- FFO per unit up 2.4% and 5.6% for the three and twelve month periods ended December 31, 2015

- Increases distribution by 10.3% to $2.25 per Trust Unit on an annualized basis

- Revises 2016 guidance to include target acquisitions of 800 â 1,200 apartment units

- Accelerated Development Pipeline, including the commencement of Phase 2 and 3 of Pines Edge in Regina

- Increases allocation to existing Trust Unit repurchase program

- Net Operating Income Optimization Strategy will continue to provide stable operating results

- Portfolio maintains occupancy above 97%

CALGARY, Feb. 18, 2016 /CNW/ – Boardwalk Real Estate Investment Trust (“BEI.UN” – TSX)

Boardwalk Real Estate Investment Trust (“Boardwalk”, the “REIT” or the “Trust”) today announced solid financial results for the fourth quarter of 2015.

Funds From Operations (“FFO”) for the fourth quarter increased to $44.2 million, or $0.86 per Trust Unit on a diluted basis, from FFO of $43.7 million or $0.84 per Trust Unit for the same period last year, an increase of 1.2% and 2.4% respectively. Boardwalk increased FFO to $184.9 million, or $3.56 per Trust Unit on a diluted basis, in the twelve month period ended December 31, 2015, an increase of approximately 5.1% in FFO and 5.6% per Trust Unit, from the same period in 2014. Adjusted Funds from Operations (“AFFO”) per Trust Unit increased 2.6% to $0.78 for the current quarter, from $0.76 per Trust Unit during the same period in 2014, and increased 5.9% to $3.23 per Trust Unit for the twelve month period ended December 31, 2015, from the period a year ago.

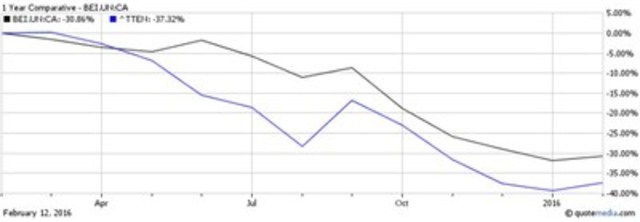

Boardwalk Trust Unit Price Disconnect

Boardwalk’s Board of Trustees and Management believe that there is a significant gap between the recent trading price of Boardwalk Trust Units and the current and longer term value of the REIT. Sam Kolias, Chairman and Chief Executive Officer of Boardwalk REIT said “It would appear that the market is valuing Boardwalk based on the prevailing price of a barrel of oil as opposed to that of, affordable, residential real estate. Despite the current economic environment, Boardwalk continues to deliver stable revenues and FFO as a result of continued high occupancy levels and stable Net Operating Income. Historically, Boardwalk has delivered sustainable financial performance in the face of oil price volatility, and has capitalized on these cyclical opportunities to create even greater value for our unitholders.”

Rental rates in the REIT’s primary market of Alberta increased by approximately 3.6% per year from 1992 to 2015, according to Canada Mortgage And Housing Corporation (“CMHC”) data. From 2004 to 2015, the CMHC rental growth rate was approximately 4.7% per year. As highlighted in the figure below, Boardwalk’s FFO as a result of stable occupancy levels and average in place rent remained steady as oil prices hit a low in 2009 and increased over the following years.

Despite headwinds as a result of lower oil prices, the chart above highlights how the REIT sustained revenues and FFO during the last oil market downturn. This resilience, coupled with the increase in FFO in fiscal 2015, demonstrates that there is a significant disconnect between the current trading price of Boardwalk’s Trust Units and the proven ability of the REIT to deliver growing and sustainable value.

One of the keys to Boardwalk’s ability to sustain value during cyclical oil troughs is its strategy to build goodwill by taking a self-regulated, long-term approach to rental revenues during economic expansions. In turn, this conservative approach supports lower turnover, reduced operating expenses and higher occupancy levels, all of which have resulted in higher revenues and a positive benefit to all of the Trust’s unitholders. Boardwalk’s self-imposed rent control and rental increase forgiveness program for financially challenged Resident Members, which eliminates or reduces rental increases where appropriate, contributes to revenue stability and continues to build goodwill. As a result, the average length of tenancy has increased to over 3.7 years.

Strategic Initiatives

Boardwalk is well positioned to create additional unitholder value in this environment. The Trust has increased its regular distribution by over 10% as we continue to share the growth in our FFO with our Unitholders. The Trust’s liquidity position is strong and is now targeting to acquire 800 to 1,200 new apartment units and commence the construction of Phase 2 and 3 of our Pines Edge development projects in 2016. By focusing on acquiring and developing new assets, and capitalizing on Boardwalk’s Brand, the Trust believes that it can create and enhance Unitholder value by decreasing the average age of our portfolio, while also creating long term revenue and net asset value growth. In addition, the significant discount that the Trust’s Unit Price currently trades at relative to Net Asset Value, presents a unique opportunity for the Trust to increase its allocation of capital towards its existing stock buyback program.

The Trust will continue to undertake a balanced approach with a continued focus on organic growth, and the above noted initiatives as the Trust’s conservative balance sheet and access to low cost debt financing has provided a source of capital to assist in funding new growth opportunities.

Kolias added: “We remain excited about Boardwalk’s business and our ability to create Unitholder value. Our team continues to work through challenging market conditions with a focus on providing the best rental Communities for our Resident Members and continued sustainable and long-term growth for all of our Stakeholders.”

Trust Unit Buyback

The continued significant dislocation between the Trust’s Unit Price and its Net Asset Value has presented a unique opportunity for the Trust to increase its Trust Unit buyback program. On June 30, 2015, Boardwalk REIT announced that it had received approval from the Toronto Stock Exchange (TSX) to make an NCIB to purchase up to a maximum of 3,855,766 trust units representing approximately 10% of the publicly listed float. The NCIB commenced on July 3, 2015 and will terminate on July 2, 2016, or such earlier date as the Trust may complete repurchases under the bid.

In 2015, a total of 740,800 trust units were repurchased for cancellation under the Trust’s current normal course issuer bid. As noted above, Boardwalk believes that the current and recent market prices of its trust units do not reflect their underlying value or the REIT’s prospects for value creation over the longer term. Boardwalk’s management is increasing this program as it feels that, at current market prices; an investment in Boardwalk’s own high quality portfolio will deliver solid returns for unitholders and represents an effective use of its capital.

|

NCIB Period |

Trust Units Purchased |

Weighted Average Cost |

Total Investment (000’s) |

|||||

|

2015 |

740,800 |

$ |

50.10 |

$ |

37,100 |

|||

|

2014 |

472,100 |

$ |

67.01 |

$ |

31,600 |

|||

|

2007 – 2012 |

4,542,747 |

$ |

37.53 |

$ |

170,600 |

|||

|

Grand Total |

5,755,647 |

$ |

41.57 |

$ |

239,300 |

|||

Distribution Increase

Boardwalk’s Board of Trustees reviews the Trust’s monthly regular distributions on a quarterly basis. With consideration to the positive FFO growth achieved in 2015, and forecasted stable FFO in 2016, the Trustees have approved an increase to the Trust’s next three monthly regular distribution to $0.1875 per Trust Unit per month, or $2.25 per Trust Unit on an annualized basis. This represents an increase of 10.3% from the previous regular distribution of $0.17 per Trust Unit per month, or $2.04 per Trust Unit on an annualized basis.

|

Month |

Per Unit |

Annualized |

Record Date |

Distribution Date |

|

Feb-16 |

$ 0.1875 |

$ 2.25 |

29-Feb-16 |

15-Mar-16 |

|

Mar-16 |

$ 0.1875 |

$ 2.25 |

31-Mar-16 |

15-Apr-16 |

|

Apr-16 |

$ 0.1875 |

$ 2.25 |

29-Apr-16 |

16-May-16 |

The Board of Trustees will continue to review the distributions made on the Trust Units on a quarterly basis.

Acquisition Opportunities

The demand for Multi-Family Investment Properties in Canada continues to be strong. As a result, capitalization rates continue to remain low and high prices for Multi-Family assets continue to be the trend. The Trust continues to bid on newly built rental projects and higher quality assets; however, no significant apartment acquisitions have been completed to date as the actual transaction prices on most of these assets, when adjusted for deferred capital expenditures, would not prove to be in the best interest of the Trust on a risk-adjusted basis.

Over the last few years, the Trust has sold select non-core properties with the intent of high-grading its portfolio by re-deploying the equity from these assets towards value enhancing transactions for the Trust’s Stakeholders.

With its strong liquidity, the Trust is well positioned to create value when opportunities arise. Boardwalk continues to monitor the acquisitions market for accretive acquisitions opportunities, including a focus on newly constructed Multi Family Communities. The Trust is currently targeting 800 to 1200 new apartment unit acquisitions in 2016.

Development Opportunities

Phase 1 of the Trust’s Pines Edge development on existing excess land the site owns in Regina was substantially completed at the end of January, 2016. The site consists of a 79 unit, four storey wood frame elevatored building with one level of underground parking. The total cost was $13.4 million, below the original budget of $14.1 million with an estimated stabilized cap rate range of 6.50% to 7.00% excluding land. Lease up of the project has begun as of February 1, 2016.

The Trust is now working on the 2nd and 3rd phase of its Pines Edge development in Regina. Both phases are four storey wood frame buildings with a single level of underground parking totalling 150 apartment units. Construction is anticipated to start in Q2 or Q3 of 2016 and is anticipated to be completed in 14 months.

The Trust continues to explore other viable development opportunities for multi-family apartment buildings on excess land the Trust currently owns and other potential land opportunities in the Trust’s Alberta and Saskatchewan markets. Continued low interest rates, and the potential for labour market volatility in Alberta and Saskatchewan may present an opportunity for the Trust to accelerate its development pipeline to maximize Unitholder Value in the near term. The sustained high demand for multi-family investment properties, which has resulted in continued low capitalization rates, presents a unique opportunity for the Trust to continue the development of multi-family rental property in order to improve the Trust’s portfolio and enhance value for Unitholders.

For further detail, please refer to page 48 of the MD&A.

Continued Financial Strength and Liquidity to Capitalize on Opportunities

Including the Trust’s undrawn line of credit, and net of the previously announced special distribution paid to Unitholders on January 15, 2016, the Trust currently has approximately $384 million of available liquidity with debt (net of cash) to reported investment properties value of approximately 38%. The Trust’s interest coverage ratio, excluding gain or loss on sale of assets, for the most recent completed four quarters ended December 31, 2015, increased to 3.64 times, from 3.37 times for the same period a year ago.

|

2015 – Q4 |

||

|

In $000’s |

||

|

Cash Position – Dec 2015 |

$ 237,000 |

|

|

Special Distribution – Jan 2016 |

$ (51,000) |

|

|

Line of Credit |

$ 198,000 |

|

|

Base Liquitity |

$ 384,000 |

|

|

Unlevered Assets |

$ 156,000 |

|

|

2016 Estimated Potential Up Financings |

$ 132,000 |

|

|

2017 Estimated Potential Up Financings |

$ 163,000 |

|

|

Potential Additional Liqudity |

$ 451,000 |

|

|

Total Potential Liquidity |

$ 835,000 |

|

|

Base Liquidity as a % of Mortgate Debt |

16% |

|

|

Mortgage debt (net of Cash) as a % of reported Investment Asset Value |

38% |

|

|

1 – The Trust’s Undrawn Credit Facility has a Credit Limit of $200mm. The balance reflects the available |

||

The Trust estimates that based on current CMHC underwriting criteria it may obtain an additional $451 million of additional liquidity within the next two years, with total potential liquidity of $835 million. The Trust’s financial strength, conservative balance sheet and historically low interest rates has positioned Boardwalk to actively explore options to deploy capital in support of unitholder value creation, including value added capital expenditures, acquisitions, development of new assets, return of capital to Unitholders and continued investment in the Trust’s own portfolio through its Trust Unit buyback program to maximize unitholder value.

For further detail, please refer to pages 66 of the MD&A.

Sustainable Revenue and Net Operating Income

Boardwalk’s strategy of managing revenue while lowering turnover and other operating costs remains key to supporting the REIT’s net operating income (“NOI”). While the REIT is not immune to short-term impacts as a result of broader economic conditions, Boardwalk’s unique approach has delivered sustainable and long-term value to unitholders over the longer term.

One component of Boardwalk’s NOI Optimization Strategy is its rental revenue strategy, which involves the continuous active management of three key variables: occupancy levels, market rents, and suite-specific incentives. Despite a softening of the Alberta and Saskatchewan economies relating to the decrease in oil prices in 2015, this strategy has allowed the Trust to report an increase in both average and occupied rents versus the same period a year ago while also maintaining high occupancy levels. In the fourth quarter of 2015, overall occupancy for Boardwalk’s portfolio was 97.4%, an increase compared to the third quarter of 2015, however slightly lower than the same period last year. Average monthly rents increased to $1,150 in December of 2015 from $1,144 in December of 2014, and average occupied rents for the period also increased to $1,179 versus $1,170 for the same period last year. Average market rents for December of 2015, however, have decreased to $1,168 from $1,202 in December of 2014, and sequentially lower than the beginning of the year as the Trust has proactively decreased market rents in Alberta markets where market vacancy levels had increased. This was tempered somewhat by some market rent increases made in the fourth quarter.

On a same-property basis, the Trust’s NOI decreased 0.6% for the fourth quarter versus the same period in 2014, driven by a 0.1% decrease to revenues, and a 0.7% increase in operating expenses in the fourth quarter. For the twelve month period ended December 31, 2015, same property revenue increased 1.8%, while operating costs increased 1.7%, resulting in a same property NOI increase of 1.8%.

The continued increase in average occupied rents the Trust has been able to achieve to date has been a positive driver to the Trust’s revenue; however, the Trust’s proactive decreases in market rents to maintain high occupancy levels in the Trust’s Calgary and Edmonton markets has decreased the mark-to-market opportunity for the Trust. Continued focus on product quality and customer service remains central to Boardwalk’s NOI Optimization strategy during difficult economic periods and will continue to drive sustainable financial performance.

For further detail, please refer to page 53 of the MD&A.

|

Property Portfolio Highlights for the Fourth Quarter of 2015 |

|||||

|

Dec-15 |

Dec-14 |

||||

|

Average Occupancy (Period Average)1 |

97.35% |

98.02% |

|||

|

Average Monthly Rent (Period Ended)1 |

$1,150 |

$1,144 |

|||

|

Average Market Rent (Period Ended)1 |

$1,168 |

$1,202 |

|||

|

Average Occupied Rent (Period Ended)1 |

$1,179 |

$1,170 |

|||

|

Loss-to-Lease (Period Ended) ($ millions)1 |

($4.4) |

$12.9 |

|||

|

Loss-to-Lease Per Trust Unit (Period Ended)1 |

($0.08) |

$0.25 |

|||

|

Same Property Results |

% Change Year- |

% Change Year- |

|||

|

Rental Revenue |

-0.1% |

1.8% |

|||

|

Operating Costs |

0.7% |

1.7% |

|||

|

Net Operating Income (NOI) |

-0.6% |

1.8% |

|||

|

1 December 2014 figures exclude 109-unit Spruce Ridge Gardens Development completed November 2013 and include all Windsor properties |

|||||

On a sequential basis, stabilized revenues for the fourth quarter of 2015 decreased 0.7% when compared to the previous quarter, mainly the result of higher market vacancy levels in Fort McMurray, Grande Prairie and Saskatchewan, and lower market rents through most of the fourth quarter in Calgary and Edmonton. Ontario and Quebec showed positive sequential growth. Continued high occupancy, coupled with increasing occupied rents, reflects positively on the Trust’s vertically integrated operating and NOI optimization strategies.

|

Sequential Revenue Analysis |

||||||

|

Stabilized Revenue |

# of Units |

Q4 2015 vs |

Q3 2015 vs |

Q2 2015 vs |

Q1 2015 vs |

|

|

Calgary |

5,419 |

-1.7% |

0.3% |

0.9% |

0.9% |

|

|

Edmonton |

12,397 |

-1.0% |

0.1% |

0.7% |

0.7% |

|

|

Fort McMurray |

352 |

-2.2% |

-9.4% |

-10.0% |

-3.1% |

|

|

Grande Prairie |

645 |

-1.4% |

-2.9% |

-0.6% |

1.4% |

|

|

Red Deer |

939 |

-0.3% |

-0.2% |

0.8% |

1.5% |

|

|

Ontario |

2,585 |

0.6% |

0.5% |

0.4% |

0.5% |

|

|

Quebec |

6,000 |

1.2% |

0.5% |

0.2% |

-1.0% |

|

|

Saskatchewan |

4,610 |

-0.6% |

-0.9% |

1.5% |

-1.7% |

|

|

32,947 |

-0.7% |

-0.1% |

0.6% |

0.1% |

||

For further detail, please refer to page 55 of the MD&A.

Fourth Quarter and Fiscal 2015 Financial Highlights

A continued focus on building better communities has provided results that reflect the resiliency of multi-family apartment assets and has contributed to steady same-property stabilized revenue driven primarily by higher occupancy levels. The current result is a minimal same-property revenue decrease of 0.1% in the fourth quarter of 2015 and an increase of 1.8% during the twelve months of 2015 from the same periods in 2014. Stabilized same-property Net Operating Income (“NOI”) decreased 0.6% for the fourth quarter, due to lower market rents in the second half of 2015 and higher operating expenses. For the twelve-month period ended December 31, 2015, same property NOI increased 1.8%. This was mainly the result of positive NOI growth in the Trust’s Calgary and Edmonton markets, partially offset by softness in the Trust’s Fort McMurray and Saskatchewan regions. The low interest rate environment continues to benefit the Trust as lower overall financing costs on the renewal of its existing CMHC Insured Mortgages continues to reduce the Trust’s interest expense.

FFO and AFFO are widely accepted supplemental measures of the performance of a Canadian Real Estate entity; however, they are not measures defined by International Financial Reporting Standards (IFRS). The reconciliation of FFO and other financial performance measures can be found in the Management Discussion and Analysis (MD&A) for the fourth quarter ended December 31, 2015, under the section titled, “Performance Measures”.

|

$ millions, except per unit amounts |

||||||||||

|

Highlights of the Trust’s Fourth Quarter 2015 Financial Results |

||||||||||

|

Three Months |

Three Months |

% Change |

Twelve Months |

Twelve Months |

% Change |

|||||

|

Same Property Rental Revenue |

$ |

115.6 |

$ |

115.7 |

-0.1% |

$ |

464.2 |

$ |

456.1 |

1.8% |

|

Total Rental Revenue |

$ |

115.7 |

$ |

119.9 |

-3.5% |

$ |

476.1 |

$ |

473.2 |

0.6% |

|

Same Property Net Operating Income (NOI) |

$ |

72.3 |

$ |

72.8 |

-0.6% |

$ |

294.6 |

$ |

289.3 |

1.8% |

|

Net Operating Income (NOI) |

$ |

70.9 |

$ |

73.4 |

-3.4% |

$ |

294.7 |

$ |

291.6 |

1.1% |

|

Profit from Continuing Operations |

$ |

114.4 |

$ |

(14.5) |

887.8% |

$ |

28.8 |

$ |

235.6 |

-87.8% |

|

Funds From Operations (FFO) |

$ |

44.2 |

$ |

43.7 |

1.2% |

$ |

184.9 |

$ |

175.8 |

5.1% |

|

Adjusted Funds From Operations (AFFO) |

$ |

40.1 |

$ |

39.6 |

1.3% |

$ |

167.8 |

$ |

159.3 |

5.4% |

|

FFO Per Unit |

$ |

0.86 |

$ |

0.84 |

2.4% |

$ |

3.56 |

$ |

3.37 |

5.6% |

|

AFFO Per Unit |

$ |

0.78 |

$ |

0.76 |

2.6% |

$ |

3.23 |

$ |

3.05 |

5.9% |

|

Regular Distributions Declared (Trust Units & LP B Units) |

$ |

26.3 |

$ |

26.5 |

-0.8% |

$ |

105.8 |

$ |

106.3 |

-0.4% |

|

Special Distribution Declared (Trust Units & LP B Units) |

$ |

51.3 |

$ |

72.8 |

-29.5% |

$ |

51.3 |

$ |

72.8 |

-29.5% |

|

Regular Distributions Declared Per Unit (Trust Units & LP B Units) |

$ |

0.509 |

$ |

0.510 |

-0.2% |

$ |

2.039 |

$ |

2.034 |

0.2% |

|

(2015 – $2.04 Per Unit – 2014 – $2.04 per Unit on an annualized basis) |

||||||||||

|

Excess of AFFO over Distributions Per Unit |

$ |

0.271 |

$ |

0.250 |

8.4% |

$ |

1.191 |

$ |

1.016 |

17.2% |

|

Regular Payout as a % FFO |

59.5% |

60.7% |

57.3% |

60.5% |

||||||

|

Regular Payout as a % AFFO |

65.6% |

67.0% |

63.1% |

66.7% |

||||||

|

Excess of AFFO as a % of AFFO |

34.4% |

33.0% |

36.9% |

33.3% |

||||||

|

Interest Coverage Ratio (Rolling 4 quarters) |

3.64 |

3.37 |

3.64 |

3.37 |

||||||

|

Operating Margin |

61.3% |

61.2% |

61.9% |

61.6% |

||||||

The Fair Value under IFRS for the Trust’s portfolio decreased relative to the end of 2014, mainly a result of a decrease in market rents in the Trust’s Alberta markets during the third quarter of 2015. Sequentially, the Trust’s Fair Value has increased relative to the third quarter as a result of market rent increases in some of the Trust’s Alberta Communities in the fourth quarter of 2015 and continued capitalization rate compression in the Trust’s Montreal region during fiscal 2015. Below is a summary of the Trust’s per unit Net Asset Value with further discussion located in the 2015 Fourth Quarter MD&A.

|

Highlights of the Trust’s Fair Value of Investment Properties |

||||||

|

12/31/2015 |

12/31/2014 |

|||||

|

IFRS Asset Value Per Diluted Unit (Trust & LP B) |

$ |

107.95 |

$ |

111.13 |

||

|

Debt Outstanding per Diluted Unit |

$ |

(45.30) |

$ |

(43.15) |

||

|

Net Asset Value (NAV) Per Diluted Unit (Trust & LP B) |

$ |

62.66 |

$ |

67.98 |

||

|

Cash Per Diluted Unit (Trust & LP B) 1 |

$ |

3.62 |

$ |

2.68 |

||

|

Total Per Diluted Unit (Trust & LP B) |

$ |

66.27 |

$ |

70.66 |

||

|

1 – Cash and Liquidity net of proceeds for the Special Distribution paid on January 15, 2016 to |

||||||

Same-Property Weighted Average Capitalization Rate: 5.38% at Dec 31, 2015 and 5.46% at Dec 31, 2014. Computation of cap rate excludes Sold Properties.

For further detail, please refer to page 48 of the MD&A.

Mortgage Financing

Interest rates continue to remain low and have benefitted the Trust’s mortgage program as the Trust has continued to renew existing CMHC Insured mortgages at interest rates well below the maturing rates. As of December 31, 2015, the Trust’s total mortgage principal outstanding totaled $2.35 billion at a weighted average interest rate of 3.01%, compared to $2.24 billion at a weighted average interest rate of 3.34% reported for December 31, 2014.

Over 99% of the Trust’s mortgages are CMHC Insured, providing the benefit of lower interest rates and limiting the renewal risk of these mortgage loans for the entire amortization period, which can be up to 40 years. The Trust’s total debt had an average term to maturity of approximately 5 years, with a remaining amortization of 30 years. The Trust’s debt (net of cash) to reported asset value ratio was approximately 38% as of December 31, 2015.

The Trust successfully renewed all of its 2015 mortgage maturities with a weighted average interest rate of 2.16%, while extending the average term to 7 years. These mortgage renewals represent an estimated $6.5 million in annualized interest savings. In addition, the Trust upfinanced $155.4 million in 2015.

For 2016, the Trust has $251.3 million maturing at an average interest rate of 3.91%. To date, the Trust has renewed, or forward locked the interest rate on $35.4 million or 14% of its 2016 maturates. The new rate on the 2016 mortgages renewed to date is 2.26%, while also extending the maturity of these mortgages for over 8 years.

The Trust continues to undertake a balanced strategy to its mortgage program. Current 5 and 10-year CMHC Mortgage Rates are estimated to be 1.50% and 2.20%, respectively. The Trust reviews each mortgage individually; however, given the current interest rate environment, the Trust presently has a bias towards renewing its maturing mortgages for longer terms (7 to 10 years).

For further detail, please refer to page 58 of the MD&A.

Investing in our Properties

Continued internalization of more maintenance and value-added capital expenditures has further enhanced curb appeal and the quality of our property portfolio. The Trust believes the quality of Boardwalk’s communities continues to drive long-term revenue growth and stability. The Trust invested $88.7 million during the 2015 fiscal year to maintain and further enhance the curb appeal and quality of the Trust’s assets. In addition, the Trust invested approximately $13.9 million in acquisitions, the development of its Pines Edge project and to explore other development opportunities on excess land the Trust currently owns.

Boardwalk’s vertically integrated structure allows many repair and maintenance functions, including landscaping, to be internalized. A continued focus on completing more of these functions in-house has resulted in improved quality, productivity, effectiveness of resources, and overall execution of the Trust’s capital improvement program, leading to sustainable value for our Resident Members and long-term growth for Unitholders.

For further detail, please refer to page 57 of the MD&A.

Revised 2016 Financial Guidance

As is customary on a quarterly basis, the Trust reviews the key assumptions used in deriving its public financial guidance. Based on this review, the Trust has revised the Investment Properties and development assumptions of its financial guidance. The following table highlights the original and current financial objectives for the 2016 fiscal year.

|

Description |

2016 Revised |

2016 Original Financial Guidance |

2015

Actual

|

|

Investment Properties |

800 – 1200 New |

No new apartment |

No new apartment |

|

Development |

Phase 1 – Pines Edge; |

Pines Edge; Regina, |

No new development |

|

Stabilized Building NOI Growth |

-2% to 2% |

-2% to 2% |

1.8% |

|

FFO Per Trust Unit |

$3.40 to $3.60 |

$3.40 to $3.60 |

$3.56 |

|

AFFO per Trust Unit – based on |

$3.06 to $3.26 |

$3.06 to $3.26 |

$3.23 |

Note: FFO and AFFO per Trust Unit financial guidance does not include any impact due to acquisitions or development work-in-progress due to the timing uncertainty of these transactions

In addition to the above financial guidance for 2016, the Trust provides guidance relating to its capital expenditure program, and is confirmed as follows:

|

Capital Budget – in thousands $ except per Unit amounts |

2016 Budget |

Per Unit |

2015 – 12 |

Per Unit |

||||

|

Maintenance Capital – $525/Apartment Unit/Year |

$ |

17,193 |

$ |

525 |

$ |

17,056 |

$ |

500 |

|

Stablizing & Value Added Capital incl. Property Plant and Equipment |

$ |

73,136 |

$ |

2,217 |

$ |

71,604 |

$ |

2,099 |

|

Total Operational Capital |

$ |

90,329 |

$ |

2,742 |

$ |

88,660 |

$ |

2,599 |

|

Total Operational Capital |

$ |

90,329 |

$ |

88,660 |

||||

|

Development |

$ |

12,444 |

$ |

10,650 |

||||

|

Acquisitions (Nun’s Island Office & Morningside Estates) |

$ |

3,290 |

||||||

|

Total Capital Investment |

$ |

102,773 |

$ |

102,600 |

Management will continue to update the Financial Guidance on a quarterly basis. The reader is cautioned this information is forward-looking and actual results may vary materially from those reported.

For further detail, please refer to page 90 of the MD&A.

Supplementary Information

Boardwalk produces the Quarterly Supplemental Information that provides detailed information regarding the Trust’s activities during the quarter. The Fourth Quarter 2015 Supplemental Information is available on Boardwalk’s investor website at www.boardwalkreit.com.

Teleconference on Fourth Quarter 2015 Financial Results

Boardwalk invites you to participate in the teleconference that will be held to discuss these results tomorrow morning (February 19, 2016) at 11:00 am Eastern Time. Senior management will speak to the period’s results and provide an update. Presentation materials will be made available on Boardwalk’s investor website at www.boardwalkreit.com prior to the call.

Teleconference: The telephone numbers for the conference are 647-427-7450 (local/international callers) or toll-free 1-888-231-8191 (within North America).

Note: Please provide the operator with the below Conference Call ID or Topic when dialling in to the call.

Conference ID: 14927761

Topic: Boardwalk REIT 2015 Fourth Quarter Results

Webcast: Investors will be able to listen to the call and view Boardwalk’s slide presentation over the Internet by visiting http://www.boardwalkreit.com prior to the start of the call. An information page will be provided for any software needed and system requirements. The webcast and slide presentation will also be available at:

http://event.on24.com/r.htm?e=1112041&s=1&k=3AFD9F0D2D4B6EA6A450A91006F77A12

Replay: An audio recording of the teleconference will be available on the Trust’s website: www.boardwalkreit.com

Corporate Profile

Boardwalk REIT strives to be Canada’s friendliest landlord and currently owns and operates more than 200 communities with over 32,000 residential units totalling approximately 28 million net rentable square feet. Boardwalk’s principal objectives are to provide its Residents with the best quality communities and superior customer service, while providing Unitholders with sustainable monthly cash distributions, and increase the value of its trust units through selective acquisitions, dispositions, development, and effective management of its residential multi-family communities. Boardwalk REIT is vertically integrated and is Canada’s leading owner/operator of multi-family communities with 1,400 Associates bringing Residents home to properties located in Alberta, Saskatchewan, Ontario, and Quebec.

Boardwalk REIT’s Trust units are listed on the Toronto Stock Exchange, trading under the symbol BEI.UN. Additional information about Boardwalk REIT can be found on the Trust’s website at www.BoardwalkREIT.com.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

Information in this news release that is not current or historical factual information may constitute forward-looking information within the meaning of securities laws. Implicit in this information, particularly in respect of Boardwalk’s objectives for 2016 and future periods, Boardwalk’s strategies to achieve those objectives, as well as statements with respect to management’s beliefs, plans, estimates and intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations are estimates and assumptions subject to risks and uncertainties, including those described in the Management’s Discussion & Analysis of Boardwalk REIT’s 2014 and 2015 Annual Report under the heading “Risks and Risk Management”, which could cause Boardwalk’s actual results to differ materially from the forward-looking information contained in this news release. Specifically Boardwalk has assumed that the general economy remains stable, interest rates are relatively stable, acquisition capitalization rates are stable, competition for acquisition of residential apartments remains intense, and equity and debt markets continue to provide access to capital. These assumptions, although considered reasonable by the Trust at the time of preparation, may prove to be incorrect. For more exhaustive information on these risks and uncertainties you should refer to Boardwalk’s most recently filed annual information form, which is available at www.sedar.com. Forward-looking information contained in this news release is based on Boardwalk’s current estimates, expectations and projections, which Boardwalk believes are reasonable as of the current date. You should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While the Trust may elect to, Boardwalk is under no obligation and does not undertake to update this information at any particular time.

SOURCE Boardwalk Real Estate Investment Trust

Image with caption: “1 Year Comparative – BEI.UN:CA; Source: Quotemedia; Chart compares BEI.un vs TSX Capped Energy Index (CNW Group/Boardwalk Real Estate Investment Trust)”. Image available at: http://photos.newswire.ca/images/download/20160218_C5040_PHOTO_EN_623500.jpg

Image with caption: “Boardwalk FFO vs WTI; Source: Internally Generated (CNW Group/Boardwalk Real Estate Investment Trust)”. Image available at: http://photos.newswire.ca/images/download/20160218_C5040_PHOTO_EN_623502.jpg