CARY, N.C.–(BUSINESS WIRE)–Recent strides in product development are not only positioning Cornerstone Building Brands’ Canadian Business Unit as a frontrunner in the building materials sector — they are also contributing to a paradigm shift in architectural solutions across North America.

“In the building materials industry, where evolution is often a driver of success, we’re proud to introduce new and exciting innovations that continue to answer the needs of customers across the board,” says Lisa Domnisch, President of the Canadian Business Unit at Cornerstone Building Brands. “We’ve used materials science research to develop better performing and more sustainable products, and we’ve introduced pioneering designs by partnering with industry influencers. We’re excited to be incorporating new trends that are leading the market in form, structure and colour.”

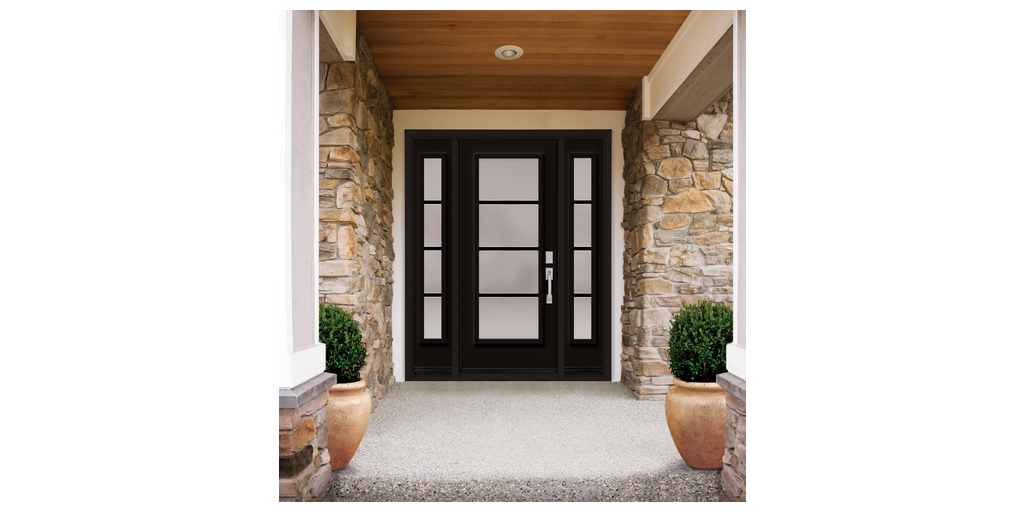

SENTINEL ENTRY DOOR SYSTEMTM BY NORTH STAR WINDOWS & DOORS

Drawing inspiration from the vigilance of actual sentinels, the Sentinel Entry Door SystemTM is a testament to North Star Windows & Doors’ reliability and durability — but with a few modern twists. The system boasts a composite frame designed for longevity and weather resistance, and its closed cellular structure and rigid poly-fiber formulation prevent rot, decay and water absorption. This all contributes to a door system that will stand guard for years to come.

What truly sets Sentinel Entry Door SystemTM apart is the customization options. Customers can choose from one or two panels, single or double sidelites and optional rectangular or elliptical transoms, allowing homeowners to fine-tune an entrance that aligns with their unique aesthetic preferences. The variety of doorlite glass types, including Obscure, Decorative, Wrought Iron and Clear Low-E glass, further adds to the versatility. Whether customers are seeking the durability of steel or the elegance of fiberglass, Sentinel Entry Door SystemTM can make their home a bastion of style and security.

For further information, visit northstarwindows.com.

FUSION COLOUR WRAPTM BY PLY GEM®

For those who value form and function in equal measure, the Ply Gem® brand has introduced a brilliant solution to transform the appearance of dated vinyl windows and sliding patio doors. The innovative technology behind Fusion Colour WrapTM involves applying a multi-layered laminate film with precise heat application, creating a permanent bond between wrap and vinyl. The result is a sleek and durable surface area that is as tough as it is low maintenance. Interior film options for the Design Series allow for a modern, aluminum-clad exterior with enhanced and contemporary interior colour options through Fusion Colour WrapTM.

Resistant to scratches and abrasions and easy to clean with standard household products, Colour WrapsTM are an excellent choice for high-traffic areas both inside and outside the home. These wraps are impervious to common environmental pollutants like carbon monoxide and particulate matter, and are resistant to chipping and peeling. In contrast to painted alternatives, the product has been designed to withstand the extreme temperature fluctuations found in most parts of Canada. Coupled with a 20-year warranty, this means longevity is ensured even in the harshest climates.

For further information, visit plygem.ca.

WEST RIDGE SIDING BY MITTEN®

The West Ridge of Mount Everest is known as one of the most difficult ways to reach the top of the world. Only a handful of climbers have reached the summit using the route, and it requires incredible commitment, planning and teamwork to even muster an attempt. Mitten®’s West Ridge line embodies the essence of this achievement, highlighted by the product’s strength, rigidity and resilience in tough conditions.

West Ridge delivers the essence of genuine wood siding without the hassle of constant maintenance. Our 8” plank, with its .046” thickness, embodies the timeless elegance of hand-cut wood, offering enduring beauty with minimal upkeep. Expertly designed with an impressively broad 8” profile width and a stacked locking system, the plank boasts additional panel strength with a rigid foam backing — all while being ultra lightweight and incredibly easy to install in horizontal, vertical and porch ceiling applications. Available in eight must-have colours, West Ridge is backed by Mitten®’s lifetime warranty and signature No Fade Promise.

For further information, visit mittensiding.com.

LEARN MORE AT THE INTERNATIONAL BUILDERS’ SHOW

Cornerstone Building Brands is built for what’s next. With unrelenting customer focus, a strong emphasis on quality and performance and an expansive network of manufacturing hubs, distribution centers and sales branches, Cornerstone Building Brands is poised to forge ahead in 2024 as a leading provider for building professionals who are navigating the challenges of tomorrow, today.

Interested in learning more? Visit Cornerstone Building Brands at the 2024 International Builders’ Show® ️at Booth C3830 or online at cornerstonebuildingbrands.com.

ABOUT CORNERSTONE BUILDING BRANDS

Cornerstone Building Brands is a leading manufacturer of exterior building products for residential and low-rise non-residential buildings in North America. Headquartered in Cary, N.C., we serve residential and commercial customers across the new construction and repair & remodel markets. Our market-leading portfolio of products spans vinyl windows, vinyl siding, stone veneer, metal roofing, metal wall systems and metal accessories. Cornerstone Building Brands’ broad, multi-channel distribution platform and expansive national footprint includes approximately 18,000 employees at manufacturing, distribution and office locations throughout North America. Corporate stewardship and environmental, social and governance (ESG) responsibility are embedded in our culture. We are committed to contributing positively to the communities where we live, work and play.

Contacts

Jennifer Candlish

Communications Director

Jan Kelley

jcandlish@jankelley.com

905-537-6163