/NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES/

TORONTO, Aug. 9, 2017 /CNW/ – Inovalis Real Estate Investment Trust (the “REIT”) (TSX: INO.UN) today reported its financial results for the second quarter of 2017.

HIGHLIGHTS

- Inovalis REIT (“Inovalis REIT“, or the “REIT” or “we“) is a Canadian REIT managed by Inovalis S.A. (“Inovalis SA“), a local cross-border French and German real estate asset manager, managing $10 billion of real estate and financial assets. As of June 30, 2017, Inovalis SA and Inovalis SA’s founding partners had a 13.4% interest in the REIT’s equity (directly and indirectly) taking into account a new promissory note from the recent private placement and 14,2% interest excluding the new promissory note.

- On June 26, 2017, the REIT closed a $13.7 million private placement pursuant to the issuance of a Euro denominated promissory note by a subsidiary of the REIT to a single non-Canadian investor for â¬9.1million paying interest at 8.18%. The Note matures on June 22, 2020. Concurrent with the issuance of the Note, the Investor and the REIT entered into a put/call agreement pursuant to which the REIT can satisfy its obligation to the Investor by delivering REIT units at $10.08 per Unit. At any time after June 25, 2018, the Investor can transfer all or any portion of the Note to the REIT in consideration for REIT units based on the Conversion Price and the REIT can acquire the Note at any time by delivering REIT units to the Investor at the Conversion Price. The Conversion Price represents the market price of the REIT units based on the five-day weighted- average closing price on June 9, 2017.

- On April 13, 2017, the REIT committed â¬5.3 million ($7.6 million) in a short-term acquisition loan to Aref Diamants Sarl (100%-owned by Inovalis SA) as a first step to the acquisition of Pantin (Paris North-Eastern periphery). The loan generates 9.5% interest income until the acquisition date for the property, which is expected to be closed in Q3 2017. This acquisition is a 50-50 joint-venture with an affiliate of Inovalis SA.

- On June 9, 2017, the REIT acquired a 50% interest in a property located in Stuttgart metropolitan region (Germany), one of the most economically sound and innovative hi-tech regions in Europe and one of the most powerful economic centers in Germany. The property is a 242,832 square feet modern office building with 432 parking units. The property is almost fully let with 96.2% occupancy, and has a weighted average lease term of 6.7 years and has high quality tenants operating in the German automotive industry.

- During the quarter, a new 10-year lease on the entire 124,076 square feet leasable area has been signed in the Hanover property with one of the largest banks in Germany. The bank will take over the lease of the current tenant as of January 1, 2019 and extend the term by five years to 2029. This reflects the demand for the REIT’s properties in a strengthening German office market. The new lease has a positive impact on the average term lease which has increased from 5.3 years as at March 31, 2017 to 5.7 years as at June 30, 2017.

- FFO / AFFO

|

Q1 2017 (1) |

Q2 2017 (2) |

Q2 2016 (3) |

REIT Guidance (1) (4) |

|

|

Including Private Placement equity |

||||

|

FFO per unit |

0.19 |

0.20 |

0.20 |

0.21 – 0.23 |

|

FFO payout ratio |

111.3% |

104.4% |

104.3% |

90% – 96% |

|

AFFO per unit |

0.20 |

0.23 |

0.22 |

0.22 – 0.24 |

|

AFFO payout ratio |

105.8% |

91.6% |

88.6% |

88% – 94% |

|

(1) $1.4101 C$/⬠foreign exchange rate |

||||

|

(2) $1.4455 C$/⬠foreign exchange rate |

||||

|

(3) $1.4842 C$/⬠foreign exchange rate |

||||

|

(4) $1.4101 C$/⬠foreign exchange rate – including future acquisitions and Rueil loan |

||||

In the table above, funds from operations (“FFO”) and adjusted funds from operations (“AFFO”) for the three-month period ended June 30, 2017 are compared to the Q1 2017, Q2 2016 and the REIT’s guidance range.

As at June 30, 2017, proceeds from the $46.0 million equity offering were fully invested but the revenue from the Stuttgart investment only accounted for 21 days in Q2 2017. Despite this gap, the Q2 2017 FFO of $0.20 per unit was in line with the FFO in Q2 2016 and $0.1 higher than Q1 2017 FFO.

AFFO for Q2 2017 of $0.23 per unit was $0.1 higher Q2 2016 FFO and in line with the run rate going forward estimated by the Management. The Q2 2017 FFO payout ratio of 104.4% is almost back to Q2 2016 FFO payout ratio and is expected to reach to the REIT’s FFO guidance range in Q3 2017.

The REIT’s FFO guidance range is expected to reach $0.21 to $0.23 per Unit and the FFO payout ratio should range between 90% and 96% (the reader is cautioned that this information is forward-looking and actual results may vary from those reported).

The Q2 2017 AFFO payout ratio of $91.5% is slightly higher than the Q2 2016 payout ratio but again on line with the estimated going forward AFFO payout ratio.

- NOI

In the table below, is NOI presentation with the run rate on a same-store basis, including the application of 2017 forecast indexation for French assets. Also presented is the run rate going forward, which includes new acquisitions and fully drown down Rueil loan.

Indexation has not been applied to the German asset forecast as it is not applied until index increases exceed 5%. Between 2013 and 2016, on average, the German index increased 0.50% per year. Over the last 7 months the index has been increasing at a rate of 1.7% per year, indicating an accelerating trend. If this trend continues, the indexation threshold of 5% could be reached between 2018 and 2021 at which time it will be applied to the German assets. These calculations include consideration of the contractual specificities of each lease.

See the section Rental Indexation for details on French and German indices.

|

Q1 2017 (1) |

Q2 2017 (2) |

Run rate same |

Q2 2017 same |

REIT Guidance (5) |

|

|

NOI (excluding IFRIC 21 impact) |

7,177 |

7,697 |

7,325 |

7,585 |

7,900 – 8,400 |

|

7% |

2% |

6% |

7% – 14% |

||

|

NOI & revenue from Rueil acquisition loan |

8,500 – 9,000 |

||||

|

16% – 23% |

|||||

|

(1) |

$1.4101 C$/⬠foreign and exchange rate |

|

(2) |

$1.4455 C$/⬠foreign exchange rate & including Stuttgart Q2 2017 revenue |

|

(3) |

$1.4101 C$/⬠foreign exchange rate |

|

(4) |

$1.4455 C$/⬠foreign exchange rate & excluding Stuttgart Q2 2017 revenue |

|

(5) |

$1.4101 C$/⬠foreign exchange rate & including future acquisitions |

The NOI Q2 2017 same store basis increased by 6% including a positive foreign exchange effect, compared to Q1 2017 NOI, which is 4% higher than REIT’s estimated same store run rate. The run rate going forward is expected to increase by 7 % to 14% as a result of future acquisitions and by 16% to 23% including Reuil loan revenue. The reader is cautioned that this information is forward-looking and actual results may vary from those reported).

- The REIT’s debt to book value was 50.5% as at June 30, 2017, significantly lower than 56.6%, one year ago. Net of cash available, the debt to book value was 48.2% as at June 30, 2017, compared to 55.8% one year before.

Management’s discussion and analysis

(Dollar amounts in the MD&A are presented in thousands of Canadian dollars, except rental rates, Unit or as otherwise stated)

OVERVIEW

The presentation of our operational information, financing information and operating results takes into account our proportionate share of income from investments in joint ventures. Please refer to “Non IFRS Reconciliation” for a reconciliation to our condensed interim consolidated financial statements.

|

June 30, 2017 |

December 31, 2016 |

||||

|

Operational information (1) |

|||||

|

Number of properties |

12 |

11 |

|||

|

Gross leasable area (sq.ft) |

1,172,139 |

1,050,336 |

|||

|

Occupancy rate (end of period) (2) |

96.2% |

95.9% |

|||

|

Weighted average lease term |

5.7 years |

5.3 years |

|||

|

Average capitalization rate (3) |

5.6% |

5.9% |

|||

|

Financing information (1) |

|||||

|

Level of debt (debt-to-book value) (4) |

50.5% |

51.3% |

|||

|

Level of debt (debt-to-book value, net of cash) (4) |

48.2% |

47.5% |

|||

|

Weighted average term of principal repayments of debt |

6.6 years |

7.2 years |

|||

|

Weighted average interest rate (5) |

2.06% |

2.11% |

|||

|

Interest coverage ratio (6) |

3.9 x |

4.4 x |

|||

|

Three months ended |

Six months ended |

||||

|

(thousands of CAD$ except per Unit and other data) |

June 30, 2017 |

June 30, 2016 |

June 30, 2017 |

June 30, 2016 |

|

|

Operating results |

|||||

|

Rental income (1) |

8,100 |

7,797 |

15,672 |

15,231 |

|

|

Net rental earnings (1) |

8,522 |

8,349 |

12,893 |

12,501 |

|

|

Earnings for the period |

159 |

3,839 |

3,300 |

8,467 |

|

|

Funds from Operations (FFO) (7) (8) |

4,647 |

3,648 |

8,981 |

7,403 |

|

|

Adjusted Funds from Operations (AFFO) (7) (8) |

5,300 |

4,009 |

9,759 |

8,141 |

|

|

FFO per Unit (diluted) (7) (8) |

0.20 |

0.20 |

0.38 |

0.41 |

|

|

AFFO per Unit (diluted) (7) (8) |

0.23 |

0.22 |

0.42 |

0.45 |

|

|

Distributions |

|||||

|

Declared distributions on Units and Exchangeable sec. |

4,852 |

3,805 |

9,675 |

7,427 |

|

|

Declared distribution per Unit (diluted) (8) |

0.21 |

0.21 |

0.41 |

0.41 |

|

|

FFO payout ratio (7) |

104.4% |

104.3% |

107.7% |

100.3% |

|

|

AFFO payout ratio (7) |

91.6% |

93.2% |

99.1% |

90.3% |

|

|

(1) |

Taking into account the interest the REIT has in the properties held in partnerships. |

|

(2) |

Calculated on weighted areas (activity, storage and intercompany restaurant areas being accounted for only a third of their effective areas). |

|

(3) |

Calculated on annualized net rental earnings (based on net rental earnings for the year-to-date period). |

|

(4) |

The definition of debt-to-book value and of debt-to-book value, net of cash can be found under the section Non-IFRS Financial Measures. |

|

(5) |

Calculated as the weighted average interest rate paid on the finance leases and the mortgage loans. |

|

(6) |

Calculated as net rental earnings plus interest, less general and administrative expenses, divided by interest expense on the financial leases and mortgage financings. |

|

(7) |

The reconciliation of FFO and AFFO to earnings can be found under the section Non-IFRS Reconciliation (FFO and AFFO). |

|

(8) |

Based on the fully diluted weighted average number of Units during the period. |

BASIS OF PRESENTATION

The following management’s discussion and analysis (“MD&A”) of the financial condition and results of operations of Inovalis REIT should be read in conjunction with the REIT’s condensed interim consolidated financial statements for the period from January 1, 2017 to June 30, 2017, and the notes thereto. This MD&A has been prepared taking into account material transactions and events up to and including August 8, 2017. Financial data provided in the condensed interim consolidated financial statements have been prepared in accordance with International Financial Reporting Standards. All amounts in this MD&A are in thousands of Canadian dollars, except per unit amounts and where otherwise stated. Historical results, including trends which might appear, should not be taken as indicative of future operations or results. Additional information about Inovalis REIT has been filed with applicable Canadian securities regulatory authorities and is available at www.sedar.com. The exchange rate used throughout this MD&A for statement of earnings items is the average rate during the said period, i.e. 1.4455 Canadian dollars per Euro for the three-month period ended June 30, 2017. For balance sheet items, projections or market data, the exchange rate used is 1.4813 (exchange rate as at June 30, 2017).

FORWARD-LOOKING INFORMATION

Although we believe that the expectations reflected in the forward-looking information are reasonable, we can give no assurance that these expectations will prove to have been correct, and since forward-looking information inherently involves risks and uncertainties, undue reliance should not be placed on such information. Certain material factors or assumptions are applied in making forward-looking statements and actual results may differ materially from those expressed or implied in such forward-looking statements. The estimates and assumptions, which may prove to be incorrect, include, but are not limited to, the various assumptions set forth in this document as well as the following: (i) we will continue to receive financing on acceptable terms; (ii) our future level of indebtedness and our future growth potential will remain consistent with our current expectations; (iii) there will be no changes to tax laws adversely affecting our financing capability, operations, activities, structure or distributions; (iv) we will retain and continue to attract qualified and knowledgeable personnel as we expand our portfolio and business; (v) the impact of the current economic climate and the current global financial conditions on our operations, including our financing capability and asset value, will remain consistent with our current expectations; (vi) there will be no material changes to government and environmental regulations adversely affecting our operations; (vii) conditions in the international and, in particular, the French and German real estate markets, including competition for acquisitions, will be consistent with the current climate; and (viii) capital markets will provide us with readily available access to equity and/or debt financing.

The forward-looking statements are subject to inherent uncertainties and risks, including, but not limited to, the factors listed under the Risk and Uncertainties section of this MD&A. Consequently, actual results and events may vary significantly from those included in, contemplated or implied by such statements.

MARKET AND INDUSTRY DATA

This MD&A includes market and industry data and forecasts that were obtained from third-party sources, industry publications and publicly available information as well as industry data prepared by Inovalis SA on the basis of its knowledge of the commercial real estate industry in which we operate (including Inovalis SA estimates and assumptions relating to the industry based on that knowledge). Inovalis SA’s knowledge of the real estate industry has been developed through its 20 years of experience and participation in the industry. Inovalis SA believes that its industry data is accurate and that its estimates and assumptions are reasonable, but there can be no assurance as to the accuracy or completeness of this data. Third-party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. Although Inovalis SA believes it to be reliable, Inovalis SA has not verified any of the data from third-party sources referred to in this MD&A, or analyzed or verified the underlying studies or surveys relied upon or referred to by such sources, or ascertained the underlying assumptions relied upon by such sources.

NON-IFRS FINANCIAL MEASURES

Funds from Operations and Adjusted Funds from Operations

FFO and AFFO are not measures recognized under IFRS and do not have standardized meanings prescribed by IFRS. FFO and AFFO are supplemental measures of performance for real estate businesses. We believe that AFFO is an important measure of economic performance and is indicative of our ability to pay distributions, while FFO is an important measure of operating performance and the performance of real estate properties. The IFRS measurement most directly comparable to FFO and AFFO is net earnings. See the Non-IFRS Reconciliation (FFO and AFFO) section for reconciliation of FFO and AFFO to net earnings.

FFO is defined as net earnings in accordance with IFRS, excluding: (i) acquisition costs, (ii) gain on bargain purchase, (iii) net change in fair value of investment properties, (iv) net change in fair value of financial instruments at fair value through profit and loss, (v) changes in fair value of Exchangeable securities, (vi) adjustment for property taxes accounted for under IFRIC 21 (if any), (vii) loss on exercise of lease option, (viii) adjustment for foreign exchange gains or losses on monetary items not forming part of an investment in a foreign operation, (ix) gain on disposal of an interest in a subsidiary and the non-cash portion of earnings from investments accounted for using the equity method, * finance income earned from loans to joint-ventures, (xi) non-recurring finance costs, (xii) deferred taxes and (xiii) gains or losses from non-recurring items. It has also been adjusted to exclude the distributions declared on Exchangeable securities and on Private placement promissory note. These distributions are recognized in profit and loss consistent with the classification of the Exchangeable securities as a liability. However, they are not to be considered when determining distributions for the Unitholders as indeed they are subordinated to the distributions to the Unitholders.

AFFO is defined as FFO subject to certain adjustments, including adjustments for: (i) the non-cash effect of straight line rents, (ii) the cash effect of the lease equalization loans (equalizing the rent payments, providing the REIT with stable and predictable monthly cash flows over the term of the France Telecom leases in the Vanves property, the Smart & Co. lease in the Courbevoie property and the Rue du Commerce leases in the Baldi property (iii) amortization of fair value adjustment on assumed debt, (iv) the non-cash portion of the asset management fees paid in Exchangeable securities, (v) capital expenditures, including those paid by the vendors of the leasehold interest in the properties and/or tenants and (vi) amortization of transaction costs on mortgage loans.

FFO and AFFO should not be construed as alternatives to net earnings or cash flow from operating activities, determined in accordance with IFRS, as indicators of our performance. Our method of calculating FFO and AFFO may differ from other issuers’ methods and accordingly may not be comparable to measures used by them.

Debt-to-book value

Our debt-to-book value ratio is calculated on a look-through basis and takes into account the REIT apportioned amount of indebtedness at the partnership level. Indebtedness at the REIT level, as well as at the different partnership levels is calculated as the sum of (i) finance lease liabilities, (ii) mortgage loans, (iii) lease equalization loans, (iv) other long-term liabilities and (v) deferred tax liabilities. Indebtedness does not take into account the contribution from Unitholders that is recorded as a liability, as is the case at the REIT level for the Exchangeable securities, Private placement promissory note and at the partnership level for the contribution from the REIT and its partners.

BUSINESS OVERVIEW AND STRATEGY

Inovalis REIT is an unincorporated open-ended real estate investment trust governed by the laws of the Province of Ontario. Inovalis REIT was founded and sponsored by Inovalis SA, our asset manager. Our Units have been listed on the Toronto Stock Exchange under the trading symbol INO.UN since April 10, 2013. Our head and registered office is located at 151 Yonge Street, 11th floor, Toronto, Ontario, M5C 2W7.

Our long-term objectives are to:

- generate predictable and growing cash distributions on a tax-efficient basis from investments in income-producing office properties;

- maximize the long-term value of both our properties and Units through active and efficient management;

- grow our asset base, primarily in France and Germany, but also opportunistically in other European countries where assets meet our investment criteria; and

- increase the cash available for distribution to holders of Units (“Unitholders”), through an accretive acquisition program that successfully leverages Inovalis SA’s extensive relationships and depth of commercial property and financing.

The REIT’s Investment criteria encompasses office properties outside of Canada with an occupancy level above 80% (unless AFFO accretive), secured rental cash flows, a property value between â¬20 million ($28 million) to â¬60 million ($85 million) (unless AFFO accretive) and a potential future upside with respect to matters including rent and area development. According to management, the target investment size falls within a very liquid segment of the real estate market in Europe, and debt financing for such acquisitions is readily available from local lenders.

BUSINESS ENVIRONMENT

French commercial real estate investment market (1)

The timing of the French presidential elections and the possibility of a “Frexit” appear to have slowed the French investment market in the first half of 2017. While demand remains strong, it is facing a genuine lack of opportunities in the small and medium space segments. Conversely, there is currently a good level of product in the over â¬200 million segment. Many of these assets should change hands over the second half of 2017 leading to a sharp rise in activity. We therefore expect the full-year investment volume for the Greater Paris Region to stand at â¬18 billion.

(1) Source: JLL)

Greater Paris Region commercial real estate investment market (1)

Over the last three months, â¬2.5 billion was invested in the Greater Paris Region investment market; this is slightly higher than the volume recorded over Q1. A total of â¬5 billion was invested over the first half of 2017 as a whole, this represents a 27% decrease compared with the first half of 2016, but is still in line with the long-term average.

This decline has been seen across all market segments, although to varying degrees. These range from -4% in the â¬100 to â¬300 million segment to -30% for transactions from â¬50 to â¬100 million. There has been an absence of mega-deals in the major transactions segment over the first half of 2017. While the number of transactions for lot sizes over â¬100 million remained unchanged year on year (14), this segment only secured â¬2.5 billion in investments over the first half of 2017, compared with â¬3.4 billion over the same period last year (-27%). All segments combined, the number of transactions posted a year-on-year decrease with 116 transactions recorded over the last six months, compared with 148 over H1 2016. The average lot size also posted a decrease from â¬46 to â¬43 million.

After an optimisticstart to the year (~663,000 sq m), Q2 results for the Greater Paris Region rental market were more subdued (500,000 sq m). This takes the overall figure for the first half of 2017 to 1,164,600 sq m (+4% year on year). Twenty transactions for spaces over 5,000 sq m were carried out over Q1, whereas only 8 were recorded over Q2. Immediate supply remained at around 3.5 million sq m at the end of June with a vacancy rate of 6.7%. Paris is currently suffering from a lack of supply with an average vacancy rate of close to 3%. There was no change in prime asking rents which stood at â¬760 in the Central Business District and â¬505 in La Défense

(1) Source: JLL)

German commercial real estate investment market (2)

Investors continue to focus on Germany. An increase in international capital on the market with ongoing strong activity from German investors as well has been recorded since year-start. Approximately â¬25.9bn was invested in German commercial assets during the first half of 2017. This result reflects an almost 45% increase in transaction volume compared to mid-year 2016, almost setting a new record for half-year activity with 2007 still holding the current record at roughly â¬28bn. 2017’s mid-year result managed to top the 10-year average by a 76%.

Looking at recent developments in numbers, the volume generated by deals involving foreign investors almost doubled to â¬12bn compared to mid-year 2016, reflecting a 46% share in total transaction volume. German investors, who dominated the market in 2016, remained active as well, increasing their share in transaction volume by 20% to â¬14bn, a 54% market share.

Investors are still willing to pay increasingly higher purchase prices, as can be seen in the prime yields for office assets in some BIG 7 markets. Even in Frankfurt, yields are now below 4%. The market has even seen a prime property change hands at 30x annual rent. As a result of high rent increases, property owners in Berlin have also been asking higher prices and the city has reached a new record low yield of 3.25%, as has Munich.

(2) Source Colliers

REAL ESTATE MANAGEMENT AND ADVISORY SERVICES

Pursuant to a management agreement, Inovalis SA is the manager of the REIT and provides the strategic, advisory, asset management, project management, construction management, property management and administrative services necessary to manage the operations of the REIT.

Upon the earlier of (i) the REIT achieving a market capitalization of $750 million (including any Exchangeable securities held by Inovalis SA) based on the volume weighted average price (VWAP) over a 20-day trading period and (ii) April 10, 2018, the Management Agreement will terminate and the management of the REIT will be internalized at no additional cost. In anticipation of the term end of the Management Agreement, the independent members of the Board of Trustees have formed a committee to review alternatives available to the REIT.

OUR OPERATIONS

Performance indicators (1)

|

As at |

June 30, 2017 |

December 31, 2016 |

||

|

Gross leasable area (sq.ft) |

1,172,139 |

1,050,336 |

||

|

Number of properties |

12 |

11 |

||

|

Number of tenants |

49 |

42 |

||

|

Occupancy rate (2) |

96.2% |

95.9% |

||

|

Occupancy rate (including Vendor Leases) |

94.7% |

94.3% |

||

|

Weighted average lease term (3) |

5.7 years |

5.3 years |

|

(1) |

Taking into account the interest the REIT has in the properties held in partnerships. |

|

(2) |

Calculated on weighted areas (activity, storage and intercompany restaurant areas being accounted only for a third of their effective areas). |

|

(3) |

Excluding early termination rights. Taking into account early termination rights, the weighted average lease term is 4.0 years as at June 30, 2017 compared to 3.5 years as at December 31, 2016. |

Portfolio

The REIT has an interest in 12 properties, of which 7 are entirely owned by the REIT (Baldi, Courbevoie, Jeuneurs, Metropolitan, Sablière and Vanves in France, Hanover in Germany) and 5 are held through partnerships with various global institutional funds (Arcueil in France, Bad Homburg, Cologne, Duisburg and Stuttgart in Germany). Seven properties are in France and 5 properties are in Germany.

These performance indicators do not take the following underlying assets into account: (i) forward purchased property in Ingolstadt (expected to be delivered in the first quarter of 2018) (ii) redevelopment loan granted to the property in Rueil (Paris Western periphery) (iii) acquisition loan on the property in Pantin (Paris north eastern periphery).

Occupancy

With acquisition of the 50% interest in Stuttgart property, the REIT’s total gross leasable area increased from 1,050,000 square feet to approximately 1,172,000 square feet.

The 96.2% overall weighted average occupancy rate across the portfolio was maintained at June 30, 2017, the same level at March 31, 2017; this is up slightly from 95.9% as at December 31, 2016.

A new 10-year lease has been signed during the quarter in Hanover property with one of the largest banks in Germany that will take over the lease of the current tenant as from 1, effective January 1, 2019. The end of lease date is also extended five years to the end of 2029. This new lease has a positive impact on the average term lease which increased to 5.7 years as at June 30, 2017 from 5.3 years as at March 31, 2017; this compares to 5.3 years as at December 31, 2016. This reflects the demand for the REIT’s properties in a robust German office market. The German markets in which the REIT is invested have a vacancy rate of approximately 5% while REIT assets have about 2% weighted average vacancy.

Tenants

The tenant base in the portfolio is well diversified from an industry segment standpoint, with many national and multinational tenants. As at June 30, 2017, the REIT had 49 tenants. Seventy-two percent of 2017 estimated gross rental income is attributable to French public agency tenants, is guaranteed by large German or international banks, or from investment grade corporations or affiliates of investment grade corporations.

The following table shows our five largest tenants, sorted by contribution to gross leasable area (GLA). The GLA shown for these tenants reflects the percentage of ownership that the REIT has in the underlying property.

|

Tenant |

Tenant Sector |

GLA |

Weighted Areas |

% of |

||

|

Orange (formerly France Telecom) |

Telecommunications |

268,740 |

253,652 |

23.2% |

||

|

Daimler AG |

Manufacturer |

218,271 |

100,578 |

9.2% |

||

|

Facility Services Hannover GmbH |

Banking / Real estate |

124,076 |

124,076 |

11.4% |

||

|

Mitsubishi Hitachi Power Systems Europe GmbH |

Manufacturer |

108,959 |

104,046 |

9.5% |

||

|

Rue du Commerce |

E-commerce |

51,926 |

51,926 |

4.8% |

||

|

Top 5 tenants |

771,972 |

634,277 |

58.1% |

|||

|

Other tenants |

Diversified |

338,218 |

416,139 |

38.1% |

||

|

Vacant |

61,949 |

41,830 |

3.8% |

|||

|

Total |

1,172,139 |

1,092,246 |

100.0% |

|

(1) |

Taking into account the interest the REIT has in the properties held in partnerships |

|

(2) |

Activity, storage and intercompany restaurant areas are weighted by being accounted for a third of their effective areas. |

Our largest tenant Orange is rated BBB+/Baa1/BBB+ by S&P/Moody’s/Fitch and has leases in two of our properties, the Vanves property and the Arcueil property (held in partnership).

Leasing profile

Lease rollover profile

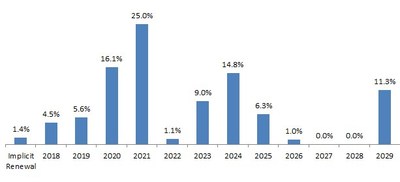

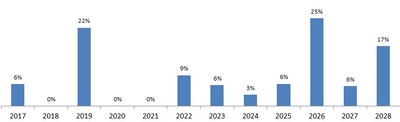

The REIT has an average remaining lease term of 5.7 years (not including tenant early termination rights). Assuming all tenants leave at the earliest possible early termination rights, which is not a likely scenario, the average remaining lease term in our portfolio is 4.0 years. The following graph sets out the amount of GLA and percentage of total GLA of the properties subject to leases expiring during the periods shown (excluding early lease terminations)

Rental indexation

All leases have rental indexation based on the French ICC (construction cost index), ILAT (index averaging construction costs and CPI indexes) or the German Consumer Price Index, as applicable.

CONSOLIDATED FINANCIAL INFORMATION

Our discussion of results of operations includes our proportionate share of income from investments in joint ventures. Please refer to “Non IFRS section” for a reconciliation to our condensed interim consolidated financial statements.

|

Three months ended June 30 |

Six months ended June 30 |

|||||

|

(in thousands of CAD$) |

2017 |

2016 |

2017 |

2016 |

||

|

Rental income |

8,100 |

7,797 |

15,672 |

15,231 |

||

|

Service charge income |

1,747 |

1,562 |

3,927 |

3,386 |

||

|

Service charge expenses |

(1,476) |

(900) |

(6,669) |

(6,076) |

||

|

Other revenue |

(6) |

42 |

80 |

42 |

||

|

Other property operating expenses |

(74) |

(152) |

(116) |

(82) |

||

|

Net rental earnings |

8,292 |

8,349 |

12,893 |

12,501 |

||

|

Administration expenses |

(1,556) |

(1,708) |

(2,997) |

(3,174) |

||

|

Foreign exchange (loss) gain |

(62) |

11 |

(62) |

107 |

||

|

Net change in fair value of investment properties |

547 |

3,039 |

3,027 |

(222) |

||

|

Gain on bargain purchase |

– |

0 |

– |

|||

|

Gain resulting from exercice of the purchase option |

– |

(664) |

– |

9,213 |

||

|

Acquisition costs |

(1,079) |

(25) |

(1,116) |

(689) |

||

|

Operating earnings |

6,142 |

9,002 |

11,746 |

17,736 |

||

|

Gain (loss) on financial instruments at fair value through P&L |

(2,343) |

(2,125) |

(1,738) |

(2,369) |

||

|

Loss on exercise of early payment option on finance leases |

– |

678 |

– |

(1,242) |

||

|

Loss on refinancing of a debt |

– |

– |

– |

(605) |

||

|

Finance income |

600 |

2 |

1,157 |

1,168 |

||

|

Finance costs |

(1,989) |

(1,947) |

(3,944) |

(4,247) |

||

|

Additional income (loss) from Arcueil’s JV |

(224) |

1,365 |

(741) |

144 |

||

|

Distributions on Exchangeable securities |

(398) |

(482) |

(777) |

(934) |

||

|

Net change in fair value of Exchangeable securities |

(1,034) |

(403) |

(1,699) |

(1,019) |

||

|

Earnings before income taxes |

754 |

6,090 |

4,004 |

8,632 |

||

|

Current income tax expense |

(92) |

(23) |

(126) |

(134) |

||

|

Deferred income tax expense |

(448) |

(229) |

(519) |

(74) |

||

|

Earnings for the period |

213 |

5,838 |

3,360 |

8,424 |

||

|

Non-controlling interest |

55 |

(1) |

60 |

(43) |

||

|

Earnings for the period (part attributable to the Trust) |

159 |

5,839 |

3,300 |

8,467 |

||

Net rental earnings

Rental income for the three-month period ended June 30, 2017 was $8,100 compared to $7,797 in Q2 2016. The $303 increase year over year accounted for by a $153 negative foreign exchange impact and a $507 increase of which $115 comes from new acquisitions (Stuttgart property) and $392 derives mainly from new leases on Metropolitan, Vanves and Courvevoie properties.

Rental income for the six-month period ended June 30, 2017 of $15,672 increased by $838 compared to the same period in 2016 of which $730 comes from new acquisitions (Metropolitain and Sttutgart properties) and the balance corresponds mainly to new leases partially offset by the end of the vendor lease on the Vanves property. This increase was partially offset by $397 negative FX impact which results in $441 year on year decrease.

Net rental earnings for the three-month period ended June 30, 2017 was $8,282 compared to $8,349 in Q2 2016. The $161 increase in net rental earnings was offset by $218 negative foreign exchange impact which results in $57 decrease year over.

Net rental earnings for the six-month period ended June 30, 2017 was $12,893 compared to $12,501 in the same period in 2016. The $392 increase takes into account $718 year-over-year increase mainly coming from the acquisition of new properties (Metropolitain and Stuttgart) and new leases on Courbevoie, Vanves, Sablière and Metropolitain properties, offset by a $326 negative foreign exchange impact.

Administration expenses

Administration expenses are primarily comprised of asset management fees paid to Inovalis SA and other general administrative expenses such as trustee fees, directors’ and officers’ liability insurance, professional fees (including accounting fees), legal fees, filing fees, Unitholder related expenses and other expenses.

Administration expenses for the quarter ended June 30, 2017 amounted to $1,556 vs. $1,708 for the same quarter in 2016. $889 is related to the asset management fees paid to Inovalis SA vs. $846 for the quarter ended June 31, 2016 and $666 to other expenses vs. $862 for the quarter ended June 30, 2016, i.e. 29 % year over year decrease (26% excluding the foreign exchange impact) as a result of management’s efforts to contain administrative expenditures. The increase of $43 in asset management fees corresponds to a $22 decrease due to the impact of foreign exchange and a $65 increase corresponding to the Metropolitain and Stuttgart asset acquisitions partially offset by Cologne (the Cologne asset management fees were invoiced after the payment of the acquisition price in May 2016).

Administration expenses for the six-month period ended June 30, 2017 amounted to $2,997 vs. $3,174 for the same period in 2016. $1,727 is related to the asset management fees paid to Inovalis SA vs. $1,600 for the same period in 2016 and $1,269 to other expenses vs. $1,574 for the same period ended June 30, 2016, i.e. 24 % year over year decrease (21% excluding the foreign exchange impact). Other administrative expenses decreased by $305 of which $41 is due to the impact of foreign exchange and $264 to operational efficiencies notwithstanding that the portfolio increased with the Metropolitain and Stuttgart acquisitions. The increase of $127 in asset management fees corresponds to a $42 decrease due to the impact of foreign exchange and an $85 increase corresponding to the Metropolitain and Stuttgart asset acquisitions

Net change in fair value of investment properties

During the quarter ended June 31, 2017, the net change in fair value of investment properties recognized in earnings was a gain of $547 (see section on Property Capital Investment â Fair Value) compared to the $3,039 gain in the quarter ended March 31, 2016 when most of the additional value of this very class of assets, based especially on the nature of building and WALT (weighted average lease term) was already appraised.

Acquisition costs

Acquisition costs of $1,079 for the quarter ended June 30, 2017 and $1,116 for the six-month period ended June 30, 2017 are related to the Stuttgart asset acquisition.

For the three-month and the six-month periods ended June 30, 2016, the acquisition costs were respectively $25 and $689 mainly attached to the Metropolitain acquisition et the Hanover refinancing.

Gain (loss) on financial instruments at fair value through profit and loss

The REIT recognized a gain on financial instruments at fair value through profit and loss for the quarter ended June 30, 2017 of $2,345 vs $2,125 for the same period in 2016. For the six-month period ended June 30, 2017, the REIT recognized a loss of $1,738 vs $2,369 for the period ended June 30, 2017. These losses are mostly the result of the variation in value realized on the foreign exchange contracts.

Loss on exercise of early payment option on finance leases

There was no loss on exercise of the early payment option on finance leases in the quarter ended June 30, 2017. A profit of $678 recorded in Q2 2016 and a loss of $1,242 in the six-month period ended June 30, 2016 are related to the exercise by the REIT of its option to purchase the Metropolitan property that was financed under a finance lease. Concurrently with the transaction, the REIT closed a new finance lease contract to replace the finance lease assumed as part of the transaction.

Loss on debt refinancing

There was no debt refinancing in the quarter ended June 30, 2017. The amount of $605 recorded in the six-month period ended June 30, 2016 is related to the refinancing of the Hanover property’s debt. The finance lease in place was terminated and replaced with a mortgage financing.

Finance income

For the three-month period ended June 30, 2017, finance income of $600 consists of $553 in interest on the acquisition loans related to the Rueil and Diamant properties and $47 in revenue from the foreign exchange hedging program.

For the six-month period ended June 30, 2017, finance income of $1,157 consists of $974 in interest on the acquisition loan related to the Rueil property and $183 in revenue from both the foreign exchange hedging program and interest on cash deposit.

Finance income for the six-month period ended June 30, 2016, of $1,168 was mostly comprised of the interest received from the acquisition loan related to the Metropolitain property (reimbursed in Q1 2016).

As at June 30, 2017, the REIT had deployed â¬12.7 million ($18.4 million) of the â¬21.7 million ($31.4 million) acquisition and redevelopment loan to a company 80%-owned by Inovalis SA, related to the Rueil property, in the Paris Western periphery. The loan bears an annual interest rate of 8.50% and, upon the eventual sale of the property to a third party, 20% of the profit will accrue the REIT. As at June 30, 2017, the REIT had deployed a total â¬12.7 million ($18.4 million). The final portion of the loan commitment of â¬9.0 million ($13.0 million) is expected to be deployed late Q3 or early Q4 of 2017.

On April 13, 2017, the REIT committed â¬5.3 million ($7.6 million) in a short-term acquisition loan to Aref Diamants Sarl (100%-owned by Inovalis SA) as a first step to the Pantin (Paris North-Eastern periphery). The loan has generated 9.5% interest income until the acquisition date for the property, which is expected to be closed in Q3 2017.

Finance costs

For the three-month period ended June 30, 2017, the finance costs amounted to $1,989 vs $1,947 for the same period in 2016 including $1,465 for interest costs related to finance leases, mortgage loans and the lease equalization loans, $335 of interests related to SWAP contracts and $189 of other finance costs (including amortization of fair value adjustment on finance leases assumed at a discount at the time of a business acquisition, amortization of transaction costs on mortgage loans and other miscellaneous costs).The increase of $42 year to year includes a $51 foreign exchange positive impact.

For the six-months period ended June 30, 2017, the finance costs amounted to $3,944 vs $4,247 for the same period in the previous year including $2,798 of interests costs related to finance leases, mortgage loans, the lease equalization loans, $643 of interests related to SWAP contracts and $503 of other finance costs (including amortization of fair value adjustment on finance leases assumed at a discount at the time of a business acquisition, amortization of transaction costs on mortgage loans and other miscellaneous costs). The decrease of $303 was primarily due to the decrease of other finance costs and the positive foreign exchange impact of $111.

Additional income (loss) from Arcueil’s JV

For the Arcueil joint venture, the consolidation presentation reflects a 25% proportionate share of results which aligns with the REIT 25% ownership interest. Per the joint venture agreement, and as reflected in the condensed interim consolidated financial statements, the REIT is entitled to receive a 25% share of the net earnings and, upon asset disposal, 75% of the variance of fair value of investment properties, reduced by 100% of foreign exchange derivative costs. This additional loss from Arcueil’s joint venture is $(224) for the three-month period ended June 30, 2017 vs $1,365 in Q2 2016 and $(741) for the six-month period ended June 30, 2017 vs $144 in the same period in 2016. The year on year variance is mainly due to the foreign exchange derivative valuation.

Distributions on Exchangeable securities

Distributions to the holders of Exchangeable securities (see note 11 in Consolidated Interim Financial Statements as at June 30, 2017) are calculated in a manner to provide a return that is economically equivalent to the distributions received by the Unitholders. During the three-month period ended June 30, 2017 the distributions recognized on Exchangeable securities were $398 compared to $482 for the same period in 2016. The decrease is accounted for by the conversion by Inovalis S.A. of 920,000 Exchangeable securities into Units in 2016, partially offset by the increase due to the additional Exchangeable securities received by Inovalis SA in lieu of asset management fees.

Net change in fair value of Exchangeable securities

The net change in value of the Exchangeable securities, as well as the cost of distributions recognized on Exchangeable securities, are recognized in profit and loss because, for financial reporting purposes, the Exchangeable securities have been classified as a liability at fair value through profit or loss.

For the three-month period ended June 30, 2017, the REIT reported a loss of $1,034 which is the result of the increase in the amount of the debt ($2,017) resulting from the change of the closing price of the units which was $10.10 on June 30, 2017 compared to $9.54 on March 31, 2017 partially offset by the issuance of $954 of Exchangeable securities in payment of Asset management fees.

For the six-month period ended June 30, 2017 the REIT reported a loss of $1,699 change which is the result of the increase in the amount of the debt ($3,513) resulting from the change of the closing price of the units which was $10.10 on June 30, 2017 compared to $9.18 on December 30, 2016 partially offset by the issuance of $1,808 of Exchangeable securities in payment of Asset Management fees.

Current income tax expense

The current income tax expense of $92 for the quarter ended June 30, 2017 and $92 for the six-month period ended June 30, 2017 is mainly due to a withholding tax paid by the REIT’s Luxemburg holding company on the dividends it received from affiliates.

Last 24 Months – Key Financial Information

The information provided in this section includes our proportionate share of income from investments in joint ventures. Please refer to “Non IFRS section” for reconciliation to our condensed interim consolidated financial statements.

|

3-month period ended |

||||||||||

|

(in thousands of CAD$) |

June 30, |

March 31, |

Dec. 31, |

Sept. 30, |

June 30, |

March 31, |

Dec. 31, |

Sept. 30, |

||

|

Rental income |

8,100 |

7,571 |

8,188 |

7,617 |

7,797 |

7,431 |

6,854 |

6,881 |

||

|

Net rental earnings |

8,292 |

4,601 |

8,698 |

7,902 |

8,349 |

4,135 |

6,975 |

6,589 |

||

|

Earnings for the period |

159 |

3,141 |

2,984 |

11,833 |

5,839 |

2,628 |

6,641 |

4,479 |

||

|

Earnings per Unit (CAD$) |

0.01 |

0.15 |

0.14 |

0.60 |

0.37 |

0.15 |

0.43 |

0.29 |

||

NON-IFRS RECONCILIATION

Investments in joint ventures

The REIT’s proportionate share of the financial position and results of operation of its investment in joint ventures, which are accounted for using the equity method under IFRS in the condensed interim consolidated financial statements, are presented below using the proportionate consolidation method (with the exception of Arcueil), which is a non-GAAP measure. For the purpose of the proportionate consolidation, the initial investment of both partners in the joint ventures were considered as being equity investments as opposed to a combination of equity and loans and accordingly, the related proportionate consolidation balance sheet items were eliminated as well as the associated finance income and finance costs.

For the Arcueil joint venture, the consolidation presentation reflects a 25% proportionate share of results which aligns with the REIT 25% ownership interest. Per the joint venture agreement, and as reflected in the condensed interim consolidated financial statements, the REIT is entitled to receive a 75% share of the net profit. A line entitled “additional gain or loss from Arcueil’s joint venture” in the consolidated statement of earnings reconciliation to consolidated financial statements bridges both presentations. A reconciliation of the financial position and results of operations to the condensed interim balance sheets and consolidated statements of earnings is included in the tables shown in the Non-IFRS Reconciliation section.

For the three-month period and year ended April 30, 2017, the proportional financial results include the following proportion of the revenues and expenses of each one of the joint ventures: 50% for Duisburg and Walpur (Bad Homburg), 50% of Stuttgart, 49% for Cologne and 25% for Arcueil.

FFO and AFFO

|

Three months ended June 30 |

Six Months ended June 30 |

|||||

|

(in thousands of CAD$) |

2017 |

2016 |

2017 |

2016 |

||

|

Earnings for the period |

159 |

5,839 |

3,300 |

8,467 |

||

|

Adjustment to related acquisition costs |

1,079 |

25 |

1,116 |

689 |

||

|

Option cost related to the acquisition of the Metropolitan property |

0 |

664 |

0 |

(9,213) |

||

|

Loss recognized on exercise of early payment option on finance leases |

0 |

(678) |

0 |

1,242 |

||

|

Loss on refinancing of a debt |

0 |

– |

0 |

605 |

||

|

Net change in fair value of investment properties |

(547) |

(3,039) |

(3,027) |

178 |

||

|

(Gain) loss on financial instruments at fair value through profit and loss |

2,343 |

2,125 |

1,738 |

2,369 |

||

|

Adjustment for property taxes accounted for under IFRIC 21 |

(825) |

(930) |

1,781 |

1,752 |

||

|

Share of net earnings of investments (equity method) |

0 |

0 |

||||

|

Additional income (loss from Arcueil’s JV) |

224 |

(1,365) |

741 |

(83) |

||

|

Distributions on Exchangeable securities |

398 |

482 |

777 |

934 |

||

|

Change in fair value of Exchangeable securities |

1,034 |

403 |

1,699 |

1,019 |

||

|

Foreign exchange (loss) gain |

62 |

(11) |

62 |

(107) |

||

|

Non-recurring finance income from Inovalis relating to the acquisition loan |

0 |

– |

0 |

(797) |

||

|

Other non-recurring finance costs |

216 |

(97) |

216 |

316 |

||

|

Deferred income tax expense |

448 |

229 |

519 |

75 |

||

|

Minority interest |

55 |

1 |

60 |

(43) |

||

|

FFO |

4,647 |

3,648 |

8,981 |

7,403 |

||

|

Add/(Deduct): |

||||||

|

Non-cash effect of straight line rents |

226 |

(100) |

305 |

223 |

||

|

Cash effect of the lease equalization loans |

(190) |

5 |

(426) |

(310) |

||

|

Amortization of fair value adjustment on assumed debt |

22 |

48 |

44 |

99 |

||

|

Amortization of transaction costs on mortgage loans |

50 |

81 |

91 |

175 |

||

|

Non-cash part of asset management fees paid in Exchangeable securities (1) |

445 |

409 |

864 |

697 |

||

|

Capex net of cash subsidy |

100 |

(100) |

(100) |

(200) |

||

|

Adjustement from investment |

0 |

18 |

0 |

54 |

||

|

AFFO |

5,300 |

4,009 |

9,759 |

8,141 |

||

|

FFO / Units (diluted) (in CAD$) (2) |

0.20 |

0.20 |

0.38 |

0.41 |

||

|

AFFO / Units (diluted) (in CAD$) (2) |

0.23 |

0.22 |

0.42 |

0.45 |

||

|

(1) |

For purposes of this presentation, 50% of non-cash part of the asset management fee is included in the AFFO reconciliation. Notwithstanding, 100% of the asset management fee is paid in Exchangeable securities |

|

(2) |

Based on the weighted average number of Units (fully diluted), i.e. 23,541,535 and 18,121,533 for the 3-month periods ended June 30, 2017 and June 30, 2016 and 23,448,295 and 17,938,082 for the 6-month periods ended June 30, 2017 and June 30, 2016. |

Management believes FFO is an important measure of our operating performance and is indicative of our ability to pay distributions. However, it does not represent cash flow from operating activities as defined by IFRS and is not necessarily indicative of cash available to fund Inovalis REIT’s needs. This non-IFRS measurement is commonly used for assessing real estate performance. Our FFO and AFFO calculations are based on the average foreign exchange rate for the period (1.4455 Canadian dollars per Euro for the period ended June 30, 2017).

Balance sheet reconciliation to consolidated financial statements

|

As at June 30, 2017 |

As at December 31, 2016 |

||||||||||

|

Assets |

As per REIT’s |

Share from |

Proportionate |

As per REIT’s |

Share from |

Proportionate |

|||||

|

Non-current assets |

|||||||||||

|

Investment properties |

431,672 |

133,117 |

564,790 |

412,231 |

97,401 |

509,633 |

|||||

|

Investments accounted for using the equity method |

59,381 |

(59,381) |

– |

43,887 |

(43,887) |

– |

|||||

|

Acquisition loans and deposit |

28,109 |

– |

28,109 |

8,906 |

– |

8,906 |

|||||

|

Derivative financial instruments |

– |

– |

– |

590 |

– |

590 |

|||||

|

Total non-current assets |

519,162 |

73,736 |

592,899 |

465,615 |

53,515 |

519,129 |

|||||

|

Current assets |

|||||||||||

|

Trade and other receivables |

4,332 |

548 |

4,880 |

3,368 |

(35) |

3,333 |

|||||

|

Derivative financial instruments |

30 |

159 |

189 |

520 |

152 |

672 |

|||||

|

Other current assets |

2,789 |

249 |

3,038 |

1,638 |

375 |

2,013 |

|||||

|

Financial current assets |

1,191 |

741 |

1,931 |

27,910 |

– |

27,910 |

|||||

|

Cash and cash equivalents |

23,519 |

4,816 |

28,335 |

11,074 |

2,446 |

13,520 |

|||||

|

Total current assets |

31,861 |

6,513 |

38,374 |

44,510 |

2,938 |

47,448 |

|||||

|

Total assets |

551,023 |

80,249 |

631,272 |

510,125 |

56,452 |

566,577 |

|||||

|

Liabilities and Unitholders’ equity |

|||||||||||

|

Liabilities |

|||||||||||

|

Non-current liabilities |

|||||||||||

|

Promissory notes |

12,951 |

– |

12,951 |

– |

– |

– |

|||||

|

Mortgage loans |

87,607 |

54,256 |

141,864 |

83,998 |

34,547 |

118,545 |

|||||

|

Finance lease liabilities |

123,481 |

16,775 |

140,256 |

120,891 |

16,389 |

137,279 |

|||||

|

Other long-term liabilities |

– |

1,246 |

1,246 |

– |

947 |

947 |

|||||

|

Lease equalization loans |

3,687 |

– |

3,687 |

4,051 |

– |

4,051 |

|||||

|

Tenant deposits |

2,165 |

– |

2,165 |

2,178 |

– |

2,178 |

|||||

|

Exchangeable securities |

6,024 |

– |

6,024 |

4,603 |

– |

4,603 |

|||||

|

Provision on investment (equity method) |

– |

– |

– |

– |

– |

– |

|||||

|

Derivative financial instruments |

922 |

171 |

1,093 |

1,616 |

206 |

1,822 |

|||||

|

Deferred tax liabilities |

2,567 |

1,633 |

4,200 |

2,236 |

1,273 |

3,509 |

|||||

|

Deferred income |

4,487 |

– |

4,487 |

– |

– |

– |

|||||

|

Total non-current liabilities |

243,891 |

74,082 |

317,973 |

219,573 |

53,361 |

272,934 |

|||||

|

Current liabilities |

|||||||||||

|

Promissory notes |

28 |

– |

28 |

– |

– |

– |

|||||

|

Mortgage loans |

614 |

66 |

680 |

541 |

– |

541 |

|||||

|

Finance lease liabilities |

24,884 |

699 |

25,583 |

24,180 |

637 |

24,816 |

|||||

|

Lease equalization loans |

1,235 |

– |

1,235 |

1,184 |

– |

1,184 |

|||||

|

Tenant deposits |

294 |

– |

294 |

198 |

– |

198 |

|||||

|

Exchangeable securities |

14,087 |

– |

14,087 |

11,995 |

– |

11,995 |

|||||

|

Derivative financial instruments |

1,149 |

7 |

1,156 |

1,225 |

6 |

1,231 |

|||||

|

Trade and other payables |

9,496 |

4,807 |

14,303 |

7,392 |

2,142 |

9,534 |

|||||

|

Other current liabilities |

450 |

484 |

934 |

1,975 |

29 |

2,004 |

|||||

|

Deferred income |

5,239 |

105 |

5,344 |

734 |

277 |

1,011 |

|||||

|

Total current liabilities |

57,475 |

6,168 |

63,643 |

49,423 |

3,091 |

52,514 |

|||||

|

Total liabilities |

301,366 |

80,250 |

381,616 |

268,996 |

56,452 |

325,448 |

|||||

|

Equity |

|||||||||||

|

Trust units |

189,869 |

– |

189,869 |

189,158 |

– |

189,158 |

|||||

|

Retained earnings |

37,857 |

– |

37,857 |

43,455 |

– |

43,455 |

|||||

|

Accumulated other comprehensive income |

21,729 |

– |

21,729 |

8,395 |

– |

8,395 |

|||||

|

249,455 |

– |

249,454 |

241,008 |

– |

241,008 |

||||||

|

Non-controlling interest |

202 |

– |

202 |

121 |

– |

121 |

|||||

|

Total liabilities and equity |

551,023 |

80,250 |

631,273 |

510,125 |

56,452 |

566,577 |

|||||

|

(1) Balance sheet amounts presented for the REIT were taken from the interim consolidated financial statements as at June 30, 2017 and audited as at December 31, 2016. |

Consolidated statement of earnings reconciliation to consolidated financial statements

|

Three months ended |

||||||||||||

|

June 30, 2017 |

June 30, 2016 |

|||||||||||

|

(in thousands of CAD$) |

Amounts per |

Share of net |

Total |

Amounts |

Share of |

Total |

||||||

|

Rental income |

6,271 |

1,829 |

8,100 |

5,853 |

1,944 |

7,797 |

||||||

|

Service charge income |

1,358 |

389 |

1,747 |

1,185 |

377 |

1,562 |

||||||

|

Service charge expenses |

(1,165) |

(311) |

(1,476) |

(989) |

89 |

(900) |

||||||

|

Other revenue |

219 |

(224) |

(6) |

42 |

– |

42 |

||||||

|

Other property operating expenses |

(73) |

– |

(74) |

(26) |

(126) |

(152) |

||||||

|

Net rental earnings |

6,610 |

1,683 |

8,292 |

6,065 |

2,284 |

8,349 |

||||||

|

Administration expenses |

(1,326) |

(229) |

(1,556) |

(1,505) |

(203) |

(1,708) |

||||||

|

Foreign exchange gain |

(62) |

– |

(62) |

11 |

– |

11 |

||||||

|

Net change in fair value of investment properties |

(2,181) |

2,728 |

547 |

3,552 |

(513) |

3,039 |

||||||

|

Gain resulting from exercice of the purchase option |

– |

– |

– |

(664) |

– |

(664) |

||||||

|

Acquisition costs |

– |

(1,079) |

(1,079) |

(30) |

5 |

(25) |

||||||

|

Share of profit of an investment (equity method) |

1,114 |

(1,114) |

– |

(153) |

153 |

– |

||||||

|

Operating earnings |

4,155 |

1,988 |

6,143 |

7,276 |

1,726 |

9,002 |

||||||

|

Gain (loss) on financial instruments at fair value through P&L |

(2,352) |

9 |

(2,343) |

(2,093) |

(32) |

(2,125) |

||||||

|

Loss on exercise of early payment option on finance leases |

– |

– |

– |

678 |

– |

678 |

||||||

|

Loss on refinancing of a debt |

– |

– |

– |

– |

– |

– |

||||||

|

Finance income |

1,524 |

(925) |

600 |

2,784 |

(2,784) |

– |

||||||

|

Finance costs |

(1,404) |

(585) |

(2) |

(1,989) |

(1,623) |

(324) |

(2) |

(1,947) |

||||

|

Additional income (loss) from Arcueil’s JV (3) |

– |

(224) |

(224) |

– |

1,365 |

1,365 |

||||||

|

Distributions on Exchangeable securities |

(398) |

– |

(398) |

(482) |

– |

(482) |

||||||

|

Net change in fair value of Exchangeable securities |

(1,034) |

– |

(1,034) |

(403) |

– |

(403) |

||||||

|

– |

||||||||||||

|

Earnings before income taxes |

491 |

263 |

754 |

6,137 |

(47) |

6,090 |

||||||

|

Current income tax expense |

(87) |

(5) |

(92) |

(23) |

(23) |

|||||||

|

Deferred income tax expense |

(190) |

(258) |

(448) |

(276) |

47 |

(229) |

||||||

|

Earnings for the period |

214 |

– |

214 |

5,838 |

– |

5,838 |

||||||

|

Non-controlling interest |

55 |

55 |

(1) |

(1) |

||||||||

|

Earnings for the period (part attributable to the Trust) |

159 |

– |

159 |

5,839 |

– |

5,839 |

||||||

|

(1) |

Income statement amounts presented for the REIT were taken from the interim consolidated financial statements as at June 31, 2017 and June 30, 2016 |

|

(2) |

Includes the REIT’s share of the hedging cost of Arcueil’s partner |

|

(3) |

Reflects the additional loss assumed by the REIT in reference to its 75% right to the net profit/loss of the Arcueil joint venture. |

|

Six months ended |

||||||||||||

|

June 30, 2017 |

June 30, 2016 |

|||||||||||

|

(in thousands of CAD$) |

Amounts per |

Share of net |

Total |

Amounts per |

Share of |

Total |

||||||

|

Rental income |

12,242 |

3,430 |

15,672 |

11,526 |

3,705 |

15,231 |

||||||

|

Service charge income |

3,208 |

719 |

3,927 |

2,775 |

611 |

3,386 |

||||||

|

Service charge expenses |

(5,782) |

(887) |

(6,669) |

(5,474) |

(602) |

(6,076) |

||||||

|

Other revenue |

303 |

(223) |

80 |

42 |

– |

42 |

||||||

|

Other property operating expenses |

(114) |

(2) |

(116) |

(67) |

(15) |

(82) |

||||||

|

Net rental earnings |

9,857 |

3,037 |

12,893 |

8,802 |

3,699 |

12,501 |

||||||

|

Administration expenses |

(2,572) |

(425) |

(2,997) |

(2,724) |

(450) |

(3,174) |

||||||

|

Foreign exchange gain |

(62) |

– |

(62) |

107 |

– |

107 |

||||||

|

Net change in fair value of investment properties |

108 |

2,919 |

3,027 |

644 |

(866) |

(222) |

||||||

|

Gain resulting from exercice of the purchase option |

– |

– |

– |

9,213 |

– |

9,213 |

||||||

|

Acquisition costs |

(37) |

(1,079) |

(1,116) |

(689) |

– |

(689) |

||||||

|

Share of profit of an investment (equity method) |

391 |

(391) |

– |

(358) |

358 |

– |

||||||

|

Operating earnings |

7,685 |

4,061 |

11,746 |

14,995 |

2,741 |

17,736 |

||||||

|

Gain (loss) on financial instruments at fair value through P&L |

(1,781) |

43 |

(1,738) |

(2,237) |

(132) |

(2,369) |

||||||

|

Loss on exercise of early payment option on finance leases |

– |

– |

(1,242) |

– |

(1,242) |

|||||||

|

Loss on refinancing of a debt |

– |

– |

– |

(605) |

– |

(605) |

||||||

|

Finance income |

3,308 |

(2,151) |

1,157 |

2,836 |

(1,668) |

1,168 |

||||||

|

Finance costs |

(3,057) |

(887) |

(2) |

(3,944) |

(3,139) |

(1,108) |

(2) |

(4,247) |

||||

|

Additional income (loss) from Arcueil’s JV (3) |

– |

(777) |

(777) |

– |

144 |

144 |

||||||

|

Distributions on Exchangeable securities |

(777) |

36 |

(741) |

(934) |

– |

(934) |

||||||

|

Net change in fair value of Exchangeable securities |

(1,698) |

– |

(1,698) |

(1,019) |

– |

(1,019) |

||||||

|

0 |

||||||||||||

|

Earnings before income taxes |

3,680 |

325 |

4,005 |

8,655 |

(23) |

8,632 |

||||||

|

Current income tax expense |

(97) |

(29) |

(126) |

(108) |

(26) |

(134) |

||||||

|

Deferred income tax expense |

(224) |

(295) |

(519) |

(123) |

49 |

(74) |

||||||

|

Earnings for the period |

3,359 |

– |

3,360 |

8,424 |

– |

8,424 |

||||||

|

Non-controlling interest |

59 |

59 |

(43) |

(43) |

||||||||

|

Earnings for the period (part attributable to the Trust) |

3,300 |

– |

3,301 |

8,467 |

– |

8,467 |

||||||

|

(4) |

Income statement amounts presented for the REIT were taken from the interim consolidated financial statements as at June 31, 2017 and June 30, 2016 |

|

(5) |

Includes the REIT’s share of the hedging cost of Arcueil’s partner |

|

(6) |

Reflects the additional loss assumed by the REIT in reference to its 75% right to the net profit/loss of the Arcueil joint venture. |

PROPERTY CAPITAL INVESTMENTS

Fair value

The fair value of the REIT’s investment property portfolio as at June 30, 2017 was $564.8 million including the REIT’s interests in the properties held in partnerships (vs. $509.6 million as at December 31, 2016). The fair value of the French properties was $429.4 million (76.0% of total asset value) and the fair value of the German properties was $135.4 million (24.0% of total asset value).

The $55.2 million increase is accounted for by a $26.8 million increase due to Stuttgart asset acquisition, $3.0 million increase in fair value, $0.9 million Capex, $(0.3) rent free impact and $23.2 million increase due to foreign exchange fluctuations.

Management principally uses discounted cash flows to determine the fair value of the investment properties. These values are supported by third party appraisals in conformity with the requirements of the Royal Institution of Chartered Surveyors Standards, and for the French properties also in conformity with the Charte de l’expertise immobilière, European Valuation Standards of TEGoVA (the European Group of Valuers’ Association) and IFRS 13.

Please refer to note 4 of the interim consolidated financial statements for a more complete discussion on our investment properties and valuation rates used by the evaluators.

Building improvements

The REIT is committed to improving its operating performance by incurring appropriate capital expenditures in order to replace and maintain the productive capacity of its property portfolio so as to sustain its rental income generating potential over the portfolio’s useful life.

Since the IPO in April 2013, a total of $1.7 million has been spent on the properties, funded by a reserve that was set aside by the vendors of the four initial properties. Improvement works of $2.2 million on Courbevoie property begun in Q2 2017 and will be completed in 2017.

Guarantees, commitments and contingencies

The REIT and its subsidiaries have provided guarantees in connection with the finance lease liabilities and the mortgage loans, including pledge of affiliates of the REIT, first mortgages and assignment of receivables and future receivables. As at June 30, 2017, guarantees provided by the REIT with respect to its long-term debts include a preferential claim held by mortgage lenders on the Jeuneurs, Veronese, Sablière and Hanover properties in the amount of $88.4 million. Including the REIT’s interest in the properties held in partnerships, preferential claim held by mortgage lenders on the properties totals $142.9 million.

OTHER SIGNIFICANT ASSETS

Investments accounted for using the equity method

This section encompasses the 50% interest the REIT (through its subsidiaries) has in the Duisburg property, the 50% interest in the Walpur property, the 25% interest in the Arcueil property, the 49% interest in the Cologne property and 50% in the Stuttgart property. Our share of fair value of the investment properties accounted for using the equity method was $59,381 as at June, 2017 compared to $43,887 as at December 31, 2016.

Acquisition loans and deposit

As at June 30, 2017, Acquisition loans and deposit of $28.1 million consisted mainly of the $18.9 million loan commitment for the Rueil project, $7.9 loan commitment for Diamant property acquisition and the $1.1 million deposit for the Ingolstadt forward purchase.

Trade and other receivables

Trade and other receivables as at June 31, 2017 amounted to $4,880 taking into account the REIT’s interests in the properties held in partnerships compared to $3,333 as at December 31, 2016. The difference of $1,547 corresponds to a $1,396 increase mainly due to the property taxes recognized according to IFRIC 21 rules to be recharged to the tenants in Q4 and to the $151 foreign exchange impact.

Other current Assets

Other current assets as at June 30, 2017 amounted to $3,038 compared to $2,013 as at December 31, 2016. This includes the 50% share of the deposit pertaining to the Ingolstadt forward purchase ($1,111) that will be borne by the yet-to-be chosen partner on this transaction. The balance of other current assets consists mainly of sales tax receivables.

PRESENTATION OF OUR CAPITAL

Liquidity and capital resources

Inovalis REIT’s primary sources of capital are cash generated from operating activities, credit facilities, sharing the ownership of actual assets owned entirely and equity issues. Our primary uses of capital include property acquisitions, payment of distributions, costs of attracting and retaining tenants, recurring property maintenance, major property improvements and debt interest payments. We expect to meet all of our ongoing obligations through current cash, cash flows from operations, debt refinancing and, as growth requires and when appropriate, new equity or debt issues. We can also sell some portion of assets owned in order to get access to capital but also in the perspective of diversification of our portfolio.

The REIT’s cash available was $23.5 million as at June 30, 2017 compared to $11.1 million as at December 31, 2016. Including the REIT’s interest in the joint ventures, cash available totals $28.3 million as at June 30, 2017, compared to $13.5 million as at December 31, 2016. This includes the net proceeds of the $13.1 million ($13.6 million gross proceeds) private placement which closed on June 26, 2017. Gross proceeds from July 2016 equity offering of $46.0 million resulted into net proceeds of $43.1 million after deduction of $2.9 million of offering costs were fully invested as at June 2017 in Rueil and Diamant acquisition loans and Stuttgart property.

Financing activities

Our debt strategy is to have secured mortgage financing with a term to maturity that is appropriate in relation to the lease maturity profile of our portfolio and then to put in place, when appropriate, interest-only financings. We intend to search for fixed rate financings or floating rate financings with a cap. As such, 93.8% of the REIT’s senior debt benefits from an interest rate protection (77.5% in the form of a swap and 16.3% in the form a cap). Our preference is to have staggered debt maturities to mitigate interest rate risk and limit refinancing exposure in any particular period. With no financial institution representing more than 30% of our senior debt commitment, we also make sure that the REIT has a diversified base of senior debt providers. Our debt to book value stands at 50.5% and net of the $28.3 million of cash available (including financial current assets) as at June 30, 2017 (including the REIT’s interest in the joint ventures), this debt to book value stands at 48.2%.

Key performance indicators in the management of our debt are summarized in the following table, which also takes into account the interests the REIT has in all assets held in partnerships.

|

As at June 30, 2017 |

As at December 31, 2016 |

|||

|

Weighted average interest rate (1) |

2.06% |

2.11% |

||

|

Debt-to-book value (2) |

50.5% |

51.3% |

||

|

Debt-to-book value, net of cash (2) |

48.2% |

47.5% |

||

|

Interest coverage ratio (3) |

3.9 x |

4.4 x |

||

|