TORONTO, April 20, 2023 /CNW/ – H&R Real Estate Investment Trust (“H&R” or “the REIT”) (TSX: HR.UN) is pleased to announce the closing of the sale of 160 Elgin Street for $277.0 million, to Groupe Mach (the “Purchaser”), a private Canadian real estate firm. 160 Elgin Street was H&R’s only Ottawa office property, comprising 973,611 square feet in downtown Ottawa, Ontario. This sale is consistent with the REIT’s strategic repositioning plan to surface significant value for unitholders, by transforming into a simplified, growth-oriented company focused on residential and industrial properties.

“Given the considerable headwinds in the public and private real estate markets, we are very pleased to have executed this transaction,” said Tom Hofstedter, Executive Chairman and CEO. “This office sale furthers our strategic repositioning plan and moves H&R REIT closer to achieving our portfolio simplification strategy goals. We continue to execute our plan with discipline by transacting when we can surface fair value for our unitholders.”

Philippe Lapointe, President of the REIT, added, “We are well on our way to creating a simplified, growth-oriented business that will create sustainable value for our unitholders. Initial proceeds of $67 million from this sale will be put to good use repaying debt and repurchasing H&R units at a significant discount to the REIT’s net asset value (“NAV”) per Unit1.”

Highlights

- $67.0 million cash proceeds received on closing.

- $180.0 million to be received within 90 days of closing.

- Net proceeds from the sale to be used to repay debt and repurchase H&R units under the REIT’s normal course issuer bid.

- On a square footage basis, 160 Elgin represents 19% of the REIT’s Canadian office portfolio.

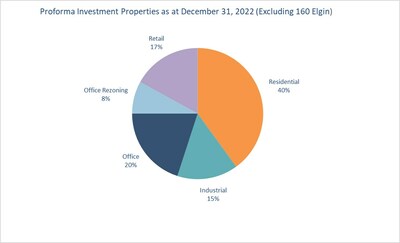

- Reduces total current office exposure from 30% to 28% on a fair value basis.

- The REIT’s proforma office weighted average lease term remains at 7.5 years.

- Improves the REIT’s growth profile by increasing exposure to higher growth residential and industrial sectors.

H&R has provided the Purchaser with a 90-day $180.0 million loan secured by a first mortgage on the property, earning interest at 6.5% per annum. In addition, H&R has provided the Purchaser with a second loan of $30.0 million which will be subordinate to the first mortgage on the property. The second mortgage will bear interest at 4.5% per annum and will mature in April 2028.

|

_______________________ |

|

1 This is a non-GAAP ratio. Refer to the “Non-GAAP Measures” section of this news release. |

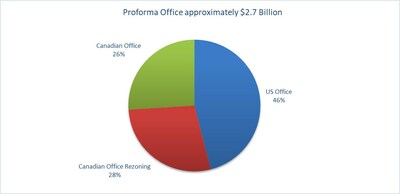

H&R’s proforma December 31st, 2022 office portfolio adjusted for the sale of 160 Elgin, Ottawa and 2611-3rd Avenue, Calgary consists of the following categories:

- Canadian office currently undergoing rezoning represents approximately $755.0 million across eight properties.

- H&R’s remaining Canadian office properties represents approximately $702.0 million across 10 properties with an average remaining lease term of 7.5 years as at December 31, 2022. H&R will continue to hold these properties for future dispositions.

- H&R’s U.S. office portfolio consists of five properties with a weighted average lease term of 8.7 years as at December 31, 2022.

On January 23, 2023, H&R borrowed $250.0 million on its unsecured credit facility to repay the Series O Senior Debentures that matured on the same day. On March 14, 2023, H&R obtained a new $275.0 million non-revolving secured credit facility secured by 42 industrial properties. Upon closing, the REIT repaid $12.5 million outstanding on its secured revolving $25.0 million line of credit facility which matured as part of closing this new term loan. The remaining proceeds were used to repay unsecured operating lines of credit.

H&R REIT is one of Canada’s largest real estate investment trusts with total assets of approximately $11.4 billion as at December 31, 2022. H&R REIT has ownership interests in a North American portfolio comprised of high-quality residential, industrial, office and retail properties comprising over 28.7 million square feet. H&R is currently undergoing a five-year, strategic repositioning to transform into a simplified, growth-oriented company focusing on residential and industrial properties to surface significant value for unitholders.

Forward-Looking Disclaimer

Certain information in this news release contains forward-looking information within the meaning of applicable securities laws (also known as forward-looking statements) including, among others, statements relating to H&R’s objectives, beliefs, plans, estimates, targets, projections and intentions and similar statements concerning anticipated future events, results, circumstances, performance or expectations that are not historical facts including, with respect to H&R’s strategic repositioning plan, the ability to surface value for unitholders, the REIT’s growth profile, the intended sales and rezoning of office properties, portfolio exposure, and the use of proceeds from the sale of 160 Elgin, and. Forward-looking statements generally can be identified by words such as “outlook”, “objective”, “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”, “plans”, “project”, “budget” or “continue” or similar expressions suggesting future outcomes or events. Such forward-looking statements reflect H&R’s current beliefs and are based on information currently available to management.

Forward-looking statements are provided for the purpose of presenting information about management’s current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. These statements are not guarantees of future performance and are based on H&R’s estimates and assumptions that are subject to risks, uncertainties and other factors including those risks and uncertainties discussed in H&R’s materials filed with the Canadian securities regulatory authorities from time to time, which could cause the actual results, performance or achievements of H&R to differ materially from the forward-looking statements contained in this news release. Material factors or assumptions that were applied in drawing a conclusion or making an estimate set out in the forward-looking statements include assumptions relating to the general economy, including the effects of increased inflation; the debt markets continuing to provide access to capital at a reasonable cost, notwithstanding rising interest rates; and assumptions concerning currency exchange and interest rates. Additional risks and uncertainties include, among other things, risks related to: real property ownership; current economic environment; credit risk and tenant concentration; lease rollover risk; interest rates and other debt-related risks; development risks; residential rental risk; capital expenditure risk; currency risk; liquidity risk; risks associated with disease outbreaks; cyber security risk; financing credit risk; ESG and climate change risk; coownership interest in properties; general uninsured losses; joint arrangements and investment risk; dependence on key personnel and succession planning; potential acquisition, investment and disposition opportunities and joint venture arrangements; potential undisclosed liabilities associated with acquisitions; competition for real property investments; and potential conflicts of interest; unit-price risk; availability of cash for distributions; credit ratings; ability to access capital markets; tax risk; additional tax risks applicable to unitholders; dilution; unitholder liability; redemption right risk; investment eligibility; risks relating to debentures; and statutory remedies. H&R cautions that these lists of factors, risks and uncertainties are not exhaustive. Although the forward-looking statements contained in this news release are based upon what H&R believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements.

Readers are also urged to examine H&R’s materials filed with the Canadian securities regulatory authorities from time to time as they may contain discussions on risks and uncertainties which could cause the actual results and performance of H&R to differ materially from the forward-looking statements contained in this news release. All forward-looking statements in this news release are qualified by these cautionary statements. These forward-looking statements are made as of today and H&R, except as required by applicable Canadian law, assumes no obligation to update or revise them to reflect new information or the occurrence of future events or circumstances.

The audited consolidated financial statements of the REIT and related notes for the year ended December 31, 2022 (the “REIT’s Financial Statements”) were prepared in accordance with International Financial Reporting Standards (“IFRS”). However, H&R’s management uses a number of measures, including NAV per Unit, which do not have meanings recognized or standardized under IFRS or Canadian Generally Accepted Accounting Principles (“GAAP”). These non-GAAP measures and non-GAAP ratios should not be construed as alternatives to financial measures calculated in accordance with GAAP. Further, H&R’s method of calculating these supplemental non-GAAP measures and ratios may differ from the methods of other real estate investment trusts or other issuers, and accordingly may not be comparable. H&R uses these measures to better assess H&R’s underlying performance and provides these additional measures so that investors may do the same. For information on the most directly comparable GAAP measures, composition of the measures, a description of how the REIT uses these measures and an explanation of how these measures provide useful information to investors, refer to the “Non-GAAP Measures” section of the REIT’s management’s discussion and analysis as at and for the three months and year ended December 31, 2022, available at www.hr-reit.com and on the REIT’s profile on SEDAR at www.sedar.com, which is incorporated by reference into this news release.

Additional information regarding H&R is available at www.hr-reit.com and on www.sedar.com.

SOURCE H&R Real Estate Investment Trust

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2023/20/c9992.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2023/20/c9992.html