Amid rising demand for clean energy technologies, Auxilium adopts Elevated Signals’ manufacturing software to unlock the estimated $3.4 trillion in critical minerals trapped in mine tailings globally

VANCOUVER, British Columbia & TUCSON, Ariz.–(BUSINESS WIRE)–#CircularEconomy—Elevated Signals Inc. (“Elevated Signals”), a pioneering technology company that offers advanced Manufacturing Resource Planning (MRP) software, announces the continued diversification of its client base into the growing waste-to-value and critical minerals recovery sectors, highlighted by a new partnership with Auxilium Technology Group (“Auxilium”).

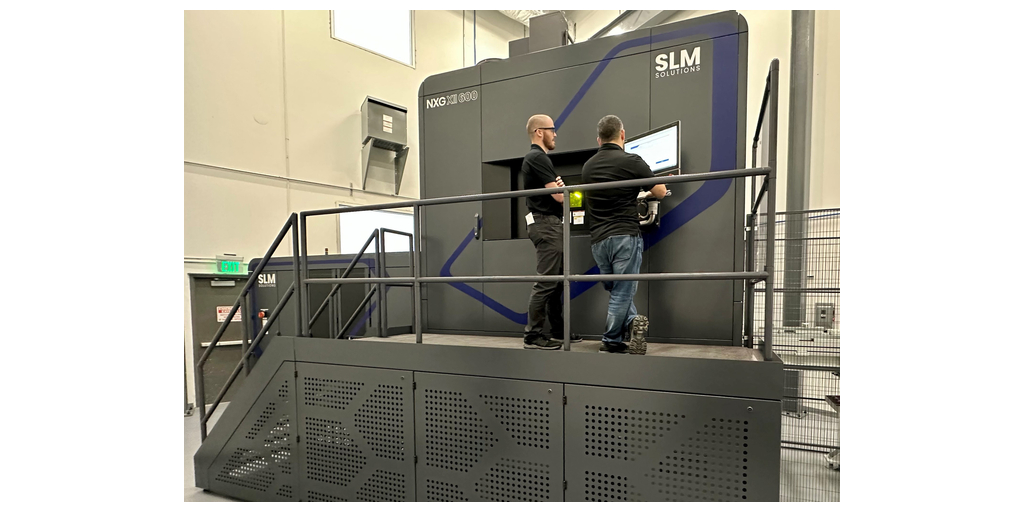

Auxilium‘s unique valorization technology efficiently extracts critical minerals from mine tailings and repurposes the reclaimed tailings to manufacture eco-friendly construction materials.

Mining waste is one of the largest waste streams generated globally, with an estimated 100 billion tons or more produced annually. The value of precious, critical, and strategic metals in these tailings is thought to exceed $3.4 trillion worldwide, and demand for these minerals, including cobalt, copper, lithium, nickel, and several other rare earth elements, is expected to more than double by 2040.

“Waste-to-value manufacturing businesses like Auxilium play a key role in providing critical minerals needed for the transition to renewable energy, which presents a significant opportunity within the mining sector,” said Amar Singh, CEO and co-founder of Elevated Signals. “As the industry expands, it has become increasingly clear that these reclamation processes can be better optimized with precise real-time inventory tracking and data-driven analytics. This is something that rigid ERP systems, spreadsheets, and paper-based processes are not equipped to deliver, which is where our platform comes in.”

“Our operation’s needs are complex and constantly evolving. At every stage of production, we must consistently monitor and evaluate the presence and quality of various measurable characteristics in the materials processed in our inventory,” said Michael Goedecke, Auxilium’s Lead Metallurgical Technician. “Elevated Signals gives us a centralized, user-friendly interface that provides a complete and clear view of the live inventory, which has really helped us simplify and optimize our processes.”

Auxilium currently operates a pilot plant in Arizona and is on a rapid growth trajectory. Its modular technology can be used to remediate old mine sites and can also be utilized by operating mines without disrupting operations. The company sees significant opportunities to expand its operations into South America, the U.S., Africa, Australia, and beyond.

About Elevated Signals

Elevated Signals Inc. (“Elevated Signals”) offers modern manufacturing software designed for the complex operations of rapidly expanding manufacturing businesses eager to scale quickly. The company caters to a wide range of clients across various sectors, including controlled environment agriculture, natural health products, critical minerals recovery, and more. Its advanced Manufacturing Resource Planning (MRP) platform sets new standards for operational efficiency with its user-friendliness, flexibility, and complete traceability. The cloud-based solution acts as a unified source of truth for managing live inventory, providing easy access across the company from any location. It streamlines operations and cuts waste by automating real-time tracking, digitizing records and custom forms, and ensuring clear inventory visibility. By removing manual processes and breaking down data silos, Elevated Signals enables quicker and more informed decision-making, allowing businesses to prioritize profitability.

Learn more at https://www.elevatedsignals.com/join-us and follow Elevated Signals on LinkedIn, Instagram, and X at @ElevatedSignals.

About Auxilium

Auxilium Technology Group (“Auxilium”) provides solutions that maximize value from mining waste while minimizing the environmental impact of the mining industry. The company uniquely offers complete tailings repurposing solutions using proprietary technologies. These solutions prioritize environmentally friendly practices, focusing on efficient metal recovery, water treatment, green energy generation, and building material production. Among its products, the Entail solution stands out as a groundbreaking regenerative tailings management system, enabling mining companies to enhance operational value and significantly reduce waste. Entail fully valorizes the input tailings feed, recovers critical elements necessary for the energy transition, produces eco-friendly construction materials, and substantially reduces carbon emissions.

Contacts

Elevated Signals:

Media inquiries: Media@elevatedsignals.com

Sales or product inquiries: Sales@elevatedsignals.com