative, a partnership between the International Zinc Association and Environmental Economist Benjamin Cox, Program Director of the Bradshaw Research Institute for Minerals and Mining at the University of British Columbia.

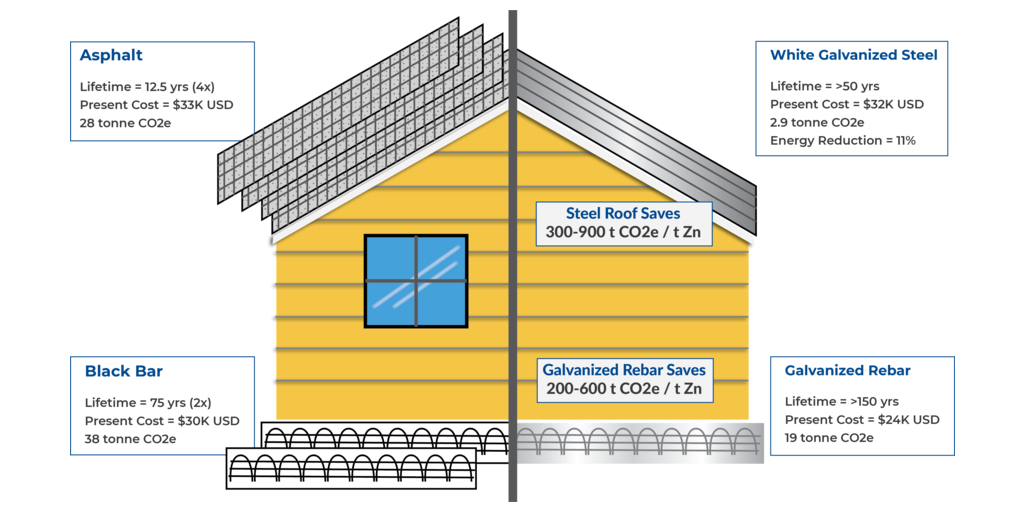

The ZED program quantifies zinc’s impact with steel on decreasing life-time costs, decreasing carbon emissions, and increasing safety in housing, infrastructure, energy and transportation. The first phase has assessed the value in residential construction, where zinc is used to coat and protect the rebar used in the reinforced concrete of a home’s foundation and in the sheeting of a metal roof. A zinc coating prevents corrosion and ensures longevity.

“Zinc plays a transformative role in building stronger, more sustainable communities, particularly in the decarbonization of residential buildings,” said Andrew Green, Executive Director of the International Zinc Association. “From the foundation to the rooftop, zinc enables long-lasting, low-maintenance solutions that enhance a home’s durability and environmental performance.”

In a typical U.S. home, a traditional foundation may last 75 years and an asphalt roof as long as 25 years, but a home using galvanized steel in concrete reinforcement and in roofing materials can double the service life and avert future costs and emissions associated with repair and replacement, according to ZED research. The selection of galvanized steel for new roofs in Europe also can prevent more than ten tonnes of carbon emissions per home and provide substantial economic savings over using tile roofing materials.

“Our research finds that zinc provides long-term savings by preventing repeated repair and replacement of a home’s roof and foundation,” said ZED Economist Benjamin Cox. “But in addition to economic savings, we’ve also accounted for the extraordinary environmental benefit provided by zinc – preventing hundreds of millions of tonnes in carbon emissions.”

The financial and environmental benefits are detailed in this graphic, showing the extended service life, lowered utility bill, and avoided environmental impact of a house built using zinc.

“Zinc’s impact in housing increases with each year of service life, adding substantial economic and environmental value to every home and providing a bright outlook for zinc and the homes it enhances,” said ZED Director Eric Van Genderen. “With these results, we can make the case to policy makers, investors, engineers, and builders to make zinc a permanent part of residential construction planning.”

The first report from the ZED program focuses on zinc’s impact on residential construction, particularly in the United States. ZED also will release reports quantifying zinc’s impact in transportation infrastructure, energy infrastructure, and the automotive industry.

About the International Zinc Association

The International Zinc Association is a non-profit trade association working on behalf of the global zinc industry and its downstream users. IZA’s mission is to provide global leadership, coordination, and value on strategic issues for the zinc industry, including market development, license to operate, communications, and sustainability.

Contacts

For more information, contact:

Tanya Correa

tcorrea@zinc.org

1-202-487-4534

Halmont Properties Corporation Year End Results

TORONTO, April 28, 2025 (GLOBE NEWSWIRE) — HALMONT PROPERTIES CORPORATION (TSX-V: HMT) (“Halmont” or the “Company”) announced today that net income for the year ended December 31, 2024, was $18.39 million as compared to $18.49 million for the year ended December 31, 2024. (millions, except per share amount) Year Ended December 31, 2024 Year… [Read More]

Report on Financial Results for the Year Ended December 31, 2024

TORONTO, April 28, 2025 (GLOBE NEWSWIRE) — Mitchell Cohen, Chief Executive Officer and President of Urbanfund Corp. (TSX-V: UFC) (“Urbanfund” or the “Company”), confirmed today that the Company has filed its financial statements for the year ended December 31, 2024 (the “Consolidated Financial Statements”) and corresponding Management’s Discussion and Analysis (“MD&A”). BUSINESS OVERVIEW AND STRATEGY… [Read More]

SmartStop Self Storage Expands Digital Capabilities With Mobile App Rollout Across All Locations

LADERA RANCH, Calif.–(BUSINESS WIRE)–SmartStop Self Storage REIT, Inc. (“SmartStop”) (NYSE:SMA), an internally managed real estate investment trust and a premier owner and operator of self-storage facilities in the United States and Canada, is pleased to announce that its SmartStop Self Storage Mobile App is officially available at all 220 locations across the United States and Canada.

After a successful phased rollout, the SmartStop Self Storage mobile app is now accessible to all SmartStop customers. It offers an enhanced, tech-forward experience that puts control at their fingertips. The SmartStop mobile app is a proprietary mobile app encompassing the latest in mobile technology, including biometrics and geographically enabled security features. The app enables users to manage their accounts, make easy and secure payments, rent new units, and access gates and doors with a single touch, providing a fully integrated storage experience directly from their smartphones.

“We’re excited to bring this level of convenience to all our customers,” said H. Michael Schwartz, Chairman and CEO of SmartStop. “The mobile app reflects our ongoing commitment to innovation and making self storage more accessible, intuitive, customer-friendly, and of course, smart.”

With a focus on simplicity and functionality, the SmartStop app streamlines everyday tasks and allows users to manage their storage needs without visiting the office, empowering them with greater flexibility. The app is free for download on iOS and Android devices via the Apple App Store and Google Play Store.

About SmartStop Self Storage REIT, Inc. (SmartStop):

SmartStop Self Storage REIT, Inc. (“SmartStop”) (NYSE:SMA) is a self-managed REIT with a fully integrated operations team of approximately 590 self-storage professionals focused on growing the SmartStop® Self Storage brand. SmartStop, through its indirect subsidiary SmartStop REIT Advisors, LLC, also sponsors other self-storage programs. As of April 24, 2025, SmartStop has an owned or managed portfolio of 220 operating properties in 23 states, the District of Columbia, and Canada, comprising approximately 157,200 units and 17.7 million rentable square feet. SmartStop and its affiliates own or manage 41 operating self-storage properties in Canada, which total approximately 34,400 units and 3.5 million rentable square feet. Additional information regarding SmartStop is available at www.smartstopselfstorage.com.

Contacts

David Corak

Sr. VP of Corporate Finance and Strategy

SmartStop Self Storage REIT, Inc.

IR@smartstop.com

Gulf & Pacific Equities Corp. reports on 2024 Year-End Results with Revenue of $4,673,950

Toronto, April 25, 2025 (GLOBE NEWSWIRE) — Gulf & Pacific Equities Corp. (TSX-V: GUF) an established company focused on the acquisition, management and development of anchored shopping centres in Western Canada, reports a 5.2% increase in revenues to $4,673,950 in the year ended December 31, 2024, from $4,442,745 at the same period last year. Details of… [Read More]

FirstService Reports First Quarter Results

Solid Top-Line Growth Across Both Divisions Operating highlights: Three monthsended March 31 2025 2024 Revenues (millions) $ 1,250.8 $ 1,158.0 Adjusted EBITDA (millions) (note 1) 103.3 83.4 Adjusted EPS (note 2) 0.92… [Read More]

Dream Residential REIT Q1 2025 Financial Results Release Date, Webcast and Conference Call

TORONTO–(BUSINESS WIRE)–DREAM RESIDENTIAL REIT (TSX: DRR.U and TSX: DRR.UN) (“Dream Residential” or the “REIT”) will be releasing its financial results for the quarter ended March 31, 2025, on Wednesday, May 7, 2025.

Senior management will be hosting a conference call to discuss the financial results. Participants may join the conference call by audio or webcast.

Conference Call:

|

Date: |

Thursday, May 8, 2025 at 10:00 a.m. (ET) |

|

|

Audio: |

1-844-763-8274 (toll free) |

|

|

647-484-8814 (toll) |

||

|

Webcast: |

A live webcast will also be available in listen-only mode. To access the simultaneous webcast, go to the Calendar of Events on the News and Events page on Dream Residential’s website at www.dreamresidentialreit.ca and click the link for the webcast. |

|

|

Digital Replay: |

A taped replay of the call will be available for ninety (90) days. For access details, please click on the Calendar of Events on Dream Residential’s website. |

About Dream Residential

Dream Residential REIT is an unincorporated, open-ended real estate investment trust established and governed by the laws of the Province of Ontario. The REIT owns a portfolio of garden-style multi-residential properties, primarily located in three markets across the Sunbelt and Midwest regions of the United States. For more information, please visit www.dreamresidentialreit.ca.

Contacts

For further information, please contact:

Brian Pauls

Chief Executive Officer

(416) 365-2365

bpauls@dream.ca

Derrick Lau

Chief Financial Officer

(416) 365-2364

dlau@dream.ca

Scott Schoeman

Chief Operating Officer

(303) 519-3020

sschoeman@dream.ca

StorageVault Reports 2025 First Quarter Results, Completes Another 100,000 Square Feet of New Space, Announces $126.2 Million of Acquisitions and Increases Dividend

TORONTO, April 23, 2025 (GLOBE NEWSWIRE) — STORAGEVAULT CANADA INC. (“StorageVault” or the “Corporation”) (SVI-TSX) reported the Corporation’s 2025 first quarter results, completes another 100,000 square feet of new space, announces $126.2 million of acquisitions and increases dividend. Iqbal Khan, Chief Financial Officer, commented: “We are pleased to start the year off with positive same… [Read More]

CORRECTION – Middlefield Global Infrastructure Dividend ETF Distributions

TORONTO, April 23, 2025 (GLOBE NEWSWIRE) — In a release issued today by Middlefield Sustainable Infrastructure Dividend ETF (TSX: MINF), please note the source should have read as Middlefield Global Infrastructure Dividend ETF. The corrected release follows: Middlefield Global Infrastructure Dividend ETF (TSX: MINF) (the “Fund”) is pleased to announce that distributions for the second quarter of… [Read More]

- « Previous Page

- 1

- …

- 30

- 31

- 32

- 33

- 34

- …

- 1159

- Next Page »