The innovative new mortgage experience takes the company into the $1.4 trillion mortgage market and further strengthens its position as Canada’s leading digital banking platform

VANCOUVER, Jan. 17, 2017 /CNW/ – Mogo Finance Technology Inc. (TSX: MOGO / Frankfurt: MO0) (“Mogo”) announced today the launch of MogoMortgage, a new product in the company’s line-up and the next step toward its goal of building the best digital banking experience in Canada. Mogo, a leading Canadian financial technology company, is focused on leveraging technology and design to pioneer financial products that make it easier for consumers to manage their financial health.

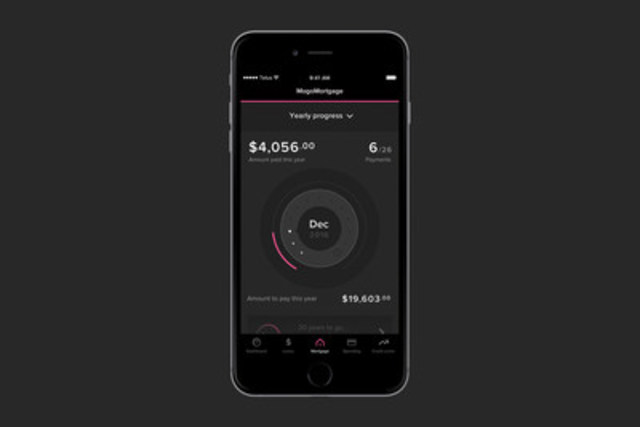

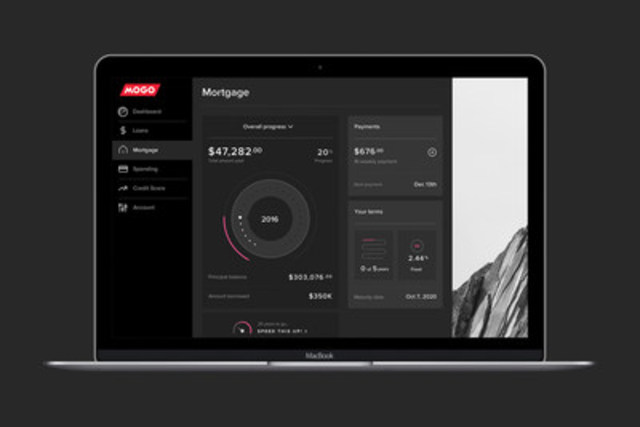

“We’re excited to launch our new MogoMortgage, which has simplified the mortgage experience by bringing a new level of transparency to not only the interest rates but also the process of getting a mortgage,” said Dave Feller, Founder and CEO of Mogo. “In addition, unlike any other mortgage experience in Canada, we focus on keeping our members on track through an interactive dashboard that is designed to encourage and reward members for paying down their mortgage, which is perhaps the single biggest thing Canadians can do towards their goal of achieving financial freedom.”

To make the experience of getting a mortgage transparent, less stressful, and more convenient, Mogo has simplified the process and made it more engaging in a number of ways for consumers including:

- An online and mobile process, from pre-approval until the mortgage is renewed or fully paid-off.

- Experienced mortgage specialists available via online chat, email, and phone to walk through the process and help get the right mortgage for them.

- Transparent advertised rates that are not only the actual rates, but are also market-leading.

- The only mortgage experience that provides free monthly credit score monitoring to help track financial health.

- A custom, interactive dashboardâthe only one in Canadaâthat gamifies the experience of getting mortgage free, including rewarding members with perks like dinner on Mogo, to celebrate payment milestones annually.

- Champagne on closing: members also get celebratory champagne sent to them on the closing of their mortgage.

“Entering Canada’s $1.4 trillion housing loan market represents a massive business opportunity and is a natural progression for us,” said Greg Feller, President and CFO of Mogo. “This also marks our expansion into fee-based products. As a mortgage broker, we have no capital requirements or credit risk, positioning us to drive high-margin, transaction revenue from our mortgage offering.”

Mogo has obtained a mortgage broker license in the provinces of BC, AB, and ON, with plans to expand throughout Canada. Working with some of Canada’s top mortgage lenders, Mogo is positioned to bring a new level of transparency and convenience to the Canadian mortgage experience, and offer the best of both worlds: market-leading rates and the best digital mortgage experience in Canada.

MogoMortgage is currently offered in BC, AB and ON by Mogo Mortgage Technology Inc. o/a MogoMortgage (Ontario: FSCO License No. 12836).

For more information on the MogoMortgage, please visit https://www.mogo.ca/mogo-mortgage

To download images related to this announcement, please visit: https://www.dropbox.com/sh/4ikqc81w7t0j3y5/AADuAXOJnnj0RzrgrxhRQaY1a?dl=0

About Mogo Finance Technology Inc.

Mogo (TSX: MOGO)â a Vancouver-based financial technology companyâ is focused on building the best digital banking experience in Canada, with innovative products designed to help consumers get in control of their financial health. Built mobile first, users can sign up for a free MogoAccount in only three minutes and get access to free credit score monitoring, a free spending account, mortgages and personal loans. With more than 350,000 members and growing, Mogo is leading the shift to digital banking in Canada. To learn more, please visit mogo.ca or download the mobile app.

Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements regarding Mogo’s plans to expand throughout Canada, the launch of its digital spending account and projections regarding member growth. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual financial results, performance or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by those forward-looking statements and the forward-looking statements are not guarantees of future performance. Mogo’s growth, its ability to invest in its platform and expand into new products and markets and its expectations for its financial performance for 2016 are subject to a number of conditions, many of which are outside of Mogo’s control. For a description of the risks associated with Mogo’s business please refer to the “Risk Factors” section of Mogo’s annual information form dated March 30, 2016 for the year ended December 31, 2015, which is available at www.sedar.com. Except as required by law, Mogo disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise.

SOURCE Mogo Finance Technology Inc