- 12M, 2016 FFO per unit of $2.84 and includes $0.09 per trust unit of one-time, non-recurring items

- Q4, 2016 FFO per unit of $0.58

- Positioning for market recovery

- Suite renovation and upgrade packages remain key to Resident value and reduction of incentives and vacancy

- Short-term capital availability increases to $482 million

- Countercyclical Acquisitions and Solid Development Pipeline

- 747 newly constructed apartment units acquired in 2016 in Calgary and Edmonton

- Partnership with Riocan REIT to co-develop a 12-storey mixed-use tower in Calgary

- Lease Up of newly developed Pines Edge ahead of schedule with over 97% occupancy

- Internal development opportunity of over 4,600 apartment units totaling 4.7 million buildable square feet on existing lands

- Purchased 666,000 Trust Units for cancellation during the twelve months of 2016

- Net Asset Value, including cash of $62.89 per Trust Unit

- Revises its 2017 financial guidance

CALGARY, Feb. 16, 2017 /CNW/ – Boardwalk Real Estate Investment Trust (“BEI.UN” – TSX)

Boardwalk Real Estate Investment Trust (“Boardwalk”, the “REIT” or the “Trust”) today announced its financial results for the fourth quarter of 2016.

In 2016, the Trust continued to feel the effects of a softer economic environment in Western Canada as a result of lower resource prices, negative GDP growth in Alberta, significant new supply of purpose built rentals and in comparison to record results in 2015. Boardwalk continues to proactively use incentives to maintain higher occupancy with a focus on customer service and quality, while providing the best value in housing.

Funds From Operations (“FFO”) for the fourth quarter of 2016 were $29.6 million, or $0.58 per Trust Unit on a diluted basis, compared to FFO of $44.2 million or $0.86 per Trust Unit for the same period last year, a decrease of 33.1% and 32.6% respectively. Adjusted Funds from Operations (“AFFO”) per Trust Unit decreased 35.9% to $0.50 for the current quarter, from $0.78 per Trust Unit during the same period in 2015.

For the twelve-month period ended December 31, 2016, FFO was $144.5 million, or $2.84 per Trust Unit on a diluted basis, compared to FFO of $184.9 million, or $3.56 per Trust Unit, for the same period a year ago, a decrease of 21.8% and 20.2%, respectively. AFFO per Trust Unit for the twelve months of 2016 decreased 22.6% to $2.50 per Trust Unit from $3.23 in 2015.

FFO for the twelve months of 2016 decreased by $0.09 per Trust Unit as a result of one-time, non-recurring items which included the previously announced cost of retirement of a senior executive ($0.02/Trust Unit), the cost associated with the retirement of a second executive ($0.01/Trust Unit), the financial impact from the discounted rental units to evacuees of the Fort McMurray wildfire in the months of May and June 2016 ($0.03/Trust Unit), and the costs associated with the Trust’s strategic review ($0.03/Trust Unit).

Stabilized same property revenue decreased 6.3%, while operating costs increased 4.5%, resulting in a Net Operating Income (“NOI”) decrease for the twelve-month period ended December 31, 2016 of 12.5%.

Rental revenues decreased through the summer turnover season and carried into the second half of 2016 as the onset of new purpose built rental supply in the Trust’s Alberta markets provided renters with additional choices, which resulted in increased vacancies and lower rental rates. Operating costs increased mainly as a result of higher property taxes, though this was partially offset by a decrease in operating G&A.

Over the long term, Alberta rents have increased by three to four percent per annum, and historically revert back to the mean as housing supply and demand re-balances. Building permits and starts continue to trend downwards, and is a positive leading indicator for the re-balancing of supply and demand of the rental market. The construction of additional purpose-built rental housing in Alberta has also slowed with limited new construction expected in 2017.

The impact of the Fort McMurray fires to both the Alberta and overall Canadian economies have tapered. Signs of macro economic recovery are beginning to show in Alberta, economic indicators of a downturn are levelling off and oil prices have stabilized above $50 USD per barrel. The recent pipeline approvals add to optimism in Alberta and, as a result, the labour market has seen a similar stabilization. Job layoffs in the province have slowed, with many companies planning to add staff in 2017. The Alberta Treasury Board has forecasted GDP growth of 2.3% in 2017, compared to negative GDP in each of the last two years.

The Trust is positioning itself to create value through the re-balancing of the housing market by utilizing this exceptional opportunity to accomplish its long term strategic goal of high-grading its portfolio by developing new assets, investing in suite renovations and upgrades, and acquiring newly built assets at price levels near construction cost. As the rental market moves towards equilibrium, Boardwalk’s investments in suite renovations are positioning the Trust to begin reducing both incentives and vacancy. These newly renovated suites, combined with Boardwalk’s commitment to quality and service, will allow the Trust to gain market share, regardless of market conditions, and reduce its incentives and vacancy.

Positioning for the Market Recovery

The Trust carried higher vacancy into the latter part of 2016, in part as a result of its commitments associated with the Fort McMurray fire disaster, and continues to offer short-term incentives to remain competitive and to optimize Net Operating Income. Incentives for the 12 months of 2016 totalled $22.3 million, while vacancy was $21.2 million. There is a significant opportunity for the Trust to re-capture higher revenues through the reduction of incentives and improving occupancy.

By investing in its suite renovation program, Boardwalk will have newly renovated homes available for Residents. Boardwalk’s Suite Renovation Package offers various levels of suite renovations to new and existing Resident Members. These renovations may include new flooring, baseboards, kitchen cabinets, countertops, appliances, tiling, lighting, and fixtures in exchange for lower incentives for our new and existing Residents. These efforts will further add to Boardwalk’s mission of providing the best value in housing and support sustainable and growing Unitholder value creation. To date, the Trust has seen some success as a result of its suite renovation program, and continues to offer incentives to decrease vacancy. In the first two months of 2017, vacancy has decreased approximately 1% from December of 2016. By decreasing vacancy and the availability of units, the Trust is well positioned to reduce incentives moving forward.

The quality of Boardwalk’s communities continues to drive long-term revenue growth and stability. The Trust invested $102.6 million during the twelve months of 2016 to maintain and further enhance the curb appeal and quality of the Trust’s assets. In addition, the Trust invested approximately $6.2 million in the development of its Pines Edge project and to explore other development opportunities on excess land the Trust currently owns.

Boardwalk’s vertically integrated structure allows many repair and maintenance functions, including landscaping, painting, and among others, suite renovations, to be internalized. A continued focus on completing more of these functions in-house has resulted in improved quality, productivity, effective use of resources, and overall execution of the Trust’s capital improvement program, leading to better value for our Resident Members and long-term growth for Unitholders.

The Trust’s focus for the first half of 2017 is to continue to position itself for a market recovery by offering incentives to maximize occupancy. Boardwalk will continue to provide its Resident Members with high quality housing, which includes value added renovation packages on new lease terms.

Since 2000, Boardwalk has invested over $1 billion in its own portfolio in the form of capital improvements and, by focusing on suite renovations, will provide Resident Members with additional value and a superior product.

Continued Financial Strength and Liquidity to Capitalize on Opportunities

Since the previous economic downturn, the Trust had taken measures to further strengthen its balance sheet to maintain financial strength and flexibility. This action, coupled with historically low interest rates, has positioned Boardwalk with the flexibility to act on opportunities to deploy capital in support of Unitholder value creation. Examples of these opportunities include value added capital expenditures such as the new suite-renovation program, acquisitions, development of new assets, joint ventures, and a continued investment in the Trust’s own portfolio through value-added capital expenditures.

At the end of 2016, the Trust had approximately $482 million in short-term availability that it could deploy towards accretive opportunities.

|

Q4 2016 |

||

|

In $000’s |

||

|

Cash Position – Dec 2016 |

$ |

99,000 |

|

Subsequent Committed Financing |

$ |

34,000 |

|

Line of Credit 1 |

$ |

194,000 |

|

Total Available Liquidity |

$ |

327,000 |

|

CMHC Certificates of Insurance – Uncommitted |

$ |

155,000 |

|

Total Short-Term Availability |

$ |

482,000 |

|

Liquidity as a % of Current Total Debt |

13% |

|

|

Current Debt (net of cash) as a % of reported asset value |

43% |

|

|

1 â The Trust’s Undrawn Credit Facility has a Credit Limit of $200mm. The balance reflects the available balance net of outstanding Letters of credit |

Interest rates remain low and have benefitted the Trust’s mortgage program as the Trust has continued to renew existing CMHC insured mortgages at interest rates well below the maturing rates. As of December 31, 2016, the Trust’s total mortgage principal outstanding totaled $2.52 billion at a weighted average interest rate of 2.78%, compared to $2.35 billion at a weighted average interest rate of 3.01% reported for December 31, 2015.

Over 99% of the Trust’s mortgages are CMHC insured, providing the benefit of lower interest rates and limiting the renewal risk of these mortgage loans for the entire amortization period, which can be up to 40 years. The Trust’s total debt had an average term to maturity of approximately 4.8 years, with a remaining amortization of 30 years. The Trust’s debt (net of cash) to reported asset value ratio was approximately 43% as of December 31, 2016.

The Trust successfully completed its 2016 mortgage program with a reduction of the interest rate on its 2016 mortgages maturities from 3.92% to 2.14%, while also extending the maturity of these mortgages to over 7 years. The estimated annualized interest savings on the renewed principal is estimated to be $4.4 million. In addition, the Trust has raised $197.2 million in additional upfinancing to assist in the execution of the Trust’s strategic initiatives.

The Trust continues to undertake a balanced strategy to its mortgage program. Current 5 and 10-year CMHC Mortgage Rates are estimated to be 2.00% and 2.70%, respectively. The Trust’s interest coverage ratio, excluding gain or loss on sale of assets, for the most recent completed four quarters ended December 31, 2016, was 3.14 times, from 3.64 times for the same period a year ago.

Boardwalk’s financial strength, conservative balance sheet and historically low interest rates has positioned Boardwalk to actively explore options to deploy capital in support of unitholder value creation, including value added capital expenditures, Boardwalk’s suite renovation program, acquisitions, joint ventures, and the development of new assets to maximize Unitholder value.

Counter-Cyclical Acquisitions and Solid Development Pipeline

Demand for Multi-Family Investment Properties in Canada continues to be strong. As a result, capitalization rates continue to remain low and high prices for Multi-Family assets continue to be the trend. Recent transactions on existing assets have shown that the appetite for Multi-Family Investment Properties continues to be high, and transaction capitalization rates continue to decrease. Private and institutional buyers are taking a longer term approach to evaluations, using higher stabilized rents, normalized vacancy and lower cap rates, reflecting record low Government of Canada 10 year treasury yields and the continued difficulty in finding apartment rental assets. There continues to be a significant disconnect between the implied value of Boardwalk’s apartment assets as represented by the implied value of Boardwalk REIT Trust Units and the evaluation of comparable apartments in Western Canada that have recently sold.

The addition of newly constructed rental communities is consistent with the high-grading of Boardwalk’s portfolio. The acquisition of these newly built assets at a cost similar to the Trust’s cost of developing its own projects provides a unique opportunity for the Trust to continue to decrease the average age and increase the quality of its portfolio, while taking advantage of Boardwalk’s operational and leasing expertise to maximize the returns on these assets both in the short and long term. Leasing of these new acquisitions remain on schedule and as they stabilize, will add to the Trust’s overall performance. Details of the acquisitions are as follows:

|

2016 Acquisition Summary |

|||||||||||

|

Project Name |

Address |

City |

# Units |

Purchase Price |

Price / Door |

Price Sq Ft |

Year Cap |

Closing Date |

|||

|

Vita Estates |

18120 â 78 Street NW |

Edmonton |

162 |

$ |

29,605,500 |

$ |

182,750 |

$ |

219 |

5.75% |

07-Jun-16 |

|

Auburn Landing |

20 & 30 Auburn Bay Street SE |

Calgary |

238 |

$ |

51,170,000 |

$ |

215,000 |

$ |

244 |

5.43% |

22-Jun-16 |

|

Axxess |

908 â 156 Street NW |

Edmonton |

165 |

$ |

30,153,750 |

$ |

182,750 |

$ |

225 |

5.62% |

09-Aug-16 |

|

The Edge |

3011 & 3005 James Mowatt Trail SW |

Edmonton |

182 |

$ |

33,260,500 |

$ |

182,750 |

$ |

228 |

5.56% |

17-Aug-16 |

|

TOTAL |

747 |

$ |

144,189,750 |

||||||||

Phase 1 of the Trust’s Pines Edge development on existing excess land the Trust owns in Regina was substantially completed at the end of January 2016. The site consists of a 79-unit, four storey wood frame elevatored building with one level of underground parking. The total cost was $13.4 million, below the original budget of $14.1 million with an estimated stabilized cap rate range of 6.50% to 7.00% excluding land. Lease up of the project began on February 1, 2016 and, to date, over 97% of the units have been leased without the use of incentives as demand has exceeded expectations.

The Trust has commenced construction of Phase 2 of Pines Edge, and has taken further steps to prepare Phase 3. Both phases are four storey wood frame buildings with a single level of underground parking totaling 150 apartment units. Construction of Phase 2, a 79-unit replica of phase 1 with the addition of 9′ ceilings, has commenced and is scheduled to be completed in July of 2017. The total cost is estimated to be $13.2 million, with an estimated stabilized cap rate range of 6.25% and 6.75%. The finalization of construction drawings and tendering of Phase 3 is underway and, subject to economic and market conditions, construction of Phase 3 could begin in Q2 of 2017.

Boardwalk’s internal development opportunities include additional projects on existing excess density that the Trust holds in its portfolio. These developments are in various stages of planning and approval, and provide a significant pipeline of over 4,600 apartment units totaling 4.7 million buildable square feet of potential new assets that could be added to the Trust’s portfolio.

Boardwalk was pleased to announce the formation of a joint venture with RioCan REIT in November of 2016, to build a mixed use retail and residential tower at RioCan’s Brentwood Village Shopping Centre. The project will include a twelve storey tower with approximately 120,000 square feet of premium residential rental housing and 10,000 square feet of retail space. The tower will be located at a desirable location adjacent to the Calgary Light Rail Transit Line, in close proximity to the University of Calgary, Foothills Hospital, and McMahon Stadium. Both partners are currently working together to finalize the submission of plans for a development permit. Subject to the receipt of both the development permit and the subdivision of the lands, closing is expected to occur on May 30, 2017, with construction beginning as early as Q3 of 2017.

The Trust continues to explore other potential developments to complement the organic growth opportunities that have arisen from the volatility in 2016.

Trust Unit Buyback

The significant dislocation between the Trust’s Unit Price and its Net Asset Value represents unique opportunity for the Trust to execute on its Trust Unit buyback program. On June 29, 2016, Boardwalk REIT announced that it had received approval from the Toronto Stock Exchange (“TSX”) to implement a Normal Course Issuer Bid (“NCIB”) to purchase up to a maximum of 3,700,292 trust units representing approximately 10% of the publicly listed float. The NCIB commenced on July 3, 2016 and will terminate on July 2, 2017, or such earlier date as the Trust may complete repurchases under the bid.

In the twelve months of 2016, a total of 666,000 Trust Units were repurchased for cancellation under the Trust’s normal course issuer bid. Boardwalk believes that the current and recent market prices of its Trust Units do not reflect their underlying value or the REIT’s prospects for value creation over the longer term. Boardwalk’s management has opportunistically utilized this program as it feels that, at certain market prices, an investment in Boardwalk’s own high quality portfolio will deliver solid returns for unitholders and, when balanced with other capital allocation opportunities, represents an effective use of its capital.

|

NCIB Period |

Trust Units Purchased for Cancellation |

Weighted Average Cost Per Trust Unit |

Total Investment (000’s) |

||

|

12 M 2016 |

666,000 |

$ |

49.02 |

$ |

32,600 |

|

2015 |

740,800 |

$ |

50.10 |

$ |

37,100 |

|

2014 |

472,100 |

$ |

67.01 |

$ |

31,600 |

|

2007 – 2012 |

4,542,747 |

$ |

37.53 |

$ |

170,600 |

|

Grand Total |

6,421,647 |

$ |

42.34 |

$ |

271,900 |

Net Asset Value

Same property fair value for the Trust’s portfolio decreased relative to the previous quarter primarily a result of increased expense assumptions relating to the adoption of 2017 budget expenses, which seasonally occurs each fourth quarter. The Trust continues to utilize the higher vacancy assumptions adopted in the third quarter of 2016 and, as a result same property fair value when excluding newly acquired assets, decreased approximately $88 million versus the previous quarter.

Since the decline in oil prices and the corresponding economic downturn in Alberta that began in the second half of 2014, the Trust has adjusted its Fair Value accordingly with a significant decrease recorded in the third quarter of 2015 as market rents were adjusted. These decreases overall were moderated by increases seen in the Trust’s Eastern Canadian Communities which have seen balanced to strong rental markets as evidenced by increasing rental rates and decreasing capitalization rates. Below is a summary of the impact to fair value since 2014.

Total Fair Value under IFRS for the Trust’s portfolio increased relative to the end of 2015, mainly as a result new acquisitions, partially mitigated by fair value losses resulting from the noted decreases in market rents, higher vacancy assumptions mainly in the Trust’s Alberta and Saskatchewan Communities where market vacancy rates have increased, and higher expense assumptions. Below is a summary of the Trust’s total per unit Net Asset Value with further discussion located in the 2016 Fourth Quarter MD&A.

|

Highlights of the Trust’s Fair Value of Investment Properties |

||||

|

Dec 31, |

Dec 31, |

|||

|

IFRS Asset Value Per Diluted Unit (Trust & LP B) |

$ |

110.62 |

$ |

107.95 |

|

Debt Outstanding per Diluted Unit |

$ |

(49.68) |

$ |

(45.80) |

|

Net Asset Value (NAV) Per Diluted Unit (Trust & LP B) |

$ |

60.94 |

$ |

62.15 |

|

Cash Per Diluted Unit (Trust & LP B) 1 |

$ |

1.95 |

$ |

3.62 |

|

Total Per Diluted Unit (Trust & LP B) |

$ |

62.89 |

$ |

65.77 |

|

1 â Cash as of December 31, 2015 is net of the Special Distribution paid on January 15, 2016 to Unitholders on Record on December 31, 2015 of $51.3 million, or $1.00 per Trust Unit. Cash balance as of December 31, 2015 was $237.0 million. |

Same-Property Weighted Average Capitalization Rate: 5.38% at December 31, 2016 and December 31, 2015

2017 Financial Guidance

At the end of the third quarter of 2016, the Trust announced its financial outlook for the upcoming 2017 year. As is customary, the Trust reviews its base level assumptions and strategy on a quarterly basis to determine if any material change is warranted in the reported guidance. Based on this review, the Trust has revised its 2017 objectives as follows:

|

Description |

2017 Revised |

2017 Original |

2016 Actual |

|

|

Acquisition of Investment Properties |

No new apartment |

No new apartment |

Acquired 747 |

|

|

Disposition of Investment Properties |

No dispositions |

No dispositions |

No dispositions |

|

|

Development |

Phase 2 of Pines Edge, Regina, Saskatchewan – 79 Units |

Phase 2 of Pines Edge, Regina, Saskatchewan – 79 Units |

Phase 1 of Pines Edge, Regina, Saskatchewan – 79 Units |

|

|

Continue with Phase 3 of Regina, 71 Units |

Continue with Phase 3 of Regina, 71 Units |

Commencement of Phase 2 and the review of 150 Units |

||

|

Commencement of Brentwood Village RioCan, ~ 164 units |

Commencement of Brentwood Village RioCan, Calgary, Alberta ~ 164 units |

|||

|

Stabilized Building NOI Growth |

-15% to -9% |

-8% to -3% |

-12.50% |

|

|

FFO Per Unit |

$2.30 to $2.65 |

$2.70 to $2.90 |

$2.84 |

|

|

AFFO Per Unit |

$1.96 to $2.31 |

$2.36 to $2.56 |

$2.50 |

|

The Trust experienced a much weaker fourth quarter than anticipated, mainly driven by lower reported revenue, the result of increased competition in our western Canadian markets. This lower revenue was the result of higher vacancy loss and rental incentives. To address this increased competition, the Trust aggressively approached existing Resident Members with an increased level of incentives to renew their leases early. In addition, we increased the level of short term incentives offered to potential new Resident Members. We believe that these initiatives, combined with increased capital investment in our properties, will lower future turnover and increase rental demand. This should result in increased occupancy levels and lower reported vacancy loss for future months. However, in the majority of these early renewals, the existing rental rate has been higher than the new net rent offered when including the increased incentives. The result of this has been a short term deterioration of reported rents during the latter part of 2016, as the rental market rebalances. By focusing on both retaining existing Resident Members and attracting new Residents, the Trust will be positioned to take advantage of future market improvement.

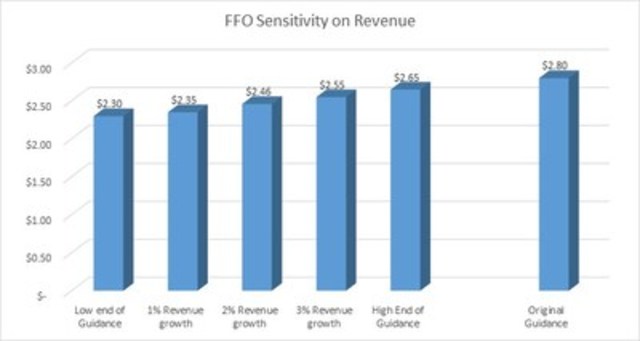

Although we are still in the early stages of this program, we have noted that overall turnover is substantially lower than the previous year, while overall rentals are also ahead of prior years, which has traditionally proven to be a leading indicator for increased revenue in the future months. Due to current market volatility, predicting future revenue trends has become more difficult. As such, we have increased the revenue sensitivity disclosure of our guidance. The main assumption that we changed was the base level of rent used in determining the original 2017 guidance. Adjusting base rent has correspondingly lowered our revenue expectation for 2017.

Since our main adjustment is related to revenue, we have provided an additional chart showing FFO outcomes using separate revenue assumptions with the lower end of the reported guidance based on the most recent financial information annualized with no provision for improvement throughout the remainder of the year. For example, if the Trust does not see any revenue improvement for the remainder of 2017, we estimate reported FFO of $2.30. The Trust’s adjusted FFO guidance range is between $2.30 and $2.65 per Trust Unit. In order to reach the higher end of the guidance, rents will have to increase by 4% above the base revenue level through 2017.

In deriving these forecasts, we have adjusted for the treatment of the LP B Units to be treated as equity (versus debt under IFRS) and their related treatment of the distributions paid (which are classified as financing charges under IFRS). In addition, we are assuming no additional acquisition or disposition of properties.

The reader is cautioned that this information is forward-looking and actual results may vary materially from those reported. One of the key estimates is the performance of the Trust’s stabilized properties. Any significant change in assumptions deriving ‘Stabilized Building NOI performance’ would have a material effect on the final reported amount. The Trust reviews these key assumptions quarterly and based on this review may change its outlook.

In addition to the above financial guidance for 2017, the Trust has assumed the following capital will be reinvested in its existing portfolio for the 2017 fiscal year.

|

Capital Budget ($000’s) |

2017 Budget |

Per Suite |

2016 Actual |

Per Suite |

||||

|

Maintenance Capital |

$ |

17,731 |

$ |

525 |

$ |

17,534 |

$ |

525 |

|

Stabilizing & Value Added Capital (including Property, Plant & Equipment) |

80,003 |

2,369 |

85,052 |

2,547 |

||||

|

Total Operational Capital |

$ |

97,734 |

$ |

2,894 |

$ |

102,586 |

$ |

3,072 |

|

Total Operational Capital |

$ |

97,734 |

$ |

102,586 |

||||

|

Repositioning Capital |

20,000 |

– |

||||||

|

Development |

24,071 |

6,167 |

||||||

|

Total Capital Investment |

$ |

141,805 |

$ |

108,753 |

||||

In total, we expect to invest $97.7 million (or $2,894 per apartment unit) on operational capital in 2017 as compared to $102.6 million (or $3,072 per apartment unit) actually spent in 2016. The Trust has maintained its Maintenance Capital estimate for 2017 at $525 per apartment unit per year. Additionally, for the year ended December 31, 2016, the Trust invested $6.2 million of development and $144.4 million on acquisitions in Alberta.

Stabilizing and Value Added capital is subject to continuous review and will only be invested if the Trust can earn a significant return on this investment.

Included in the 2017 Budget is $20 million for the Trust’s suite upgrade and repositioning program. This Fund is targeted for specific properties and will focus on significant upgrades to existing suites, common areas, as well as internal amenities. This reserve is subject to continuous review and internally set rates of return and is consistent with the Trust’s Long Term Strategy of upgrading its existing property portfolio.

Timing of Future Financial Guidance Release

The Trust has previously released its forward guidance each year with its third quarter results. The Trust continues to be committed to financial transparency by making this information public. Recent events have highlighted that additional information through the final months of each year will allow the Trust to improve the accuracy of these estimates prior to the release of its forward financial guidance.

As a result, future financial forecasts for subsequent years will be issued as part of the Trust’s fourth quarter and year end results. The Trust will continue to review its key assumptions on a quarterly basis and where warranted make changes to its financial guidance.

Q4 Regular Monthly Distributions

Boardwalk’s Board of Trustees reviews the Trust’s monthly regular distributions on a quarterly basis, and has confirmed the next three months regular distribution as follows:

|

Month |

Per Unit |

Annualized |

Record Date |

Distribution Date |

||

|

Feb-17 |

$ |

0.1875 |

$ |

2.25 |

28-Feb-17 |

15-Mar-17 |

|

Mar-17 |

$ |

0.1875 |

$ |

2.25 |

31-Mar-17 |

17-Apr-17 |

|

Apr-17 |

$ |

0.1875 |

$ |

2.25 |

28-Apr-17 |

15-May-17 |

Boardwalk has distributed over $1 billion in cash distributions since 2004.

The Board of Trustees will continue to review the distributions made on the Trust Units on a quarterly basis.

Supplementary Information

Boardwalk produces the Quarterly Supplemental Information that provides detailed information regarding the Trust’s activities during the quarter. The Fourth Quarter 2016 Supplemental Information is available on Boardwalk’s investor website at www.boardwalkreit.com.

Teleconference on Fourth Quarter 2016 Financial Results

Boardwalk invites you to participate in the teleconference that will be held to discuss these results tomorrow morning (February 17, 2017) at 11:00 am Eastern Time. Senior management will speak to the period’s results and provide an update. Presentation materials will be made available on Boardwalk’s investor website at www.boardwalkreit.com prior to the call.

Teleconference: The telephone numbers for the conference are 647-427-7450 (local/international callers) or toll-free 1-888-231-8191 (within North America).

Note: Please provide the operator with the below Conference Call ID or Topic when dialing in to the call.

Conference ID: 44110902

Topic: Boardwalk REIT 2016 Fourth Quarter Results

Webcast: Investors will be able to listen to the call and view Boardwalk’s slide presentation over the Internet by visiting http://www.boardwalkreit.com prior to the start of the call. An information page will be provided for any software needed and system requirements. The webcast and slide presentation will also be available at:

http://event.on24.com/r.htm?e=1339063&s=1&k=47F7BD2C84BF232FA4D3651EAD8EE97B

Replay: An audio recording of the teleconference will be available on the Trust’s website: www.boardwalkreit.com

Fourth Quarter 2016 Financial Highlights

|

$ millions, except per unit amounts |

||||||||||

|

Highlights of the Trust’s Fourth Quarter 2016 Financial Results |

||||||||||

|

3 Months |

3 Months |

% |

12 Months |

12 Months |

% |

|||||

|

Same Store Total Rental Revenue |

$ |

104.4 |

$ |

115.6 |

-9.7% |

$ |

435.1 |

$ |

464.2 |

-6.3% |

|

Total Rental Revenue |

$ |

106.1 |

$ |

115.7 |

-8.3% |

$ |

438.8 |

$ |

476.1 |

-7.8% |

|

Same Store Net Operating Income (NOI) |

$ |

57.5 |

$ |

72.3 |

-20.5% |

$ |

257.9 |

$ |

294.6 |

-12.5% |

|

Net Operating Income (NOI) |

$ |

56.4 |

$ |

70.9 |

-20.4% |

$ |

253.1 |

$ |

294.7 |

-14.1% |

|

(Loss) profit for the period |

$ |

(84.7) |

$ |

114.4 |

-174.0% |

$ |

(57.4) |

$ |

28.8 |

-299.1% |

|

Funds From Operations (FFO) |

$ |

29.6 |

$ |

44.2 |

-33.1% |

$ |

144.5 |

$ |

184.9 |

-21.8% |

|

Adjusted Funds From Operations (AFFO) |

$ |

25.2 |

$ |

40.1 |

-37.2% |

$ |

126.9 |

$ |

167.8 |

-24.4% |

|

FFO Per Unit |

$ |

0.58 |

$ |

0.86 |

-32.6% |

$ |

2.84 |

$ |

3.56 |

-20.2% |

|

AFFO Per Unit |

$ |

0.50 |

$ |

0.78 |

-35.9% |

$ |

2.50 |

$ |

3.23 |

-22.6% |

|

Regular Distributions Declared (Trust Units & LP B Units) |

$ |

28.5 |

$ |

26.3 |

8.5% |

$ |

113.4 |

$ |

105.8 |

7.1% |

|

Regular Distributions Declared Per Unit (Trust Units & LP B Units) |

$ |

0.563 |

$ |

0.510 |

10.3% |

$ |

2.233 |

$ |

2.039 |

9.5% |

|

Excess of AFFO over Distributions Per Unit |

$ |

(0.063) |

$ |

0.270 |

-123.1% |

$ |

0.267 |

$ |

1.191 |

-77.6% |

|

Regular Payout as a % FFO |

96.4% |

59.5% |

78.5% |

57.3% |

||||||

|

Regular Payout as a % AFFO |

113.4% |

65.6% |

89.3% |

63.1% |

||||||

|

Excess of AFFO as a % of AFFO |

-13.4% |

34.4% |

10.7% |

36.9% |

||||||

|

Interest Coverage Ratio (Rolling 4 quarters) |

3.14 |

3.64 |

3.14 |

3.64 |

||||||

|

Operating Margin |

53.1% |

61.3% |

57.7% |

61.9% |

||||||

|

Portfolio Highlights for the Fourth Quarter of 2016 |

||||

|

Dec-16 |

Dec-15 |

|||

|

Average Occupancy (Period Average) |

94.24% |

97.34% |

||

|

Average Monthly Rent (Period Ended) |

$ |

1,019 |

$ |

1,150 |

|

Average Market Rent (Period Ended) |

$ |

1,103 |

$ |

1,168 |

|

Average Occupied Rent (Period Ended) |

$ |

1,086 |

$ |

1,179 |

|

Loss -to-Lease (Period Ended) ($ millions ) |

$ |

6.0 |

$ |

(4.4) |

|

Loss -to-Lease Per Trust Unit (Period Ended) |

$ |

0.08 |

$ |

(0.08) |

|

% Change Year- Over-Year-3 |

% Change Year- Over-Year-12 |

|||

|

Same Property Results |

Months Dec-16 |

Months Dec-16 |

||

|

Rental Revenue |

-9.7% |

-6.3% |

||

|

Operating Costs |

8.4% |

4.5% |

||

|

Net Operating Income (NOI) |

-20.5% |

-12.5% |

||

|

Same property Results Exclude 79-unit Pines Edge of (Pines of Normanview II Development) completed January 2016, 162-unit Vita Estates acquired June 2016, 238-unit Auburn Landing acquired June 2016, 165-unit Axxess acquired August 2016 and 182-unit The Edge acquired in August 2016. |

|

All rental rates noted are net of incentives |

|

Stabilized Revenue Growth |

# of Units |

Q4 2016 vs |

Q3 2016 vs |

Q2 2016 vs |

Q1 2016 vs |

|

Edmonton |

12,397 |

-3.8% |

-2.9% |

-4.1% |

-2.2% |

|

Calgary |

5,419 |

-4.1% |

-5.0% |

-4.0% |

-2.5% |

|

Red Deer |

939 |

-6.5% |

-7.7% |

-3.9% |

-2.8% |

|

Grande Prairie |

645 |

-10.2% |

-8.6% |

-6.4% |

-3.2% |

|

Fort McMurray |

352 |

-0.8% |

17.5% |

-14.6% |

-9.7% |

|

Quebec |

6,000 |

-0.9% |

2.0% |

0.8% |

-0.8% |

|

Saskatchewan |

4,610 |

1.9% |

-2.4% |

-1.8% |

-2.3% |

|

Ontario |

2,585 |

0.9% |

0.5% |

0.5% |

0.6% |

|

32,947 |

-2.9% |

-2.2% |

-2.9% |

-2.0% |

FFO and AFFO are widely accepted supplemental measures of the performance of a Canadian Real Estate entity; however, they are not measures defined by International Financial Reporting Standards (“IFRS”). The reconciliation of FFO and other financial performance measures can be found in the Management Discussion and Analysis (“MD&A”) for the fourth quarter ended December 31, 2016, under the section titled, “Performance Measures”.

Corporate Profile

Boardwalk REIT strives to be Canada’s friendliest landlord and currently owns and operates more than 200 communities with over 33,000 residential units totaling over 28 million net rentable square feet. Boardwalk’s principal objectives are to provide its Residents with the best quality communities and superior customer service, while providing Unitholders with sustainable monthly cash distributions, and increase the value of its trust units through selective acquisitions, dispositions, development, and effective management of its residential multi-family communities. Boardwalk REIT is vertically integrated and is Canada’s leading owner/operator of multi-family communities with 1,500 Associates bringing Residents home to properties located in Alberta, Saskatchewan, Ontario, and Quebec.

Boardwalk REIT’s Trust units are listed on the Toronto Stock Exchange, trading under the symbol BEI.UN. Additional information about Boardwalk REIT can be found on the Trust’s website at www.BoardwalkREIT.com.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

Information in this news release that is not current or historical factual information may constitute forward-looking information within the meaning of securities laws. Implicit in this information, particularly in respect of Boardwalk’s objectives for 2016 and future periods, Boardwalk’s strategies to achieve those objectives, as well as statements with respect to management’s beliefs, plans, estimates and intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations are estimates and assumptions subject to risks and uncertainties, including those described in the Management’s Discussion & Analysis of Boardwalk REIT’s 2016 Annual Report under the heading “Risks and Risk Management”, which could cause Boardwalk’s actual results to differ materially from the forward-looking information contained in this news release. Specifically Boardwalk has assumed that the general economy remains stable, interest rates are relatively stable, acquisition capitalization rates are stable, competition for acquisition of residential apartments remains intense, and equity and debt markets continue to provide access to capital. These assumptions, although considered reasonable by the Trust at the time of preparation, may prove to be incorrect. For more exhaustive information on these risks and uncertainties you should refer to Boardwalk’s most recently filed annual information form, which is available at www.sedar.com. Forward-looking information contained in this news release is based on Boardwalk’s current estimates, expectations and projections, which Boardwalk believes are reasonable as of the current date. You should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While the Trust may elect to, Boardwalk is under no obligation and does not undertake to update this information at any particular time.

SOURCE Boardwalk Real Estate Investment Trust

To view this news release in HTML formatting, please use the following URL: http://www.newswire.ca/en/releases/archive/February2017/16/c5772.html