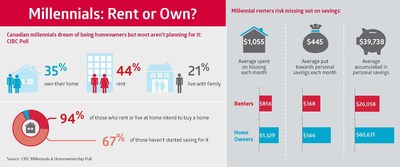

60 per cent believe that ‘renting is just as costly as homeownership’ even though those who do own homes manage to put more into savings

TORONTO, April 26, 2018 /CNW/ – A new CIBC (CM:TSX) (CM:NYSE) poll finds that Canadians aged 18-37 who rent or live with family still dream of owning a home but few are on track to make it a reality. While nearly half (46 per cent) of those who intend to buy plan to do so within the next five years, 76 per cent haven’t started to save or have accumulated less than a quarter of their down payment.

“Our survey reveals that few millennials are taking the necessary steps to make the move to homeownership,” says Grant Rasmussen, Senior Vice President, Mobile Advice, CIBC. “You can’t buy a home with intent and desire alone. It’s important to have a financial plan to make the most of your income and set yourself up with the right savings plan to achieve your goals now and in the years ahead.”

Key poll findings:

- 65 per cent of millennials aged 18-37 currently rent (42 per cent) or live with family or others (23 per cent)

- 94 per cent currently renting or living with family/others intend to buy a home;

- 67 per cent who plan to buy a home haven’t started saving yet.

- 46 per cent intend to buy within five years, with very few having saved the down payment

- 31 per cent have saved about one quarter of the down payment

- 9 per cent have saved about half

- 7 per cent have saved three-quarters

- 7 per cent have saved the total amount

- 45 per cent haven’t yet started to save

- 45 per cent of renters and a third of live-at-homers (39 per cent) can see the appeal of being a homeowner, but don’t think it’s realistic or desirable anymore

- 35 per cent of Canadians aged 18-37 own their home

- 58 per cent of millennial homeowners worry that rising rates will affect their ability to manage current household expenses

- 75 per cent say being a homeowner has a ‘downside’ and can come with ‘significant social costs’, such as fewer social gatherings, and longer commutes to visit friends or family

“While most still dream of owning a home one day, higher house prices, the prospect of higher rates, and new qualifying rules are prompting some millennials to pause and question whether being a homeowner is realistic or even desirable for them,” says Mr. Rasmussen. “The key is to understand your total housing costs and start planning early so you can consider your rent versus buy options in the context of your overall financial plan and desired lifestyle.”

Renters risk missing out on savings

The poll findings show that while the top reason for owning a home is to provide ‘a place to set down roots and raise a family’ (49 per cent), an almost equal number also feel that renting is a ‘waste of money’ (46 per cent). Poll findings also suggest that renters are not taking advantage of the opportunity to save for their future.

As many as 60 per cent of millennials believe renting is just as costly as homeownership. However, the poll finds that millennial homeowners spend as much as 50 per cent more per month on housing costs than their peers who rent, and more than half (51 per cent) of homeowners admit they didn’t quite understand the total costs of owning a house before making their purchase.

Despite the higher expenses, millennial homeowners still manage to save more each month than renters or live-at-homers, on average $566 compared to $368 or $360, respectively. Further, homeowners have amassed an average nest-egg of just over $60,600 – more than double that of their peers who rent or live at home.

In most cases, because renters don’t have the same housing costs as homeowners, they have a real opportunity to grow their wealth. Yet regardless of income levels, fewer millennial renters appear to be making savings a priority. In fact, the poll shows that only 18 per cent of renters and live-at-homers who intend to buy a home have met with a financial expert and less than half (45 per cent) have set a monthly budget.

“Deciding to buy a home is often the trigger for most people to get serious about their finances, cut spending and build the necessary savings habits and behaviours to achieve that goal. But for millennials who rent or still live with family, it’s easy to delay or put off savings and developing a financial plan,” says Mr. Rasmussen. “Remember, the earlier you start, the more your money will grow. Renting shouldn’t be a free-pass to spend.”

“Even if you never buy a home, the most important thing to do early on is to work with an advisor to help you identify your short- and long-term goals and start working towards them. It’s easy to get caught up in the idea of homeownership, but owning a home isn’t the only way to build your net worth,” he adds.

Key questions for choosing whether to rent or buy a home:

- Are you planning to live in this home for at least five years?

- Do you have an adequate emergency fund to cover any unexpected costs?

- Are you willing to do your own property maintenance and repairs?

- Do you have enough saved to cover a down payment and closing costs? Are you clear about your total monthly costs beyond just your mortgage payments including taxes, insurance, utilities, and condo fees if applicable? Use CIBC’s Rent or Buy Calculator to see how these costs compare to total rental costs, including rental insurance and any utilities.

- Will you have additional savings and be able to contribute regularly to them if you purchase a home?

KEY POLL FINDINGS:

Percentage of Canadians aged 18-37 who are homeowners, by age:

|

All (18-37) |

18-22 |

23-29 |

30-37 |

|

|

Own |

35 % |

16 % |

25 % |

56 % |

|

Rent |

42 % |

38 % |

50 % |

37 % |

|

Other (e.g. live with parents/family at no cost) |

23 % |

45 % |

25 % |

6 % |

Average amount of monthly spending on housing among Canadians aged 18-37, by age:

|

ALL (18-37) |

18-22 |

23-29 |

30-37 |

|

|

Own |

$1,329 |

$1,144 |

$1,213 |

$1,389 |

|

Rent |

$856 |

$752 |

$848 |

$932 |

|

All (Rent or own) |

$1,055 |

$835 |

$954 |

$1,196 |

Progress of saving for a down payment among those who plan to buy a home, by age:

|

ALL (18-37) |

18-22 |

23-29 |

30-37 |

|

|

I haven’t started to save yet |

67 % |

81 % |

62 % |

53 % |

|

I’ve saved about a quarter (25%) |

20 % |

14 % |

23 % |

24 % |

|

I’ve saved about half (50%) |

5 % |

3 % |

7 % |

6 % |

|

I’ve saved about three-quarters (75%) |

4 % |

2 % |

4 % |

8 % |

|

I’ve already saved the full amount (100%) |

4 % |

– |

4 % |

9 % |

Progress of saving for a down payment among those who plan to buy a home in the next five years:

|

ALL (18-37) |

|

|

I haven’t started to save yet |

45 % |

|

I’ve saved about a quarter (25%) |

31 % |

|

I’ve saved about half (50%) |

9 % |

|

I’ve saved about three-quarters (75%) |

7 % |

|

I’ve already saved the full amount (100%) |

7 % |

Average amount Canadians aged 18-37 are saving each month, by age:

|

ALL (18-37) |

18-22 |

23-29 |

30-37 |

|

|

Mean |

$445 |

$303 |

$409 |

$559 |

|

Less than $50 |

14 % |

16 % |

15 % |

10 % |

|

$50-$99 |

10% |

13 % |

10 % |

8 % |

|

$100-$249 |

15 % |

13 % |

17 % |

15 % |

|

$250-$499 |

12 % |

10 % |

12 % |

13 % |

|

$500-$999 |

9 % |

4 % |

9 % |

12 % |

|

$1000+ |

9 % |

3 % |

9 % |

12 % |

|

Varies by month |

19 % |

25 % |

18 % |

17 % |

|

Not saving |

12 % |

16 % |

10 % |

12 % |

Average amount Canadians aged 18-37 are saving each month, by housing status:

|

ALL (18-37) |

18-22 |

23-29 |

30-37 |

|

|

All |

$445 |

$303 |

$409 |

$559 |

|

Own |

$566 |

$585 |

$496 |

$588 |

|

Rent |

$368 |

$233 |

$377 |

$454 |

|

Live with family |

$360 |

$237 |

$382 |

$648 |

Total amount accumulated in savings on average, by age and housing status:

|

ALL (18-37) |

18-22 |

23-29 |

30-37 |

|

|

Own |

$60,631 |

$21,109 |

$28,799 |

$79,000 |

|

Rent |

$26,058 |

$6,534 |

$21,783 |

$44,699 |

|

Live with family |

$26,696 |

$6,885 |

$23,400 |

$83,766 |

|

All |

$39,738 |

$9,856 |

$24,562 |

$68,416 |

Total amount accumulated in savings on average, by age:

|

ALL (18-37) |

18-22 |

23-29 |

30-37 |

|

|

Mean |

$39,738 |

$9,856 |

$24,562 |

$68,416 |

|

Below $5,000 |

18 % |

23 % |

20 % |

12 % |

|

$5,000-$9,999 |

7 % |

5 % |

10 % |

7 % |

|

$10,000-$29,999 |

13 % |

11 % |

16 % |

12 % |

|

$30,000-$49,999 |

4 % |

2 % |

3 % |

6 % |

|

$50,000-$99,999 |

5 % |

– |

5 % |

8 % |

|

$100,000+ |

6 % |

1 % |

3 % |

12 % |

|

Don’t know |

27 % |

34 % |

25 % |

24 % |

|

No savings |

20 % |

24 % |

17 % |

19 % |

*indicates low incidence

About the CIBC Millennials & Homeownership Poll:

From March 19-26 2018, an online survey was conducted among 1,471 randomly selected 18-37 year old Canadian adults who are Angus Reid Forum panellists. The margin of errorâwhich measures sampling variabilityâis +/- 2.5%, 19 times out of 20. The results have been statistically weighted according to education, age, gender and region (and in Quebec, language) Census data to ensure a sample representative of the 18-37 year old adult population of Canada. Discrepancies in or between totals are due to rounding.

About CIBC

CIBC is a leading Canadian-based global financial institution with 11 million personal banking, business, public sector and institutional clients. Across Personal and Small Business Banking, Commercial Banking and Wealth Management, and Capital Markets businesses, CIBC offers a full range of advice, solutions and services through its leading digital banking network, and locations across Canada, in the United States and around the world. Ongoing news releases and more information about CIBC can be found at www.cibc.com/en/about-cibc/media-centre.html or by following on LinkedIn (www.linkedin.com/company/cibc), Twitter @CIBC, Facebook (www.facebook.com/CIBC) and Instagram @CIBCNow.

SOURCE CIBC – Consumer Research and Advice

View original content with multimedia: http://www.newswire.ca/en/releases/archive/April2018/26/c3596.html